Insights from Educators: Training and Onboarding

In her new interview series with credit union educators and trainers, Kasey Olchowski sits down with TBA Credit Union’s Training and Development Specialist, Mae Johnson, to uncover her insider knowledge on onboarding and new hire training.

Key Corporate Legal Issues Facing CUSOs

Patrick Sickels covers a few key areas where CUSOs are vulnerable to legal ramifications at the moment, including member and shareholder issues as well as merger and acquisition liabilities.

AI Case Studies: Considerations for AI Workplace Use

With many organizations eagerly jumping on the AI bandwagon, Patrick Sickels encourages credit unions to slow down and examine the risks and emerging regulations around AI and develop strong policies and protections before taking on this developing technology.

Every Credit Union Is a Cooperative, But Not Every CUSO Is a Cooperative

Patrick Sickels details the difference between cooperative CUSOs and non cooperative CUSOs and why credit unions should be investing in and building the former.

Don’t Let Members Get Spooked By Spoofed Sites

As we close out Cybersecurity Month, CUSO Magazine’s Esteban Camargo warns about the dangers of spoofed websites, how to recognize them, and how to avoid getting spooked.

The Unsung Heroes: America’s Credit Union Museum Pays Tribute

In deference to the hardworking pioneers of the credit union movement, America’s Credit Union Museum has unveiled its newest exhibit, Woven in History: A Tapestry of Unsung Heroes. Emily Claus sat down with the museum’s Executive Director, Stephanie Smith, to learn more about the inspiration for the exhibit as well as their upcoming day of giving, a Labor of Love.

Igniting a Financial Rebellion: Modernizing Financial Literacy for Younger Generations

Credit unions are rushing to bring in younger members amidst the Great Wealth Transfer, but are often missing the mark on how to do so. To help, Emily Claus sat down with Todd Romer, founder of Young Money University to learn how credit unions can better connect with these potential members through modernized financial literacy programs.

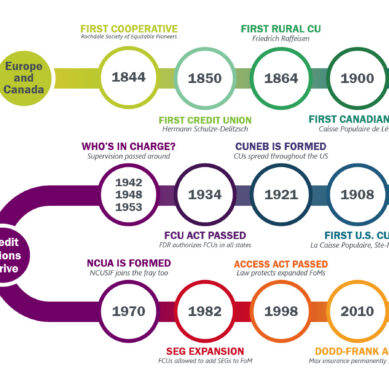

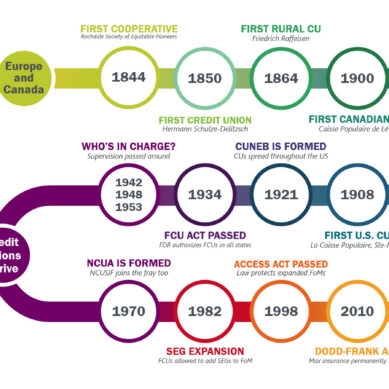

A History of Credit Unions Part 5: Where We Are Today

The conclusion of our five-part history of credit unions takes us to a head-to-head confrontation with the banking industry in the 90s and the impact of the Great Recession on credit unions.

A History of Credit Unions Part 4: Rapid Growth and the NCUA

Part 4 of this credit union history series explores the formation of the National Credit Union Association in 1970, the rapid growth of credit union assets over the course of the next decade, and the changes in credit union services and policies that would lead to a confrontation with the banking industry…

A History of Credit Unions Part 3: Credit Unions Go National

In part three of his series on the history of credit unions, Esteban Camargo details how credit unions made their way to the U.S., became written into law via the Federal Credit Union Act, and began to flourish.