NCUA Publishes Quarterly System Performance Data, Deposits Outpacing Loans

As the National Credit Union Administration releases the second quarter 2025 credit union performance data report, Esteban Camargo reports on some of the notable findings and changes from the previous quarter.

America’s Credit Unions Calls on NCUA to Reduce Operational Expenses Related to Travel

America’s Credit Unions is calling on the NCUA to keep a tighter rein on its travel expenses, one step in ensuring the NCUA is a “prudent steward of credit unions’ funds”. CUSO Magazine’s Esteban Camargo reports.

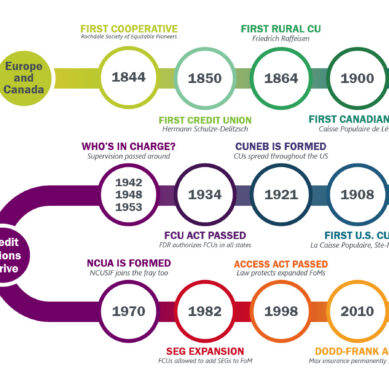

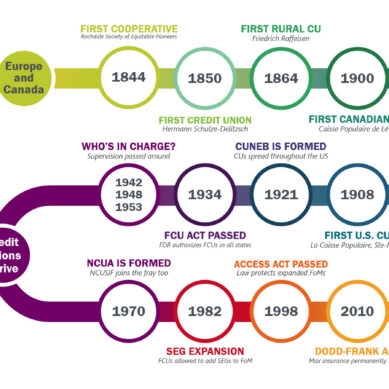

A History of Credit Unions Part 5: Where We Are Today

The conclusion of our five-part history of credit unions takes us to a head-to-head confrontation with the banking industry in the 90s and the impact of the Great Recession on credit unions.

NCUA Board Members Harper and Otsuka Return for Board Meeting Prior to Stay by Appeals Court

Following their reinstatement as members of the NCUA Board, Todd Harper and Tanya Otsuka returned for the July 24 board meeting before a stay by a federal appeals court set them outside looking in once again. CUSO Magazine’s Esteban Camargo reports.

Public Hearings to Correct the Merger Free-for-All

Amidst a wave of mergers and little-to-no-information provided to members, Chip Filson calls for the creation of public hearings as a part of the merger approval process, to both enhance accountability and transparency by the credit union and encourage member participation.

A History of Credit Unions Part 4: Rapid Growth and the NCUA

Part 4 of this credit union history series explores the formation of the National Credit Union Association in 1970, the rapid growth of credit union assets over the course of the next decade, and the changes in credit union services and policies that would lead to a confrontation with the banking industry…

Federal Judge Reinstates Fired NCUA Board Members Harper and Otsuka

In a win for NCUA’s independence, a US District Judge has ruled that the President overstepped his authority in firing NCUA Board Members Tanya Otsuka and Todd Harper in April of this year, ordering that they be reinstated to their positions immediately, reports Emily Claus.

NCUA Advances Voluntary Review of Agency Regulations

The National Credit Union Administration announced the second Request for Comment has been opened as part of its voluntary review of agency regulations to identify burdensome rules, reports CUSO Magazine’s Esteban Camargo.

House and Senate Committees Put Pressure on NCUA’s Lone Board Member

As the agency currently operates with a one board member quorum, House and Senate committees are questioning the NCUA’s ability to do so and requesting information on its daily functions, reports Emily Claus.

America’s Credit Unions Calls for Succession Planning Rule to Be Rescinded

As the NCUA considers changes to the Succession Planning Rule it issued last year, America’s Credit Unions is calling for the rule to be rescinded and reproposed altogether. Meanwhile, all decisions are likely on hold until the courts rule on former board members Harper and Otsuka’s case, an decision the two are pushing to have handed down before the board reconvenes in July, reports Emily Claus.