Why the CLF Has No Interest

The Central Liquidity Facility exists to provide credit unions with liquidity lending, and yet it hasn’t had activity in years. Not only that, but they’re struggling to manage their assets and Chip Filson is wondering whether credit unions still need it.

The Next NCUA Chair: Someone Who Cares About Us

With a new President incoming and NCUA Chair Todd Harper’s term ending in August 2025, Chip Filson is asking who credit unions would like to see appointed to the role, and what attributes that person will have.

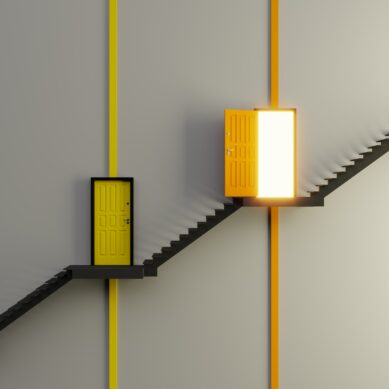

Diversity in Credit Union Charter Options Matters

Credit unions have a number of different designations available to them that can help them better align with their members. Chip Filson details some of the designations and why they are a boon to credit unions as they seek to differentiate themselves.

Getting Back to Work: A Member with a 536 FICO Score

Chip Filson shares one member’s story to remind credit unions why they’re here: to provide members with little financial miracles every day.

What to Do When Credit Unions Go Rogue: Part One

Chip Filson analyzes the merging habits of Credit Union 1 in Illinois, the businesses decisions and bonuses the follow these mergers, and the outcome for members and employees involved in part one of two.

Almost 100,000 Members Vote in SECU Election

Chip Filson shares the impressive outcome of SECU’s recent board election, in which nearly 100,000 credit union members turned out to vote.

The Lehman Trilogy and the Arc of American Finance

Chip Filson shares the story of the rise of the Lehman Brothers and the credit union lessons that can be learned from their downfall.

Wisdom for Life from Children’s Stories

Chip Filson views recent mergers and bank acquisitions through the lens of children’s stories to ask the industry: when is it time to say enough?

Reclaiming Civility in American Politics

Chip Filson references the change in political discussions as a reminder to credit unions not to fall into the same traps, and most importantly, to remember who credit unions are meant to serve.