A cursory search of the web will find you any number of articles signaling the doom of cash in society. The pandemic in particular ushered in a sizeable shift in how cash is used as shutdowns forced consumers online for purchases and away from in-person transactions.

As sites proclaim physical currency to be in its death throes, countries too have begun the march towards completely cashless societies. India, China, Japan, and others have started trials. Sweden is leading the charge in going to entirely digital currency.

As Americans begin to shift their attitudes toward the prospect of a cashless society, credit unions should ask themselves: what is our role in this process? While it may seem alluring to ride the trends and continue to shift away from physical currency, credit unions may have a moral obligation to lead from behind.

What a cashless society looks like

As of March 24, 2023, Sweden will complete its transition to becoming the first completely cashless society. Meaning that as of then, hard cash will no longer be accepted as a form of currency. But how did they get to this point?

The move has actually been a decade in the making, when in 2012 the six largest Swedish banks collaborated on Swish, a mobile payment platform that was quickly embraced by Swedish residents. Over the last decade, more and more industries transitioned to declining cash as an acceptable form of payment, instead choosing to take plastics and other forms of digital payment instead. Today, less than 1 percent of transactions are made via cash.

Among the benefits, the nation professes is reduced crime/robberies as the movement of cash among individuals and businesses is no longer needed, and less tax avoidance as digital records exist for transactions. The long-term ramifications of the change are as yet unknown, however. And as instances of cyber-attacks increase, Swedes may discover drawbacks to a cashless society.

Sweden, however, is the exception. Many Western nations still rely heavily on cash and coins and will be far slower to adapt.

Where is the U.S. in moving towards digital currency?

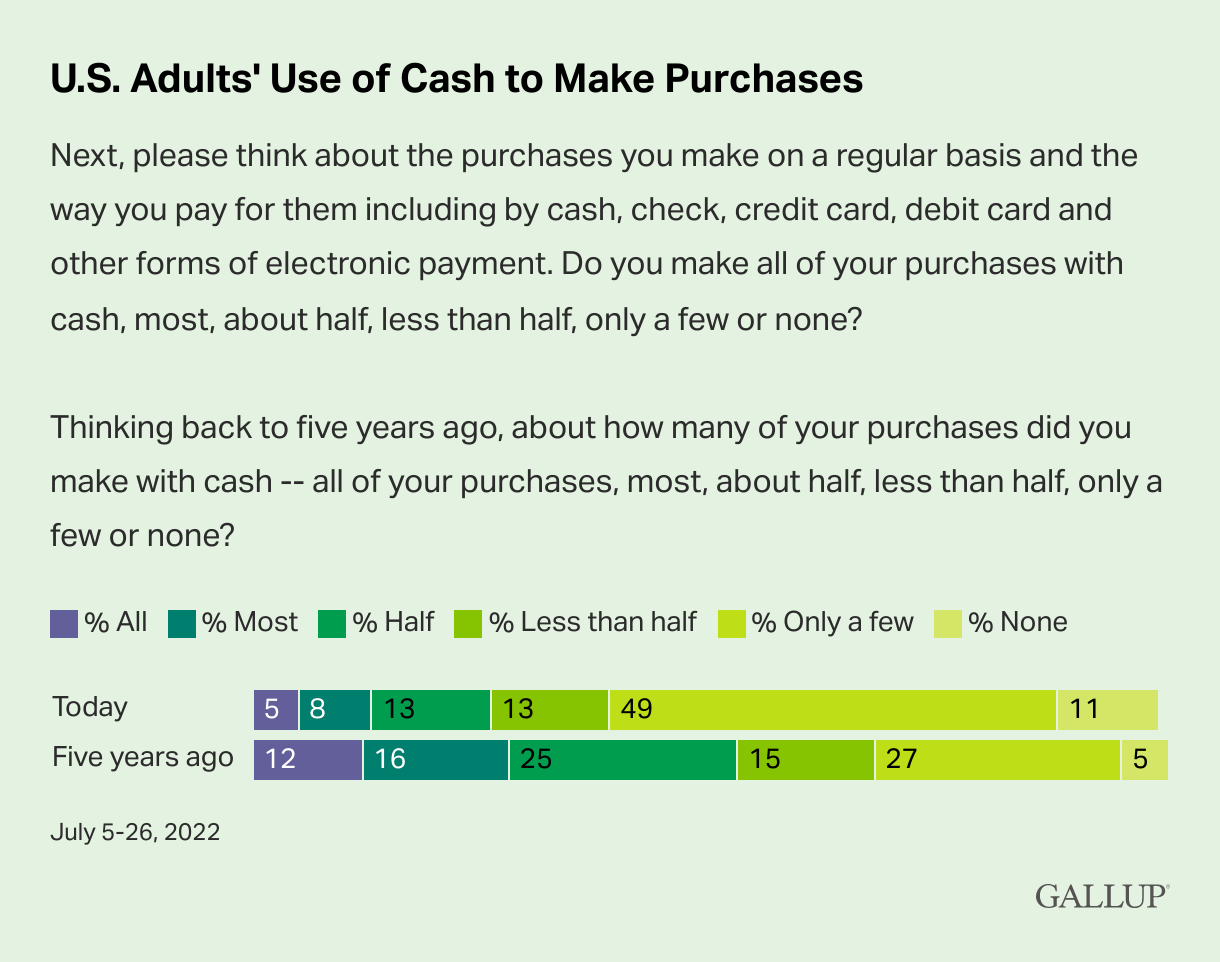

Sweden the United States is not. Cash still accounts for a considerable amount of transactions in the U.S. economy, though the numbers are dropping. According to 2022 research from Gallup, Americans are making fewer and fewer purchases with cash now, especially as compared with five years ago, pre-pandemic.

