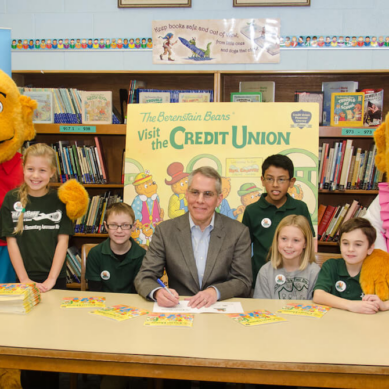

Financial Literacy Spotlight: The Berenstain Bears Cub Club

As part of Financial Literacy Month, Emily Claus spotlights the Berenstain Bears Financial Literacy Program for kids, created through a partnership with Franklin Mint Federal Credit Union and the Berenstain Bears organization.

The CAMELS in the Room

Starting April 2022, NCUA introduced a new letter to the CAMEL rating system: “S” for Sensitivity to Market Risk. Esteban Camargo gives a brief history of CAMELS and what each letter stands for in this financial literacy month series.

What Can We Learn from the Oldest FCUs?

22 of the 100 original charters the NCUA granted after the passage of the Federal Credit Union Act are still in business—a rate almost double that of all FCUs. Chip Filson ponders the reason behind this and what lessons we can take from history.

How You Can Use Google Analytics to Write Better Blogs for Your Credit Union

Casey Smith discusses how your credit union can take advantage of Google Analytics to write content specific to your members and their needs.

Increasing Financial Literacy in Students: Credit Union of Texas Opens SMART Branch

Credit Union of Texas, in an effort to increase financial education amongst students, has created an encompassing financial literacy program consisting of student-run SMART branches and student financial coaches. Emily Claus explains.

It’s Not About Growing Bigger, It’s About How We Can Grow Together

Credit union mergers have received a lot of negative attention in recent years. Canvas Credit Union CEO Todd Marksberry argues that mergers can be both a viable growth strategy and a means of better serving credit union communities.

Important Ratios to Understand Your Credit Union’s Performance

As we continue our series on financial literacy basics for credit unions, Esteban Camargo gives some commonly used ratios and benchmarks some attention, explaining what they are, how they are, how they’re calculated, and what they’re used for.

Can We Use Loan Applications as a Barometer of Success?

Can examining the changes in the number of loan applications a credit union receives be a prediction of success or failure? Josh Peacock thinks so, and he’s here to explain why.

The Steps for Cross Sales Success

Suggesting products and services to members doesn’t need to be a daunting task. BlueOx Credit Union’s Deb Slavens gives the steps necessary to create a repeatable program for cross sales success.

How Are Credit Unions Different from Banks? Three Powerful Words

Chip Filson sums up the credit union difference in three words and remarks on how living up to those three words should be the mission of each credit union.