Read more at chipfilson.com

In the gaggle of bipartisan Congressional speakers, the nobility of CUNA praising attendees, the inside-the-beltway literati’s wisdom, and the obligatory regulatory updates, one person missed his scheduled talk at this year’s GAC.

Chef and humanitarian José Andrés was meant to participate in a fireside chat with National Credit Union Foundation Executive Director Gigi Hyland. The public purpose was to talk about “how he lives out the ‘people helping people’ mission through his global humanitarian efforts as a passionate human rights advocate.”

Chef Andrés was not in Washington DC. He was on the ground feeding refugees at the Polish-Ukrainian border.

Chef Andrés’s works in places of natural disaster such as Haiti, flood and hurricane regions of the American South, and throughout the world have been widely reported.

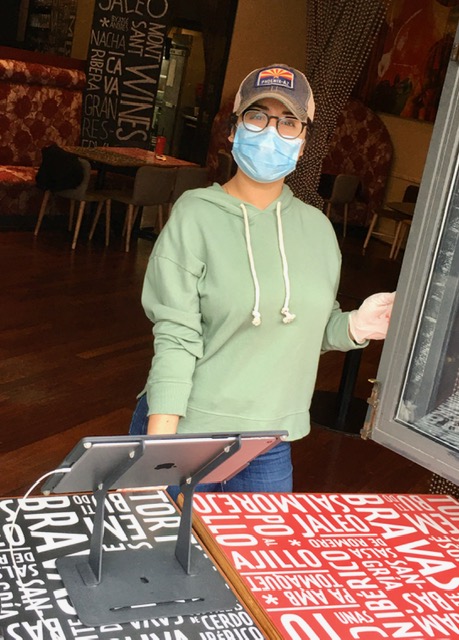

In March 2020 I witnessed his work locally. The entire economy had been shut down. Restaurants were closed, but Chef Andrés kept his Bethesda location, Jaleo open. His staff was still employed providing free meals for several hours each day to workers and anyone else who needed access to food.

The occasion for his absence may have said more than an appearance at GAC could have ever accomplished, for José Andrés embodies an aspect of “people helping people” that is often overlooked: he runs, not walks, toward danger, need, and human suffering.

Walking toward member problems in credit unions

Some of the most powerful examples of the cooperative model at work are when leaders walk toward, not away from their member’s needs. Here are some examples:

- In 2009, a Dayton credit union continued and expanded its dealer lending program when all other lenders backed out because the traditional car title collateral was suspect as the auto manufacturers faced bankruptcy.

- A Florida credit union rewrote first mortgages with payments extending out 50 years to keep members in homes as incomes were reduced by over half by job loss.

- Credit unions in Lowell, MA (Cambodian), St Paul MN (Hmong), and Missoula, MT (sub-Saharan Africa) serve refugees from all over the world who are new to this country’s financial options.

- The New York City taxi lender who divided his loans into A and B notes. A was pay what you earn; B-we’ll worry about later.

Two crises

In the national COVID economic shutdown in March 2020, there are thousands of examples of credit unions willing to walk in the members’ shoes and share their collective capital by waiving fees and giving loan payment holidays, all the while setting up remote delivery options literally overnight. Employees worked from new home offices and kept their full pay.

Perhaps the most consequential example was when I watched the CEO of the second largest credit union in America offer the senior management of the NCUA a solution to the corporate crisis in early 2009. He said his credit union and his peers would buy all the legacy assets and carry them on their books if the NCUA would guarantee no loss of principal. He was turned down. The NCUA instead guaranteed Wall Street investors in the NGN program so they could walk away from the problem.

A unique capability

The cooperative model is unique in its capacity to walk the extra mile for its members when they are in harm’s way. That is what self-help means. Putting member needs first in all circumstances.

I don’t know what Chef Andrés would have said in a “fireside chat” at the GAC. However, I believe his personal witness is more important than any words he may have used. I hope his example might inspire everyone to ask again what our slogan of “people helping people” means in today’s world.

chip+filson#1

Chef Andres just opened up foor service in Florida in areas with limited power and access following Hurricane Fiona.