Per their poll, Americans 28% of transactions were made mostly with cash in 2017, down to just 13% in 2022. 32% of Americans made only a few or none of their transactions with cash in 2017 compared with 60% in 2022. That’s a dramatic decrease and as past data has shown, is likely only to continue trending down.

Cash use did actually see a slight bump in 2021 as purchasers were able to begin returning to stores and making transactions in person. But overall, cash use has decreased significantly over the last two decades.

Obligation to community

Cash is on the decline, that much is clear. Congress has also begun to discuss the possibility of a digital currency. However, we all know that the American government can be fairly slow moving and any meaningful change will have to come from businesses and consumers first.

The question however is “what is the credit union’s role in this shift?”

It is certainly tempting to see the trends of cash flow and the benefits of shifting away from cash, and then decide to lead the charge. Credit unions have certainly benefited from debit and credit card programs, and have made great strides in providing easy access to other forms of digital payments. But might we be leaving anybody behind by leading from the front?

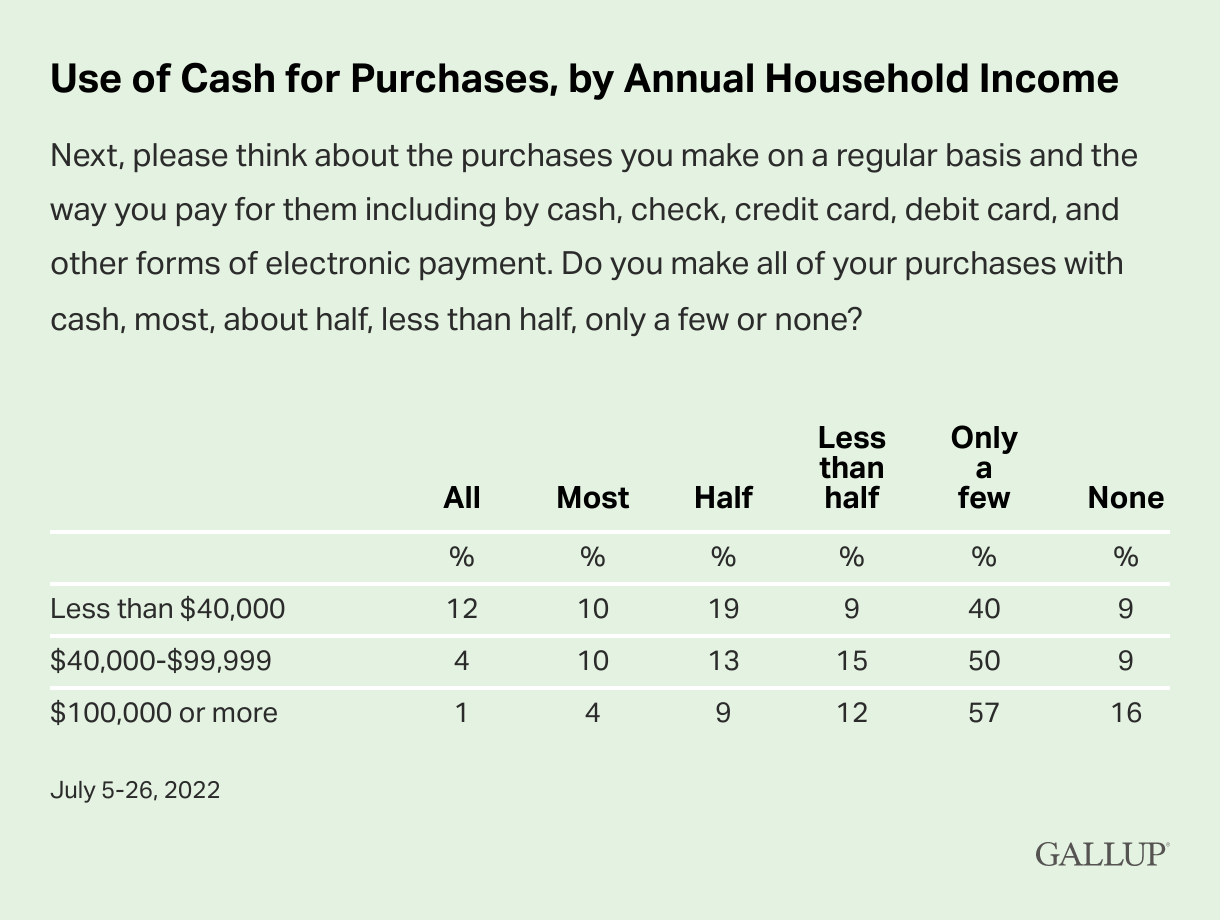

Gallup’s research also shows that cash use often depends on income level and that lower-income families tend to depend on it more.

A whopping 22% of households making less than $40,000 use cash for all or most of their purchases. Only 5% of households making $100k or more do the same. Some outlets suggest that moving to digital currencies is beneficial to the poor:

“Digital currencies also benefit the poor and the “unbanked.” It is hard to get a credit card if you don’t have much money, and banks charge fees for low-balance accounts that can make them prohibitively expensive. But a digital dollar would give everyone, including the poor, access to a digital payment system and a portal for basic banking services. Each individual or household could have a fee-free, noninterest-bearing account with the Federal Reserve, linked to a cellphone app for making payments. (About 97 percent of American adults have a cellphone or a smartphone.)”

Saying it is beneficial and realizing those benefits is another ball game. Credit unions’ role in all of this may be in educating the under- and unbanked and helping those communities’ slower transition to digital services. Where does your credit union stand? Share your thoughts in the comments below.