The Year Will Not Wait

As we look ahead to what 2026 has to offer, marketing expert Bo McDonald encourages credit unions to move along with the year and all the changes it brings, instead of pushing back against them or worse—waiting to act.

The Credit Union’s Data-Rich, Insight-Poor Dilemma

Credit unions are constantly collecting member data, yet most of it sits unused, doing little to build a connection between the member and the credit union. Ashleigh Craven urges credit unions to take their data out of the box and use it to start meaningful conversations with members.

Most Credit Unions Are Measuring the Wrong Thing

The Your Marketing Co team explains why measuring member satisfaction isn’t a winning strategy and why it won’t bring the results your credit union is hoping for, namely, because satisfaction is not loyalty.

The Icarus Syndrome: What’s Holding Credit Union Leaders Back

Just as Icarus took a fatal fall after flying too close to the sun, marketing expert Bo McDonald warns that credit union leaders may be on ther verge of making a similar mistake by forgetting their original mission and becoming overconfident or complacent in their business.

The Cost of Winning: Why Zero-Sum Thinking is Poisoning the Credit Union Movement

In an age where members belong to several financial institutions, Jeffrey Kusler explains why credit unions retaining a zero-sum thinking approach does little but pit credit unions against each other, opposing our cooperative foundations.

What Are You Going to Do With the Cost Savings in Your Contact Center?

Artificial intelligence shouldn’t take jobs, it should change them, busying itself with routine, mundane tasks and freeing up employees for more meaningful work. In the wake of this change, Rick DeLisi asks credit unions how they will reallocate their resources and reinvest in their teams.

Data Processing for Credit Unions: Balancing Compliance, Innovation, and Member Trust

Operational expert Jeff Miller shares why credit unions need to be utilizing their data as critical infrastructure through which to build credit union processes around, instead of simply compiling and storing it for a later day that may never come.

Would Members Say This About Your AI Chat Service?

In the age of AI everything, Chip Filson issues a reminder to credit unions’ distinguishing factor is strong member service provided through genuine human connection.

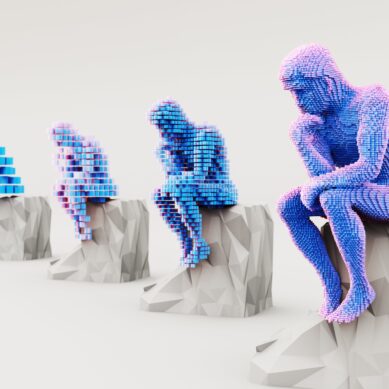

AI and Behavioral Science: Crack the Code to Member Action

Experts agree that personalization is the secret sauce to any good marketing strategy, but how do credit unions go about achieving that? Ashleigh Craven of Pocketnest shares how credit unions can leverage AI to reach a perfect level of personalization and enhance the member experience.

Sub-Optimal Fraud Prevention Hurts Member Experience and Hastens Member Churn

Frank Moreno explains how a credit union’s lack of modern fraud prevention technology can spurn away younger generations and lead them into the arms of a new financial institution.