Carla Decker, the CEO of DC Credit Union, discusses her credit union’s commitment to community and how the COVID-19 crisis has affected her certified CDFI shop.

Carla Decker is the CEO of DC Credit Union. She’s held the position since 2001.

Carla Decker, CEO, DC Credit Union

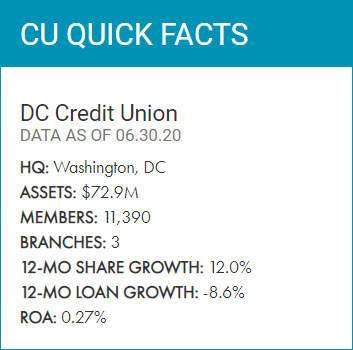

DC Credit Union ($72.9M, Washington, DC) is dedicated to providing access to credit as a tool for economic development. In the past three years, the credit union has received $2,083,000 in grants from the CDFI Fund, the NCUA Technical Assistance program, and other organizations.

What populations do you serve?

Carla Decker: Our credit union was founded in the 1950s by Black municipal employees specifically because they could not access credit from banks. What they were able to access was either through loan sharks or other type of predatory credit. Our roots are steeped in civil rights, and to this day we continue with that same tradition of serving the most vulnerable people who lack access to affordable, safe, financial services. We live in a highly gentrified city, and there is tremendous financial inequality.

What do these populations need from a financial institution?

CD: They need financial coaching and second chances. They need to be able to reset a relationship with a financial institution and access affordable credit. That’s first and foremost.

We need to provide a basic understanding of how to benefit from a banking relationship. We don’t want our members to find themselves in accounts where they are paying more fees than they are returning in dividends. We also need to motivate them to think further than today and tomorrow while making sure they’re able to get from paycheck to paycheck without taking on too much financial burden and creating a cycle of indebtedness.

When did DC Credit Union become a CDFI? Why?

CD: One of our first strategic objectives when I became CEO in 2001 was to diversify our membership and diversify our work. Because we were formed by city government employees, our credit union was tied to the financial and budgetary cycles of the municipal government. We had acquired a low-income designation, and my job was to use that more effectively to provide services, such as transition services and home and credit products, to immigrants.

We opened a fully bilingual branch in the Mount Pleasant neighborhood of DC in 2006. It operates in partnership with other local credit unions and other community organizations and advocacy groups for Latinos. When we became a CDFI-certified credit union in 2009, we had experience and expertise in serving low- to moderate-income families through this branch.

We’ve since learned the products and services that work well for one underserved group translate to other groups that might be underserved. The timing of our CDFI certification coincided with the economic downturn. Our members were affected early on, so the credit risk was tremendous. We needed to be able to access additional capital, and knowing that we were devoted to our mission of financial inclusion, the transition to CDFI-certification was a natural one.

How competitive is the grant process? How do you stand out from other applicants?

CD: We have a high operating cost, which means our margins are narrow. We can’t grow as fast as others who have better rates of return. Having that capital cushion to make loans to our members, who are often higher risk, is critical to ensure we can absorb the hard times they experience and continue to grow in size and impact.

All of which is to say the grant process is important and also pretty competitive. There are many credit union CDFIs and other financial institutions doing tremendous work, and each one has a story and impact that can be measured and viewed in different ways. For us, we’ve found success standing out from others by knowing our story and being able to articulate it — both qualitatively and quantitatively. We make sure our application focuses on programs or projects in which we already have expertise, but we’re also careful to document how we’ve used our funds in the past to create a positive impact. We do that by embedding our community work into our strategic plan so what we do as it relates to our grant work parallels our core work.

Who or what is historically the aim of your community work? What challenges do you look to address? Why?

CD: There was a 2017 FDIC study that showed 8% of DC’s 700,000-plus residents were unbanked — compared to 6.5% nationally — and 25% were underbanked — compared to 19% nationally. There is a large population within the District who need access to financial services as a way to fully participate in the economy and build assets and wealth. In DC, poverty is most prevalent among people of color. In addition, one-third of DC residents have subprime credit scores.

You might think of DC as this high-powered, wealthy city. The fact is, there are a lot of people who have been left behind and lack a voice. This is especially true as investment in some parts of the city have forced some people from living and benefiting from that investment.

Representatives from DC Credit Union help community members prepare their federal income tax returns.

How has COVID-19 changed your operations or your community work?

CD: At this point, all three of our branches are open. Our biggest shift has been in our mindset now that there’s such a need to serve members remotely. Our model is high-touch. We sit with members to talk them through how we might best serve them. That’s been disrupted.

We aim to provide friendly and easy banking, but how do we build new or existing relationships with acrylic panes of glass separating us from members? Although we have a robust suite of electronic remote services and capabilities, many of our members using those services might not be as comfortable or adept as we would have anticipated. So, as we move away from majority in-person interactions, how do we replicate or maintain that same level of service or relationship by phone, email, or online banking?

How has COVID-19 changed the way you think about the credit union and its mission? How have you evolved?

CD: It has reminded us of the need for the credit union. In the earliest months of the pandemic, April and May, the city streets were empty and yet we were serving 120 to 150 members every day. I remember people walking into our branches saying, ‘I have nowhere else to go.’ There weren’t many other financial institutions open. It was a clear reminder that the folks we serve are frontline public servants, emergency responders, service industry workers — populations who were most at risk and needed to be able to cash a paycheck or deposit a stimulus payment.

Then, we see a need to focus on entrepreneurship and small business support. This is a population that doesn’t have the luxury to work from home, so making sure they know they have a financial institution working for their best interest is important. We do have some basic products for this population, such as a microbusiness loan that is underwritten to the consumer as opposed to the business, but we see the need to support these groups to a level that wasn’t as prevalent before the pandemic.

Why are CDFI-certified credit unions important to the financial services landscape?

CD: CDFI credit unions have the ability to respond to and invest in areas that other financial institutions, particularly for-profit financial institutions, would not.

CDFIs are vehicles by which public policy can direct financial resources into a community. The U.S. Treasury Department might not be able to invest in the Latino population in Washington, DC, but it can invest in us. We’re then able to deploy services that would benefit that population. We can be a mechanism by which larger for-profit entities can direct resources in ways they would not traditionally do.

What lessons or advice do you have for credit unions considering CDFI certification?

CD: There are many wonderful professional resources out there to help organizations navigate the certification process. But to be successful with the certification, you have to be true to your mission and the needs of your membership. If your conscience as a credit union lies in community development, and if that’s something that already defines your work, then CDFI certification is for you.

This interview has been edited and condensed.

This article appeared originally on CreditUnions.com and is the intellectual property of CALLAHAN & ASSOCIATES. No part may be reproduced, transmitted, distributed, published, or otherwise communicated without the express written permission of CALLAHAN & ASSOCIATES.