Read more at chipfilson.com

There are financial deserts in towns and cities across America; there is also an absence of new credit union charters.

Since December 2016, the number of federally insured credit unions has fallen from 5,785 to 4,780, at year end 2022. This is a decline of over 165 charters per year. In this same six years, fourteen new charters were granted.

Expanding fields of membership (FOMs) to “underserved areas” or opening an out-of-area credit union branch, is not the same solution as a locally inspired and managed charter.

Obtaining a new charter has never been more difficult for interested groups. Through its insurance approval, the NCUA has the final say on all new applications whether for a federal or state charter.

Today, credit union startups are as rare as __________. (You fill in the blank.)

At the 2023 GAC convention,q an NCUA board member announced the agency’s latest new chartering enhancement: the provisional charter phase. This approach does not address the fundamental charter barriers.

Could an example from the movement’s history suggest a solution?

The chartering record of the first Federal regulator

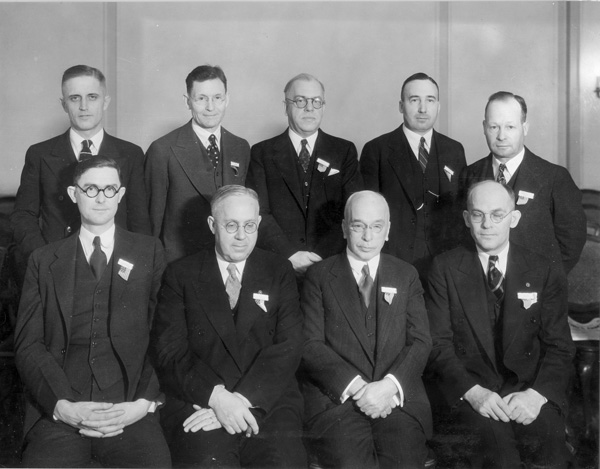

Looking at the record of Claude Orchard demonstrates what is possible for an individual government leader. He was the first federal administrator/regulator managing a new bureau within the Farm Credit Administration to create a federal credit union system. He was recruited for this startup role by Roy Bergengren, who, along with Edward Filene, founded the credit union movement.

The story of how and why he was chosen is told here. Bergengren nominated Orchard because he had “the proper credit union spirit.” This had been demonstrated by his efforts to charter over 70 de novo state credit unions for his employer Amour.

Orchard accepted this government role in the middle of the Depression using borrowed FCA staff. The state-chartered system was the only model of how to create a federal option. That experience and belief in the mission is what Orchard brought to this new role.

Unlike the banking and S&L industry, there was no insurance fund for credit union shares/savings. The coop model was based on self-help, self-financing, and self-governance. Self-starters provided the human and social (trust) capital; no minimum financial capital was needed. Credit unions tapped into the quintessential American entrepreneurial spirit to help others.

Orchard’s critical tenure as the first federal regulator is described in a special NCUA 50th Anniversary Report published in 1984:

“He emphasized organizing as much as supervision. ‘I think in general we tried in the beginning to avoid paperwork because it seemed to me like that was a waster of effort. After all what we were out for was to get some charters and get some organizational work done.’

“When Mr. Orchard stepped down in 1953, federal credit unions numbered over 6,500. During his 19 year he espoused a passionate belief in the ideals of creditunionism. ‘It seems to me that we have here a tool. If it can be made to really be responsive and to really be, in the end, under the control of the members, it can teach people in this country something about democracy which could be taught in no other way.‘

“Deane Gannon, his successor at the Bureau of Federal Credit Unions said to Mr. Orchard on the 30th anniversary of the Federal Credit Union Act, ‘If it hadn’t been for you none of us would be here to celebrate anything.‘”

That last observation echoes today. How many charters will be left to celebrate the 100th anniversary of the FCU Act in 2034?

Alternatives are springing up

For the credit union movement to remain relevant it will require a modern-day Claude Orchards. These are leaders who believe in creditunionism. And possess the passion to encourage new entrants to join the movement.

Regulatory processes or policy improvements may help. But the real shortfall is leadership committed to expanding credit union options.

To address the continuing financial inequities throughout American communities, alternative solutions are being created. Many of these startups are outside the purview of banking regulators.

These community-focused lenders are listed in Inclusiv’s 2022 CDFI Program Aware Book. The firm introduces its role with these words:

“Access to affordable financial products and services is a staple of economically sound communities. Yet at least one-quarter of American households do not have bank accounts or rely on costly payday lenders and check-cashing outlets.

“In recent years, the lack of access to capital investments for small businesses and other critical community development projects has also led to an increased need for alternative and reliable sources of financing.

“Mission-driven organizations called Community Development Financial Institutions–or CDFIs–fill these gaps by offering affordable financial products and services that meet the unique needs of economically underserved communities.

“Through awards and trainings, the Community Development Financial Institutions Program (CDFI Program) invests in and builds the capacity of CDFIs, empowering them to grow, achieve organizational sustainability, and contribute to the revitalization of their communities.”

Of the total $199.4 million awarded to 435 organizations, only 176 or 40% were to credit unions. The rest of the field included 213 local loan funds, 43 banks, and 3 venture capital firms.

Without credit union charters, alternative organizations will be created to serve individuals and their communities. These lenders may not put credit unions out of business but will attract the entrepreneurs that would have added critical momentum to the cooperative system.

Credit unions can qualify for CDFI status and grants. But Inclusiv has a much broader vision for implementing Claude Orchard’s playbook.

In their listing of 2022 total awards and grants, every amount of over $1.0 million went to an organization that was not a credit union. A few were banks, but most were de novo local community lenders or venture capital firms.

Without credit union options, civic motivated entrepreneurs will seek other solutions, and slowly replace credit unions’ role.

Today it is Inclusiv carrying out Orchard’s vision.

Should NCUA delegate its chartering function to those who have “the proper spirit” to secure credit unions’ future?

It will also result in “teaching people in this country something about democracy which could be taught in no other way.”