Credit Unions and the Consolidation Curve

Credit union mergers have been at the forefront of news for years now, with industry professionals expressing disappointment and concern over the trend. But are mergers a worrisome sign or simply a symptom of a much larger trend at play? Emily Claus reports on the Consolidation Curve and where we our industry fits into it.

Eltropy Announces Integration with Portico from Fiserv for Enhanced Credit Union Member Engagement

Eltropy, the leading digital conversations platform for community financial institutions (CFIs), today announced its integration with Portico® from Fiserv, a full-service account processing platform.

Mandates Failing in Cyber-Insurance: Why Mandates Work for Traditional Insurance Categories, But Not for Cyber-Insurance

While mandates may work well for other lines of insurance, they often fail when it comes to cybersecurity insurance, according to Brett Helm, who provides some background on the situation.

Members of CUNA and NAFCU Approve Merger

The proposed merger between CUNA and NAFCU to form America’s Credit Unions was approved last week by members of the organizations. The new entity will be legally formed on the first of the new year, reports Emily Claus.

Cross Border Payments: How Credit Unions Can Remain Vital

In the race to keep up with new technologies and member expectations, Almond FinTech’s Howard Davidson encourages credit unions not to overlook an essential and increasingly popular service: cross-border payments.

NCUA’s Proposed 2025 Operating Budget Would Be Nearly $100 Million More Than Its Approved 2022 Budget

NCUA’s budget proposal for 2024-2025 has been released, and the numbers they are asking for should be setting off alarms with credit unions, says CUSO Magazine’s Esteban Camargo.

CUSO Identifies Opportunity in Underutilized Credit Union Owner Investment Authority

The multi-credit union-owned operational services CUSO, Xtend, analyzed the available CUSO investment dollars represented in its credit union owners. Vic Pantea explains the results of the analysis and the opportunities possible, and why more credit unions should be taking them.

Marijuana Businesses Sue to Gain Access to Financial Services

Due to a lack of federal regulation, many financial institutions cannot serve marijuana businesses without risk of repercussions. This inaccessibility leaves marijuana businesses open to safety and financing issues, the Massachusetts marijuana businesses argued when they filed their lawsuit last week, reports David Baumann.

Are Credit Unions Being Disrupted?

Chip Filson debates the possibility of disruption within the credit union industry, from what competition said disruption might be originating, and what this may suggest for the industry.

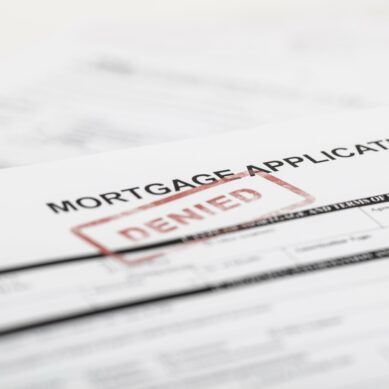

Banking’s Hidden Risk: Cyber Insurance Coverage Gaps, Exclusions, and Denied Claims

Cyber insurance has become essential in the past few years, with regulators expecting it of their credit unions, and many credit unions expecting it of borrowers. However, there are gaps in insurance that can leave businesses, and in turn credit unions, open to risk, says expert Brett Helm.