Explaining Credit Union Allowance for Credit Losses and CECL

As Financial Literacy Month kicks back off, Esteban Camargo continues his education series on the inner working of credit unions by examining Allowance for Loan and Lease Losses and Current Expected Credit Loss.

Cooking with CUSO Mag: Colombian Cooperatives and Empanadas

In the second edition of this exclusive series from CUSO Magazine, Esteban Camargo bridges the gap of credit union education and food blog… Learn about the landscape of Colombian credit unions before making Esteban’s favorite food: Colombian empanadas.

NCUA’s Released 2023 Q4 System Performance Data Continues Trend of Declining Credit Union Numbers

Last week, the National Credit Union Administration released the credit union system performance data for the fourth quarter of 2023. Esteban Camargo reports on some of the highlights from the report.

NCUA’s Tanya Otsuka Attends First Meeting as Member of the Board

Ten days after being sworn in on January 8th as the 25th NCUA Board Member, Tanya Otsuka attended her first National Credit Union Administration board meeting. Esteban Camargo reports on the events.

Despite Earlier Success, Marijuana Banking May Be a Ways Off

With Congress recessed, any expectations for protections to financial institutions serving cannabis businesses will have to wait until 2024, and most lobbyists and Congressional staff suggest even that is unlikely.

NCUA Board Finalizes 2024-2025 and Central Liquidity Facility Budgets

Following its October budget proposal and subsequent commenting period, the NCUA Board has approved the 2024-2025 and Central Liquidity Budgets, reports CUSO Magazine’s Esteban Camargo.

Cooking with CUSO Mag: Desjardins and Madeleines

In this brand new exclusive series from CUSO Magazine, Esteban Camargo bridges the gap of credit union history and food blog… Learn about the life of French-Canadian Alphonse Desjardins before baking a fresh batch of delicious madeleines.

NCUA’s Proposed 2025 Operating Budget Would Be Nearly $100 Million More Than Its Approved 2022 Budget

NCUA’s budget proposal for 2024-2025 has been released, and the numbers they are asking for should be setting off alarms with credit unions, says CUSO Magazine’s Esteban Camargo.

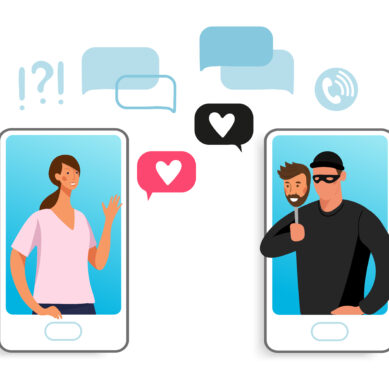

One Scam, Two Scam, Old Scam, New Scam

The more things change, the more they stay the same, or at least so it goes in the world of scammers. CUSO Magazine’s Esteban Camargo documents some of the oldest scams around as well as some newer ones that attempt to con your members out of their money.