I just love a greasy spoon diner. Every Wednesday morning, the same waitress at my favorite spot brings me the same breakfast prepared by the same cook. When she sees me walk in, she puts coffee, creamer, a glass of water, and a paper wrapped straw on the table I usually sit at, just as she has done for every other regular for years. Her routine continues the same, despite the fact that I always take my coffee black and have not used a straw for a glass of water in my adult life. When I finish breakfast, I hand her my debit card and she will dutifully ask if I would like a receipt. There are two things I do not want for breakfast: plastic straws and paper receipts.

Every time money changes hands, we feel the need to have a paper record that acts as proof of the transaction. Do you really need proof given the amount of electronic record keeping and the ubiquitous access to information we enjoy today? In the case of my breakfast, the restaurant has electronic records from their register and my credit union has instantly recorded the agreed upon amount as a debit to my account. Do we really need a paper receipt to resolve any issues?

What if I were to buy that greasy spoon? If I bought the business instead of my veggie omelet, would I want a receipt? I would have a deed to the land, a sale contract, a small business loan from my credit union, and all the required federal and state transfer of ownership documents. Do I really need another piece of paper saying “1 small business —- $1,385,046.37” when we’ve already printed and electronically signed and archived numerous other pieces of evidence?

Even the oldest, smallest breakfast joint in town can provide electronic receipts. Given the option of losing a receipt you’ll likely never need in the first place or getting instant access to it on your mobile device with the click of the button, which would you choose? When you receive your quarterly 401k statements do you need paper, or could you just download them from your provider’s website? Whether the paper copy exists or not, the electronic copy will exist for more than long enough to have a record of your history.

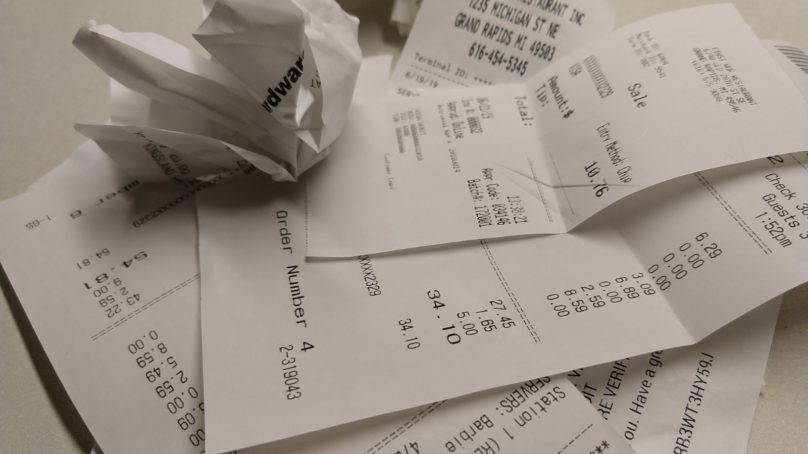

Most receipts we print will end up with the same fate as the paper on the plastic straw left on my breakfast table every Wednesday morning. They end up a wet, useless mess in the wastebasket. We already have instant access to all receipts, documents, and plenty of proof of what we’ve done. As providers of financial services, we should be working with our customers to maximize the availability of access to our data and minimize the amount of extra work it takes to maintain useless paper copies of electronic documents.

Miguel Abreu#1

Agreed, printed receipts is quickly being made obsolete due to the 247 access we have of our banking information.

I believe that, like the telegram, it will eventually be something that’s done on special occasions and then phase out.

Western union officially closed their telegraph service in 2006.