Senate Subcommittee Meets to Discuss Overdraft Fees

The United States Senate Subcommittee on Financial Institutions and Consumer Protection met on Wednesday, May 4 to discuss overdraft fees and their effects on working families. Esteban Camargo reports on the discussion.

New Bill Aims to Prevent the SBA From Becoming a Direct Lender

Republicans have introduced a new bill to congress that aims to scale back the Small Business Association’s lending abilities, leaving a gap for credit unions to fill in the lending sphere. Emily Claus details the contents of the bill as well as CUNA’s endorsement of it.

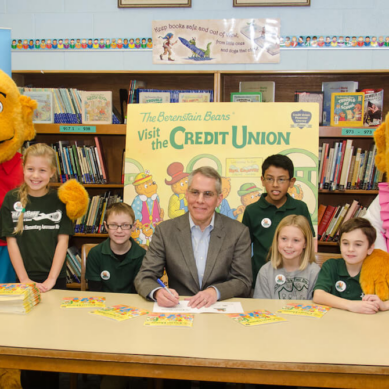

Financial Literacy Spotlight: The Berenstain Bears Cub Club

As part of Financial Literacy Month, Emily Claus spotlights the Berenstain Bears Financial Literacy Program for kids, created through a partnership with Franklin Mint Federal Credit Union and the Berenstain Bears organization.

Increasing Financial Literacy in Students: Credit Union of Texas Opens SMART Branch

Credit Union of Texas, in an effort to increase financial education amongst students, has created an encompassing financial literacy program consisting of student-run SMART branches and student financial coaches. Emily Claus explains.

The Expanded Role of the CFPB in the Biden Administration

From overdraft policies to Buy Now Pay Later contracts, the CFPB during the Biden administration has taken action against those businesses that CFPB officials say are taking advantage of consumers. David Baumann shares some insights on what the CFPB has been focused on, and how interested parties have responded.

Financial Literacy Month: How is Your Credit Union Celebrating?

Calling all credit unions: April is Financial Literacy Month! Is your credit union ready for it? Emily Claus covers the history and purpose of the month, ways your credit union can get involved, and why you shouldn’t miss out on this year’s festivities.

CU Trades Ask CFPB to Regulate Buy Now Pay Later Firms

Contending that the programs are growing tremendously and are largely unregulated, credit union trade groups are calling on the Consumer Financial Protection Bureau to set rules for Buy Now Pay Later programs being offered by relatively new financial companies, reports David Baumann.

NCUA Board Treads Lightly on Climate Change Risks

Under fire from farm state elected officials, the National Credit Union Administration board emphasized at its March meeting that the agency will not micromanage credit union policies as credit unions consider the risks of climate change. Other issues were also discussed, reports David Baumann of the Washington Credit Union Daily.

House Dem Credit Union Bill Has Bankers, CUs Fired Up

As the House Financial Services Committee prepares to consider legislation that would allow all federal credit unions to add underserved areas to their fields of membership, the war of words between banks and credit unions has ratcheted up once again, reports David Baumann of the Washington Credit Union Daily.

Funding Deal: $295 Million for CDFI; Easier Ouster of CU Members

House and Senate appropriators have reached agreement on an FY22 government funding package that would provide a $25 million boost for the Community Development Financial Institution program and make it easier for credit unions to expel members, reports David Baumann of the Washington Credit Union Daily.