How Credit Unions Can Beat the Megabanks and Neobanks

In a banking world rife with banking options, from megabanks to trendy neo banks, credit unions can feel overwhelmed by the compeititon. Rick DeLisi explains how credit unions can take advantage of new technology to beat them at their own game.

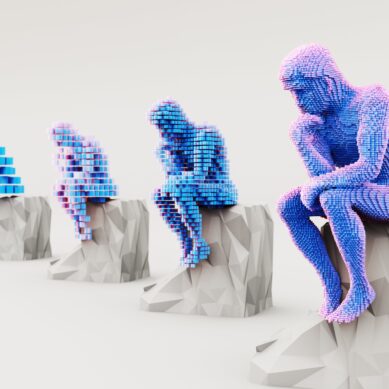

3 Mistakes Credit Unions Should Avoid in AI Adoption in 2026

As credit unions rush to add AI to just about everything, Saeid Kian explains where most mistakes in AI adoption occur and how your credit union can avoid those pitfalls.

Four Ways to Seize The Power of AI for Marketing

With AI making its way into just about everything these days, your marketing should not be the exception. Taylor Mahoney shares how you can use the new technology to make more engaging and reliable content.

AI Case Studies: Considerations for AI Workplace Use

With many organizations eagerly jumping on the AI bandwagon, Patrick Sickels encourages credit unions to slow down and examine the risks and emerging regulations around AI and develop strong policies and protections before taking on this developing technology.

The Phantom in Your Phone: The Rise of AI Scams

Everyone is using AI these days, including bad actors and scammers. Emily Claus explores how fraudsters are using this new technology to impersonate others, and how credit unions can educate members to spot the phantom in their phones.

Why AI Is No Longer Optional for Credit Unions

To use AI or not to use AI, that is the question credit unions are asking themselves. But with the genie out of the bottle, credit unions need to look at adopting the technology sooner rather than later, says Saeid Kian, but in a responsible and intentional way.

What Are You Going to Do With the Cost Savings in Your Contact Center?

Artificial intelligence shouldn’t take jobs, it should change them, busying itself with routine, mundane tasks and freeing up employees for more meaningful work. In the wake of this change, Rick DeLisi asks credit unions how they will reallocate their resources and reinvest in their teams.

Would Members Say This About Your AI Chat Service?

In the age of AI everything, Chip Filson issues a reminder to credit unions’ distinguishing factor is strong member service provided through genuine human connection.

Less Artificial, More Intelligent

In the overwhelming world of AI technology, chatbots are usually top of the list for credit unions to take on. But not all chatbots are made equal, nor do they offer the same outcomes and member experience. Ellis Stefanovsky provides insight into the world of AI chatbots and which type credit unions should be adopting for hand-tailored member support.

AI and Behavioral Science: Crack the Code to Member Action

Experts agree that personalization is the secret sauce to any good marketing strategy, but how do credit unions go about achieving that? Ashleigh Craven of Pocketnest shares how credit unions can leverage AI to reach a perfect level of personalization and enhance the member experience.