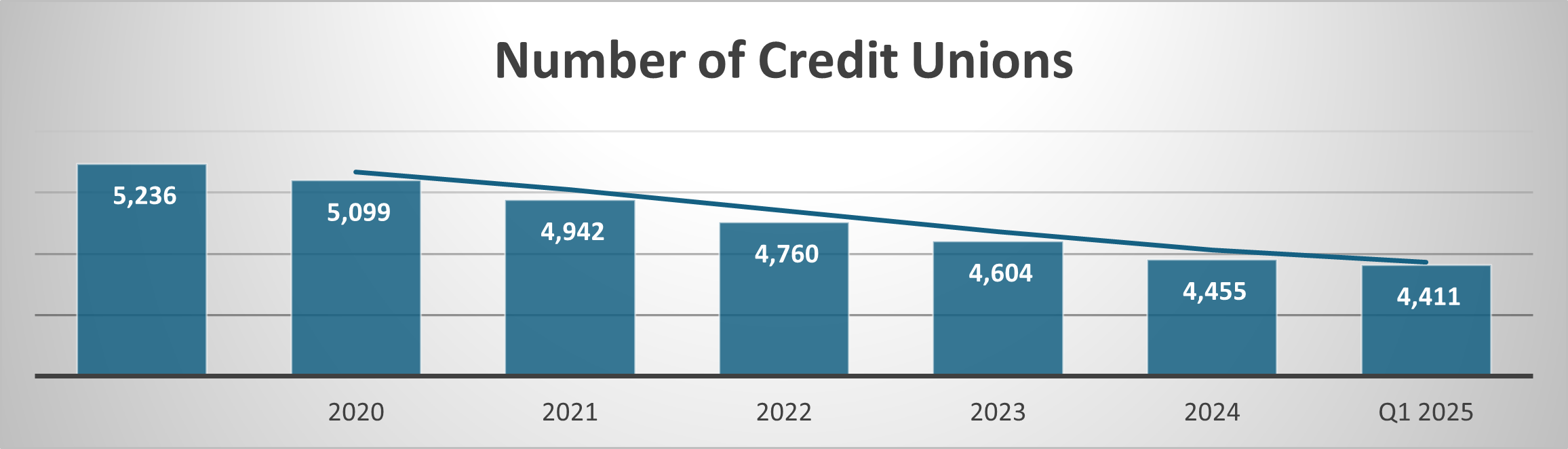

The credit union movement has and continues to consolidate at an alarming rate, particularly small credit unions. There are many reasons why the credit union movement is consolidating, including, but not limited to, an inability to successfully “do all that is required” of credit unions at this point, an inability to effectively compete with larger credit unions and banks, and an inability to successfully replace retiring leaders.

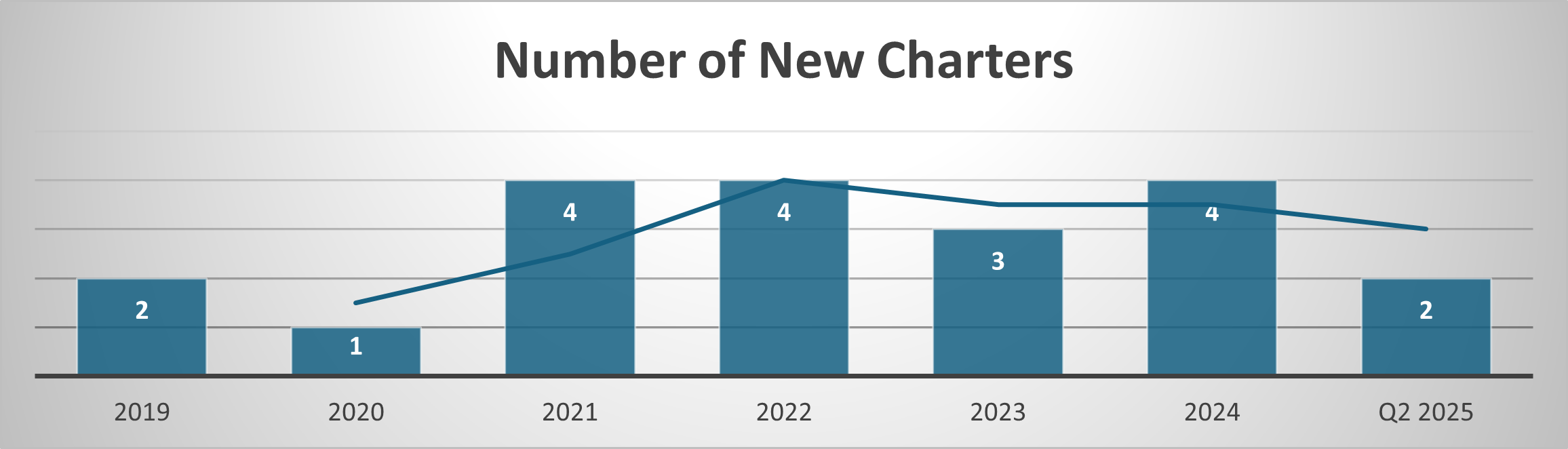

Many have studied this, identifying reasons for the continuing consolidation and are either currently offering solutions or expect to be offering solutions in the near future. Offsetting this is a minimum number of newly chartered credit unions (see graphs below). The result? The loss of small credit unions as a whole, as I noted in my previous article.

Adding to the importance of this is the fact that in many cases, it is these smaller credit unions that serve the unserved and underserved individuals and communities who otherwise would be subjected to obtaining financial services from predatory lenders and financial services providers. Clearly, this is not what we want for our most vulnerable, at-risk populations and communities.

