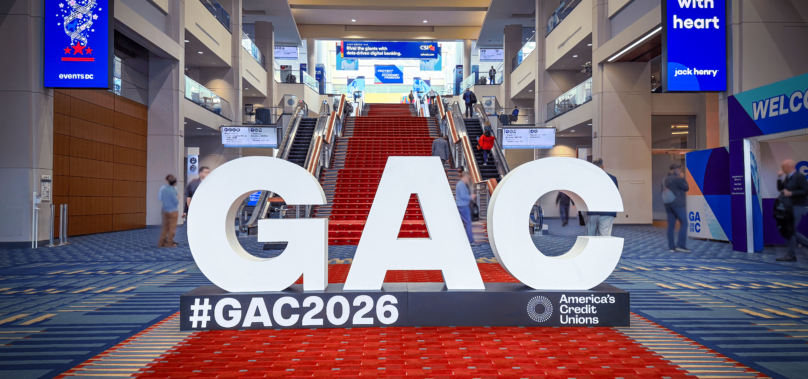

As the 2026 Governmental Affairs Conference comes to a close, Emily Claus reports on all that went down on the fourth and final day, including a young professionals panel, key election information, and addresses from several members of Congress.

Chip Filson discusses the history of credit unions’ tax exemption, why it was created in the first place, if we are still the same industry that was granted it to begin with, and what we would do without it.

As the 2026 Governmental Affairs Conference comes to a close, Emily Claus reports on all that went down on the fourth and final day, including a young professionals panel, key election information, and addresses from several members of Congress.

Emily Claus reports on day three of the 2026 Governmental Affairs Conference, including an appearance from Senator Ricketts, insights from the Filene Research Institute, and an update on the economic outlook.

Another day, another special report hot off the press! Today, Emily Claus covers all that went down at day two of the 2026 Governmental Affairs Conference, including ACU President and CEO Scott Simpson’s first GAC appearance and a chat with NCUA Board Chairman Kyle Hauptman.

As the 2026 Governmental Affairs Conference kicks off in D.C., CUSO Magazine’s Emily Claus is boots on the ground reporting on all the latest coming out of the nation’s capital. With insights into this year’s Undergound and info on the future of the NCUA, day one of GAC was not one to miss!

News from the cuasterisk.com network

CUSO Magazine delivers relevant, timely news and insights to the credit union industry. CUSO Magazine begins as a digital product with the potential to grow.

CUSO Magazine approaches stories with the mindset that we want to bring something new with our information and create a sense of intrigue for the reader to want to learn more.

If you have a story idea, would like to submit an article, or want to advertise with us, please contact us.