Building Bridges: Credit Unions Empowering LMI Communities Toward Financial Prosperity

Financial literacy efforts cannot and should not be constrained to the month of April, it needs to be core principle, ingrained into the credit union’s mission and practiced daily, says Kelli Holloway.

CDFI Fund Marked Safe From Cuts, Deemed Statutory

After weeks of uncertainty, the Treasury Department has now officially confirmed that all 11 CDFI programs are safe from cuts as they are deemed statutory programs, reports Emily Claus.

Kyle Hauptman Becomes Newest NCUA Board Chairman

President Trump designated Kyle Hauptman to serve as the National Credit Union Administration’s thirteenth Chairman of its board of directors. CUSO Magazine’s Esteban Camargo reports on Hauptman’s priorities and track record on the board.

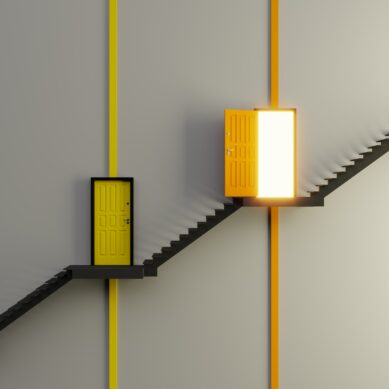

Diversity in Credit Union Charter Options Matters

Credit unions have a number of different designations available to them that can help them better align with their members. Chip Filson details some of the designations and why they are a boon to credit unions as they seek to differentiate themselves.

Credit Unions Avoid Expanded CRA Rules In New Housing Bill

Senator Elizabeth Warren reintroduced the American Housing and Economic Mobility Act without any expansion to CRA requirements for credit unions, in a move highly praised by advocacy groups, Emily Claus reports.

Credit Unions Behind on CDRLF Grant Applications Now Have Until July 12

On July 8, the National Credit Union Administration announced that it has extended the deadline for applying for the 2024 Community Development Revolving Loan Fund (CDRLF). Interested and eligible credit unions now have until July 12 to submit their application. CUSO Magazine’s Esteban Camargo reports.

CDFI, LID, and MDI: What’s the Difference?

The credit union world is chock full of acronyms. CUSO Magazine’s Esteban Camargo looks at community development financial institutions (CDFIs), low-income credit unions (LICUs), and minority depository institutions (MDIs); what they mean and the benefits each provide.

GAO Says CDFIs Need Help, NCUA Making $3.4 Million Available to Low-Income-Designated Credit Unions Through CDRLF Grants

The Government Accountability Office recently published a study suggesting CDFIs and MDIs need more help acquiring and implementing technology to help low- and moderate-income communities; meanwhile the NCUA is opening its CDRLF grant program for 2024 to assist low-income-designated credit unions. CUSO Magazine’s Esteban Camargo reports.

CU Groups Applaud NCUA Minority Depository Institution Program, but Say More Work Needed

From tailored examinations to merger assistance, the NCUA has taken useful first steps in increasing assistance to MDIs, but more work is needed say industry trade associations and MDI credit unions. CUCollaborate’s David Bauman reports.

NCUA’s Community Development Revolving Loan Fund to Award Up to $3.5M in 2023

The National Credit Union Administration announced that eligible credit unions will once again be able to apply for Community Development Revolving Loan Fund (CDRLF) grants in 2023, with the application window opening from May 1 to June 30, reports Esteban Camargo.

- 1

- 2