NCUA to Receive Third-Party Oversight with New Bill Introduced

In a move opposed by credit union trade groups, Senators Jon Ossoff, D-GA, Cynthia Lummis, R-WY, and Mark Warner, D-VA, introduced a new bill that would provide NCUA with oversight powers over credit union organizations and service providers, reports CUSO Magazine’s Esteban Camargo.

Going Public: A Credit Union, Their CUSO, and a SPAC

What happens when a credit union-owned CUSO is sold? Chip Filson looks into the 2022 sale of Safe Harbor Financial to special purpose acquisition company North Lights Acquisition Corp.

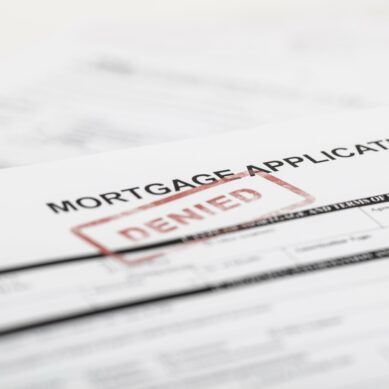

Neighborhood Mortgage Solutions Hires New MLO To Retail Lending Division

Neighborhood Mortgage Solutions, a Credit Union Service Organization (CUSO) based in Michigan announced the launch of a new loan origination arm in November 2021, the NMS Retail Lending Division.

Arkatechture Forms Data-Driven CUSO with ORNL Federal Credit Union and Tucson Federal Credit Union

Arkatechture, a technology company, has formed a CUSO with ORNL Federal Credit Union and Tucson Federal Credit Union to help accelerate implementation of the firm’s data analytics platform Arkalytics into the credit union market.

Tips for Managing Your Next CUSO Examination

CUSO examinations, while less frequent than credit union examinations, are no less stressful or thorough. Patrick Sickels advises on how best to prepare yourself and your staff ahead of time for an audit to make sure you pass with flying colors.

Your Results May Vary: The Hidden Price of Customization

Dawn Moore warns credit unions against diving too deep into customization as the result can make shared resources and support materials confusing enough to members that they become useless.

Comply-YES! Continues First Year Momentum: Adds Five Credit Unions and one CUSO in Q3 2021

Comply-YES! continues its first-year momentum by establishing ally (client) relationships with five new credit unions and one new Credit Union Service Organization (CUSO).

What Harper Got Wrong with the CUSO Rule Vote

Vic Pantea shares his thoughts on the recent CUSO rule approved by the NCUA board, and why Harper got the vote wrong.

NCUA Board to Consider Final CUSO Rule on October 21

The National Credit Union Administration board on Oct. 21 will consider a final rule governing the permissible activities for Credit Union Service Organizations—an issue that has been a contentious one for board members in the past, reports David Baumann of the Washington Credit Union Daily.

Credit Union Trade Groups Endorse Proposed CUSO Rule While Consumer Groups Argue Would Authorize Predatory Lending

Two stories from David Baumann of the Washington CU Daily: Saying that the NCUA’s current rule governing Credit Union Service Organizations is sorely outdated and hampers innovation, CUNA and NAFCU are calling on the agency board to finalize an updated regulation. The National Credit Union Administration’s proposed Credit Union Service Organization rule would allow CUSOs to become predatory payday lenders that could make loans that far exceed the interest rate in the Federal Credit Union Act, consumer groups are warning.