Cooperative Design’s Two Unmatchable Advantages

In the financial forest, Chip Filson discusses the two elements that have led to the successful growth of the credit union system: ownership and relationship.

Senate Subcommittee Meets to Discuss Overdraft Fees

The United States Senate Subcommittee on Financial Institutions and Consumer Protection met on Wednesday, May 4 to discuss overdraft fees and their effects on working families. Esteban Camargo reports on the discussion.

Are Overdraft Fees on the Chopping Block?

Overdraft and NSF fees have been in the CFPB’s spotlight of late. Jim Vilker suggests slowing down and considering the ramifications carefully before rushing to respond.

Bold Vision for a Bold Future: A Case Study in Eliminating In-Person Teller Lines

In the age of self-service, many credit unions are asking themselves if they need a teller line anymore or if it can be done away with. Rick Preble of RVA Financial Credit Union has done exactly that, replacing his teller lines with ITMs. John Beachamp examines the motive behind the decision, the process, and how members took the shift.

Redesigning Your Website: Where Should You Put Your Effort?

Web developer Sam Lechenet analyzes how much traffic each of your web pages is getting and how you can refocus your design efforts to save time and money.

New Bill Aims to Prevent the SBA From Becoming a Direct Lender

Republicans have introduced a new bill to congress that aims to scale back the Small Business Association’s lending abilities, leaving a gap for credit unions to fill in the lending sphere. Emily Claus details the contents of the bill as well as CUNA’s endorsement of it.

Five Tips to Improve Your Self-Awareness as a Leader

There are a number of traits that go into making a good leader, but Alycia Meyers argues that self-awareness is one of the most essential skills, and she relays a few tips on how to improve yours.

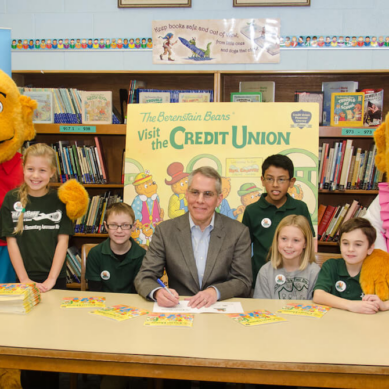

Financial Literacy Spotlight: The Berenstain Bears Cub Club

As part of Financial Literacy Month, Emily Claus spotlights the Berenstain Bears Financial Literacy Program for kids, created through a partnership with Franklin Mint Federal Credit Union and the Berenstain Bears organization.

The CAMELS in the Room

Starting April 2022, NCUA introduced a new letter to the CAMEL rating system: “S” for Sensitivity to Market Risk. Esteban Camargo gives a brief history of CAMELS and what each letter stands for in this financial literacy month series.

What Can We Learn from the Oldest FCUs?

22 of the 100 original charters the NCUA granted after the passage of the Federal Credit Union Act are still in business—a rate almost double that of all FCUs. Chip Filson ponders the reason behind this and what lessons we can take from history.