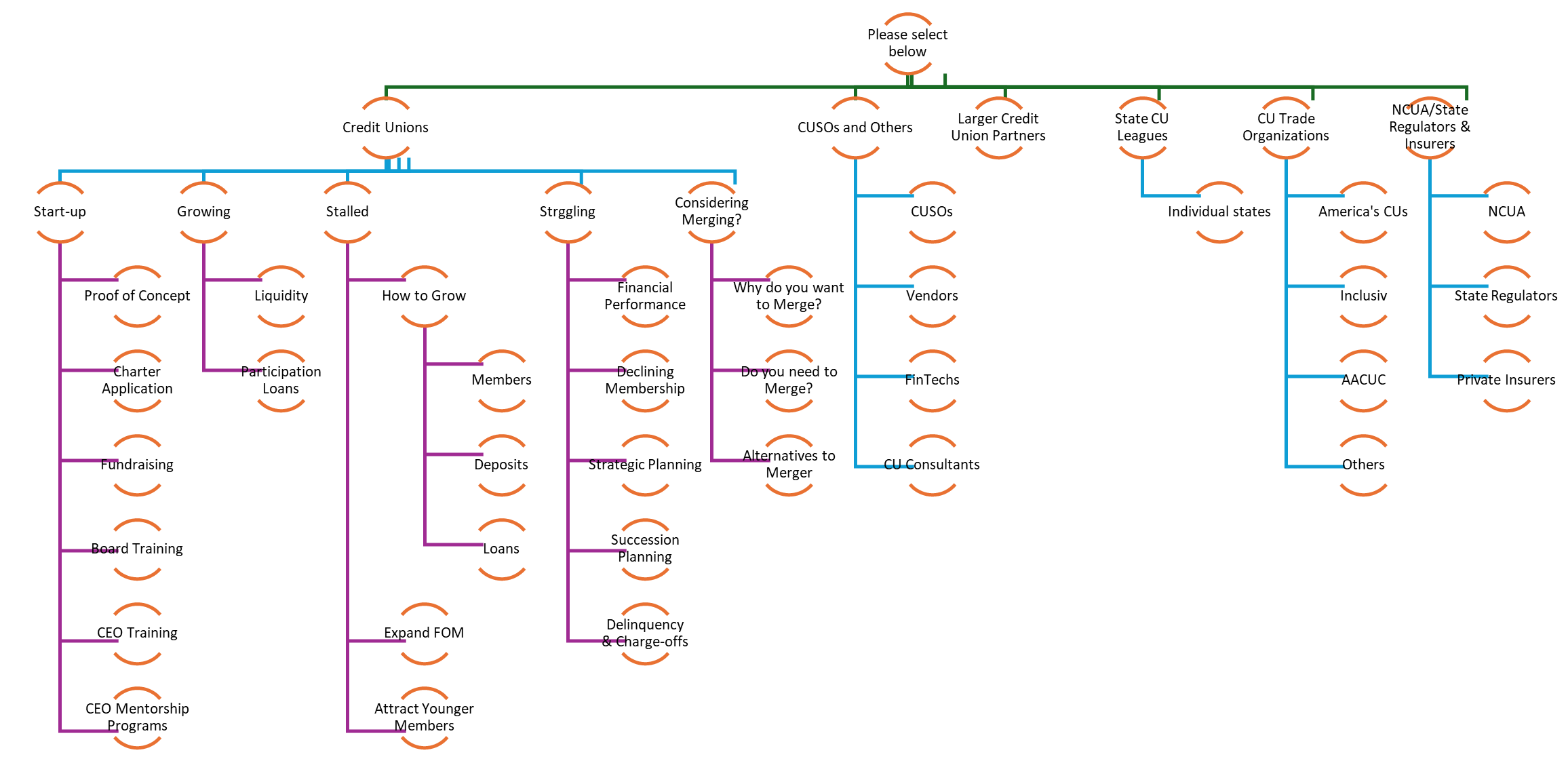

This article discusses the need to develop and implement an online “National Resource Center” for small credit unions and De Novo credit unions.

Many solutions and expected users of the resource center

There are many solutions currently available to credit unions that might be “stalled” as to their growth, those that might be “struggling, those that intentionally want to grow and expand their credit union to serve more individuals and communities, and those individuals (organizers) that want to start new credit unions to serve the financial needs of those they represent, often unserved or underserved individuals and communities.

Some examples of these solutions to supplement a credit union’s internal capacity are outside help with accounting, finance, asset/liability management, compliance, information technology, project management, marketing, field of membership expansion, and chartering, to name a few.

However, in many cases, credit unions are not aware of the many resources that are available to help them. As a result, many stalled and struggling credit unions believe that merging the credit union is their only option. That said, it is of paramount importance to make these resources known and available to those who need them the most!

What is the resource center?

The resource center would be similar in operation to an “Angi’s List” for credit unions, whereby a credit union could identify a service provider based on its current need. For example, a credit union needs someone to assist with its accounting, marketing, or compliance function. By accessing the resource center database, they could identify service providers that provide those needed services for credit unions such as theirs.

A key difference, however, would be that there would not be any “ratings” of the service providers, and thus the credit union would need to conduct its own due diligence of the service provider. The resource center would also include links to helpful resources for small credit unions, such as CUSOs, larger credit unions that work with smaller credit unions, state leagues, trade organizations, and federal and state regulators.

Working together to save small credit unions

Working together to save small credit unions

By creating an “online repository” of helpful resources available to both existing small credit unions and de novo credit unions, we believe we will increase the number of credit unions that will survive and thrive, and new credit unions chartered.