Three Priorities for Software Development at a CUSO

In the first article of his new three-part series, software developer Bob Anderson shares the three guiding principles behind creating software as a CUSO and how to cultivate a “fit it first” mindset.

Credit Union Supported Bill Passes Senate

Over the weekend, the Senate passed the Homebuyers Privacy Protection Act, a credit union-supported bill, aimed at stopping the practice of trigger leads, Emily Claus reports.

Driving Trust and Efficiency: The Untapped Potential of Private Party Auto Loans for Credit Unions

In the face of high lending fraud rates, Brad Parker urges credit unions to take advantage of the opportunities that lie in private party lending through solutions that offer enhanced cybersecurity and a better member experience.

Igniting a Financial Rebellion: Modernizing Financial Literacy for Younger Generations

Credit unions are rushing to bring in younger members amidst the Great Wealth Transfer, but are often missing the mark on how to do so. To help, Emily Claus sat down with Todd Romer, founder of Young Money University to learn how credit unions can better connect with these potential members through modernized financial literacy programs.

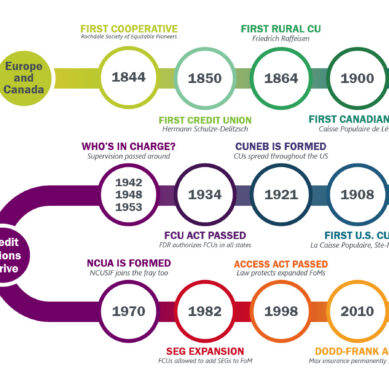

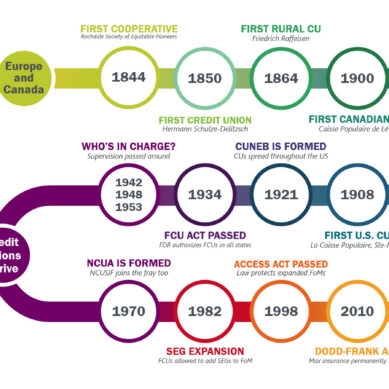

A History of Credit Unions Part 5: Where We Are Today

The conclusion of our five-part history of credit unions takes us to a head-to-head confrontation with the banking industry in the 90s and the impact of the Great Recession on credit unions.

NCUA Board Members Harper and Otsuka Return for Board Meeting Prior to Stay by Appeals Court

Following their reinstatement as members of the NCUA Board, Todd Harper and Tanya Otsuka returned for the July 24 board meeting before a stay by a federal appeals court set them outside looking in once again. CUSO Magazine’s Esteban Camargo reports.

Public Hearings to Correct the Merger Free-for-All

Amidst a wave of mergers and little-to-no-information provided to members, Chip Filson calls for the creation of public hearings as a part of the merger approval process, to both enhance accountability and transparency by the credit union and encourage member participation.

A History of Credit Unions Part 4: Rapid Growth and the NCUA

Part 4 of this credit union history series explores the formation of the National Credit Union Association in 1970, the rapid growth of credit union assets over the course of the next decade, and the changes in credit union services and policies that would lead to a confrontation with the banking industry…

Federal Judge Reinstates Fired NCUA Board Members Harper and Otsuka

In a win for NCUA’s independence, a US District Judge has ruled that the President overstepped his authority in firing NCUA Board Members Tanya Otsuka and Todd Harper in April of this year, ordering that they be reinstated to their positions immediately, reports Emily Claus.

House Financial Services Committee Introduces Bill to Create More Credit Unions

Emily Claus reports on the House Financial Services Committee’s introduction of the American Access to Banking Act, which aims to support the creation of de novo credit unions and community banks.