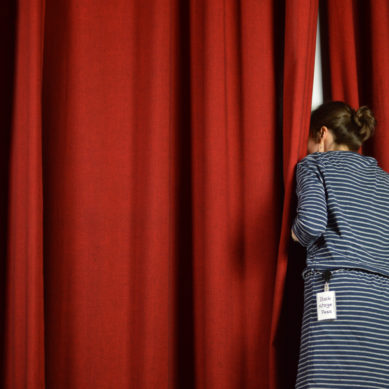

Behind the Scenes of Quality Control

Vice President of Quality Control Mary VanAntwerp offers a special look behind the curtains of her department to reveal the secrets of software development and testing.

Would Your Electronic Document Process Take You to the Championship?

Coach Kyle Karnes wants to make sure your credit union team – and your electronic documents process – is ready to not just make it all the way to the big game, but take home the trophy.

CUNA Continues Push for Liability Protection from Coronavirus Lawsuits

CUNA signed a letter with hundreds of other organizations urging Congress to include temporary coronavirus liability protection in any new economic stimulus legislation, reports David Baumann of the Washington Credit Union Daily.

Make It Or Break It: How to Use Charts to Communicate Your Message

When attempting to convey data through charts, using the right form and medium is essential to effective communication. Mike Warren is here to help guide you to the right format and make your presentation a success.

Five Strategies for Internal Data Monetization

Data management can be expensive, but it’s worth it when you’re getting value from it. Data Analyst Thomas Hull shares a few ways credit unions can use their data to increase revenue and decrease expenses.

The $3.0 Billion Question in 2021 for Credit Unions and NCUA

“When government gets more money, it wants to spend more,” warned Ed Callahan in 1984. Chip Filson calls on credit unions to hold NCUA’s feet to the fire when it comes to returning AME surpluses to credit unions.

Galicia Named Harper’s Chief of Staff

David Baumann of the Washington CU Daily reports that new NCUA Chairman Todd Harper on Monday announced the appointment of Catherine Galicia as his chief of staff. Before being named chief of staff, Galicia served as Harper’s senior policy counsel.

Operational Change at the Core is a Critical Skill Set

Operations Manager Jeff Miller discusses the complexity that comes along with consistently updating and improving on products, and what his team is doing to make this process a priority.

A Once-a-Decade Opportunity

Chip Filson argues that what the aging Central Liquidity Facility needs is reform that focuses on cooperative solutions to the problems that ail it.

Biden Appoints Todd Harper As New NCUA Board Chairman

On Monday, January 25th, President Joe Biden appointed Democrat Todd Harper as the new NCUA Board Chairman.