Digital Member Experience: The Key to Loyalty

Andrea Argueta warns credit unions of the dangers of becoming digital laggards and risks of falling behind on member expectations.

Credit Unions Need Mergers and Acquisitions to Grow and Technology to Sustain It

In a desire to expand, credit unions have been acquiring community banks and growing their reach. Alex Jimenez explains why these institutions will then need the technological capabilities to back those mergers and acquisitions up and maintain their members.

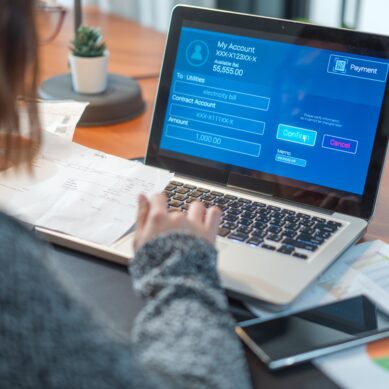

Catering to Digital Natives: Bridging the Gap Between Branches and Digital Channels

Credit unions always strive to meet their members where they are, and in today’s society, where they are is online. Jennifer Dimenna shares some of the latest research on what digital tools consumers are looking for from their credit unions and how they can rise to the challenge.

Adopting and Adapting for Member Acquisition

To aid in credit unions’ never-ending campaign to win over younger generations, Brian Hufford shares data and insight on what these new members prioritize most and how your credit union can align with those needs.

Top Three Trends in Credit Union Marketing

Bo McDonald of Your Marketing Co covers the top three trends impacting credit union marketing at the moment and how credit unions are using these to drive growth.

Industry Survey Reveals Current Digital Technologies Adoption Rates

A recent industry study offers insight on how quickly credit unions are adapting new digital tools and automation for internal workflows and what might be holding others back from doing so.

The Importance of Educating Members on Fraud Alert Procedures

Scams are on the rise, and one of the easiest tricks to get your members’ information is for them to impersonate the credit union. Kaylee Russell explains why educating your members on fraud alert procedures is the best defense for both the credit union and its members.

Marketing Should Never Stop, It Should Adapt to the Circumstances

Marketing isn’t just about getting members to invest in new products and services, it’s also about letting your members know how you can help them when they need it. Sarah Ashby reflects on events of recent years and how essential it is that your marketing plan remains adaptable, regardless of the circumstances.

Staying In One’s Lane

In an effort to grow, financial institutions are at risk of veering in directions that do not align with their foundations or their members’ best interests, argues Chip Filson, who urges credit unions to stay in their lane.

Is Audio Banking Dead?

At first glance, one might assume that audio banking is slowly disappearing as digital methods become increasingly popular and convenient. But there’s more to the story, says Brian Maurer, who argues that thanks to devoted members, audio banking may live longer than expected.

- 1

- 2