Last year, the NCUA asked for a 9.6% increase in its operating budget from $320 million to $350 million. Ultimately, it settled for a paltry 7.5% increase to $344M for 2023. Not to outdo itself, at the time, the NCUA also proposed a 10.7% operating budget increase for 2024, anticipating it would need a whopping $388M to get the job done.

On October 26, the NCUA published its 2024-2025 draft budget justification. The result? That 10.7% increase for 2024 wasn’t enough.

Instead, the NCUA’s budget proposal for 2024 has them requesting an additional 11%. Though still below that $388M marker set a year prior thanks to the approved budget, it is a staggeringly high year-over-year increase.

What’s more, they anticipate needing yet another 9.6% for 2025, which would put the operating budget at $418.9M. Which means that from 2022 to 2025, just three years, the NCUA says it needs another one hundred million dollars to perform its duties. That’s a nearly 30% increase.

The nitty-gritty of NCUA’s increased costs

In last year’s proposal, a big chunk of the additional money the NCUA was requesting was slotted for 25 new staff positions, increased compensation for current employees ($8.9M), and a travel funding increase.

This year, the NCUA identified three key areas: 11 new staff positions, 17 existing “overhire” positions currently unfunded in the 2023 budget, increased compensation for current employees ($18.2M), and lastly, $10.7 million to fund contracted services.

Inflationary pressures, as the NCUA points out, have factored into the increased costs. From a category level, the $10.7M for contracted services is the biggest increase, up 25.7%.

In order to help fund this increase, the NCUA is also calling for an Operating Fee increase of 19.59% with the current exemption for credit unions under $1 million in total assets. They have proposed extending that exemption to credit unions below $2 million which would further increase the Operating Fee to 19.61%

NAFCU isn’t impressed with the numbers

NAFCU President/CEO Dan Berger felt there was much work to be done by the NCUA to decrease its budget. In the organization’s statement, Berger said: “NAFCU and credit unions support fiscal responsibility. It’s only natural that the agency overseeing credit unions follows the same principle; however, the NCUA, once again, has proposed unreasonable increases for its 2024-2025 budgets. With a proposed increase of 9.5 percent over 2023, the agency needs to rein in unnecessary spending. At a time of such economic uncertainty, the NCUA shouldn’t be taking away money from credit unions and the 138 million members they serve. NAFCU will continue to call on the NCUA to find cost-saving measures and hold the agency accountable.

The NCUA will hold a public budget briefing at its office in Washington D.C. on November 16 at 2PM ET, which will be available via livestream from their website.

How the NCUA attempts to justify these budget increases

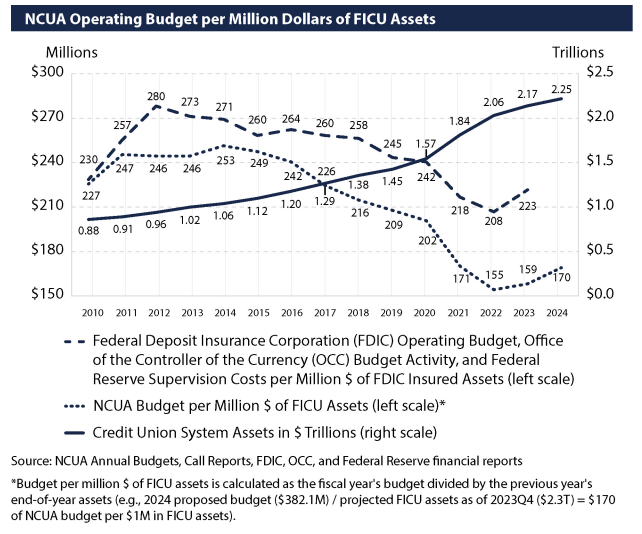

If you are familiar with these NCUA budget proposal documents, you may recognize the chart titled “NCUA Operating Budget per Million Dollars of FICU Assets.” The line for “NCUA Budget per million $ of FICU Assets” mostly trends down since 2010 (though it’s gone up the last two years), while as you might imagine the line for “Credit Union System Assets in $ Trillions” goes up year after year.

Source: NCUA 2024-2025 Staff Draft Budget Justification (October 26, 2023)

To further drive home the point that the NCUA is operating efficiently, they include an equivalent line of the FDIC’s operating budget per FDIC-insured assets, which follows a similar pattern, but at a greater amount. For example, in 2023, they show FDIC with 223 and NCUA with 159.

And while this is all a factually accurate way of analyzing their budget, they never explain why more total assets for FICUs warrants the increased expenses. Here’s a different way of looking at the budget:

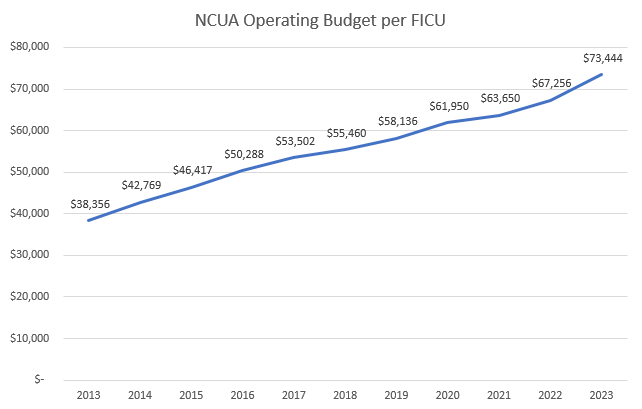

Using data available from the NCUA website, I compared the number of federally insured credit unions (FICUs) reported at year-end from 2013 to 2023 (using NCUA’s June quarterly report for 2023) with the board-approved operating budget for those years. The result paints a far different story of the NCUA’s budget trend. Yes, the NCUA’s budget has decreased as a percentage of total credit union assets, but it has nearly doubled its budget per federally insured credit union in a decade.

I fully acknowledge that as credit unions grow in size, so too does the complexity of their balance sheets. A one billion dollar credit union very likely requires more attention, resources, and time for the NCUA to audit than does a one million dollar credit union. But there are also 1,868 fewer FICUs from Dec 2013 to June 2023. That’s a 28% decline in the number of institutions they need to monitor and visit.

You might argue that this makes sense. As smaller credit unions are merged out of existence by the dozens year after year, their departure will drag the NCUA’s per FICU budget up. But it’s not just that the number of FICUs has dropped from 6,554 to 4,686, but that the NCUA’s budget has increased from $251 million in 2013 to $344 million in 2023.

Which then brings us back to their new proposal, which would set the 2025 budget at $418 million. From 2013 to 2022, their operating budget “only” went up $68 million. And yet from 2022 to 2025, they need that budget to go up $98 million? That should be a really tough pill to swallow for credit unions.