The Watchdog Continues to Rob the Henhouse

Vic Pantea questions the choices and comments made by NCUA Chairman Todd Harper, arguing his motives are to take member’s capital to cushion the organization’s budget.

CUSO Identifies Opportunity in Underutilized Credit Union Owner Investment Authority

The multi-credit union-owned operational services CUSO, Xtend, analyzed the available CUSO investment dollars represented in its credit union owners. Vic Pantea explains the results of the analysis and the opportunities possible, and why more credit unions should be taking them.

Strategies to Avoid Mergers: Economies of Scale

When merging, credit unions often cite a lack of scale and economic capability. Liz Winninger and Vic Pantea discuss ways CUSOs can offer support these credit unions to help combat the rise of mergers in the industry.

Strategies to Avoid Mergers: Adopting a Broker Model

Credit union consolidation and mergers pose a threat to the industry’s many CUSOs and vendors, say Liz Winninger and Victor Pantea. Assisting credit unions in adopting a broker-like model, they argue, can help credit unions increase their product and service offerings and potentially avoid mergers altogether.

CUSOs Are Our Best Choice for a Strategic Partnership

Vic Pantea argues that while the world may be full of third-party vendors anxious to do business with your credit union, only CUSOs offer the full benefits of being a true owner and partner.

What Harper Got Wrong with the CUSO Rule Vote

Vic Pantea shares his thoughts on the recent CUSO rule approved by the NCUA board, and why Harper got the vote wrong.

Have Members Seen ALL the Alternatives?

When voluntary mergers are proposed, do members of the absorbed credit union deserve more say in where their members’ equity should go? Vic Pantea thinks so. He looks at the potential merger of Xceed Financial Credit Union and Kinecta FCU and wonders what should happen to $95M in equity.

Banks are Currently the Envy of Credit Unions When It Comes to De Novos

When it comes to supporting start up financial institutions, the banking industry is beating the credit union industry at its own game. Vic Pantea shares the FDIC’s commitment to de novos and what the NCUA can learn from them.

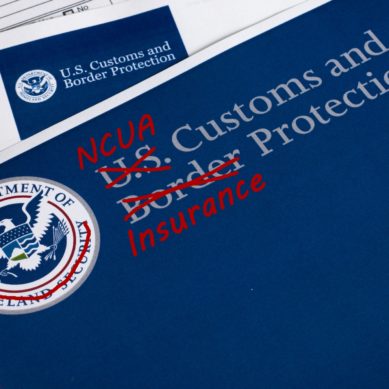

When It Comes to Changing Insurance, the NCUA Should Be a Simple Vendor, Not a Customs Agent

Why is it that NCUA dictates the rules for switching to private insurance for credit unions that are chartered by their state, not federally? Vic Pantea thinks that should change to give credit unions and their states more autonomy over their insurance choices.

Recapping the May 2020 NCUA Board Meeting

What happens when a board chair takes for granted the votes he receives in his favor? Vic Pantea deliverers notes on the May NCUA Board Meeting and wonders what went wrong for Chairman Hood as the board voted on an interim final rule concerning credit union overdraft policies.

- 1

- 2