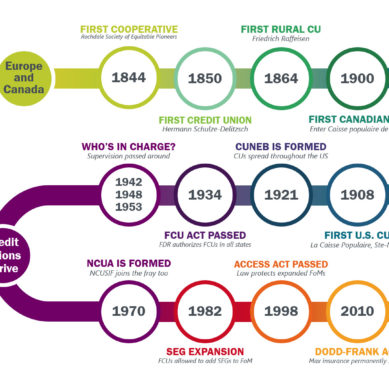

More Than Marketing: Cooperative CUSOs Have Been Supporting Credit Unions for Decades

Reflecting on the long history of cooperative CUSOs, CU*Answers CEO Geoff Johnson reminds credit unions not to be swayed by flashy marketing, but to find a true cooperative partner.

An Annual Meeting that Owners Stand in Line to Attend

Chip Filson asks what your credit union is doing to create excitement about annual meetings, and shares two examples, big and small, if organizations doing their best to respect their owners.

Form Follows Function Even in Credit Unions

Like the Wainwright Building in Chicago or many species of animal on Earth, credit unions were originally formed to function in a certain way. But has the form evolved away from that function and what does that mean to the future of the industry, Chip Filson wonders.

The Power of Community

In the race to grow, credit unions might be losing out on an important aspect of what makes them so impactful: their local effect. Chip Filson shares how credit unions parallel local press in that way, and reinforces the importance of community.

The Ultimate Cooperative Advantage

In a financial business, the temptation to prove success through dollar signs and numbers is pervasive. Chip Filson reminds credit unions that their greatest success is demonstrated in their relationships with members and the impact on their communities.

A Credit Union-Like Story: The Bank of Dave

Chip Filson discusses the story (and now film) of Dave Fishwick, a British resident who sought to shake up the financial industry in the UK.

The Skill of Keeping Honest People Honest

Chip Filson discusses the most critical aspect of leadership and how the barriers we erect reduce, but don’t eliminate temptation.

Website Design: Learning From Others

Website design can be a tricky hurdle for credit unions, but while some can be hesitant to take inspiration from other credit unions, Brett Taylor encourages credit unions to learn from their peers in order to create better websites for their members.

First Lessons from a Credit Union’s CUSO’s Public Offering

Valuable lessons can be learned from Partner Colorado Credit Union and their CUSO subsidiary Safe Harbor Financial. Chip Filson shares what happened when Safe Harbor went public, and what credit unions might learn from the episode.

The Legacy Effect of Credit Unions

As charitable organizations ask Chip Filson to become a legacy member, he reflects on one credit union’s lasting legacy and urges others to pay tribute to their founding and the reason they are around today.