In today’s rapidly evolving financial landscape, consumers’ interaction with their primary financial institution is undergoing a dramatic change as consumers shift from banking in branches to conducting transactions digitally. This is particularly true for the youngest American consumers who look for digital-first experiences in all areas of their lives.

Given the importance of digital banking today, credit unions that prioritize their online and mobile experience have an opportunity to gain a greater share of the sought-after Gen Z and millennial segment. New research conducted by The Harris Poll provides insights into how best to appeal to these consumers.

The branch paradox

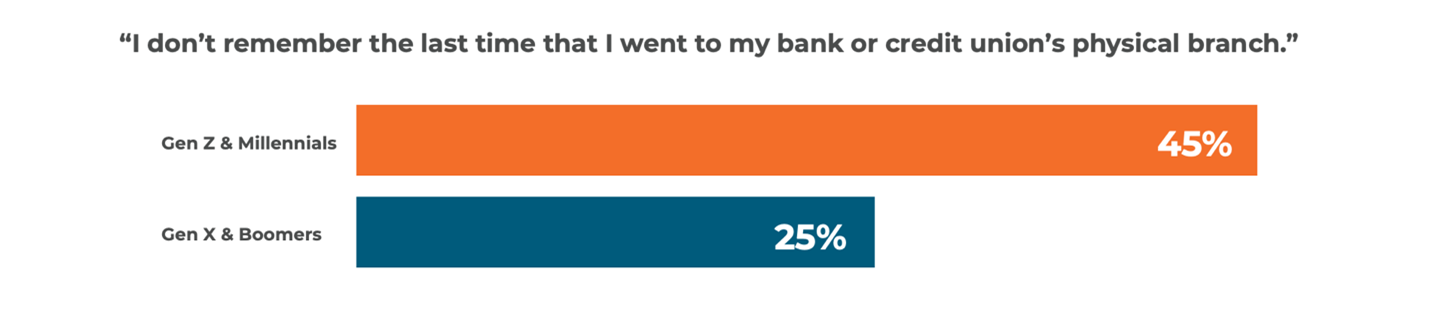

A majority of Americans still prefer their financial institution to have physical branches, according to The Harris Poll. However, the importance of these branches is decreasing among younger consumers. While 65% of Gen X and 76% of boomers believe branches are essential, only 57% of Gen Z and 60% of millennials share this view. Furthermore, 45% of Gen Z and millennials can’t recall the last time they visited a branch.

This physical location paradox has clear implications for traditional credit unions. While branches remain important, their value relative to digital channels is likely to decline as digital natives represent a greater share of the population. To serve this segment, your credit union must find ways to deliver the same exceptional support and service through digital channels that you currently provide in the branch.

Last Branch Visit: Younger vs Older Consumers

Understanding Gen Z and Millennials’ unique needs

As digital natives, Gen Z and millennials have grown up with smartphones, social media, and constant internet connectivity. As a result, they expect a modern, intuitive experience in all digital interactions, including those with their financial institution. According to The Harris Poll, 85% of millennials and 84% of Gen Z state that the ability to conduct banking activities, track spending, and access finances digitally is critical.

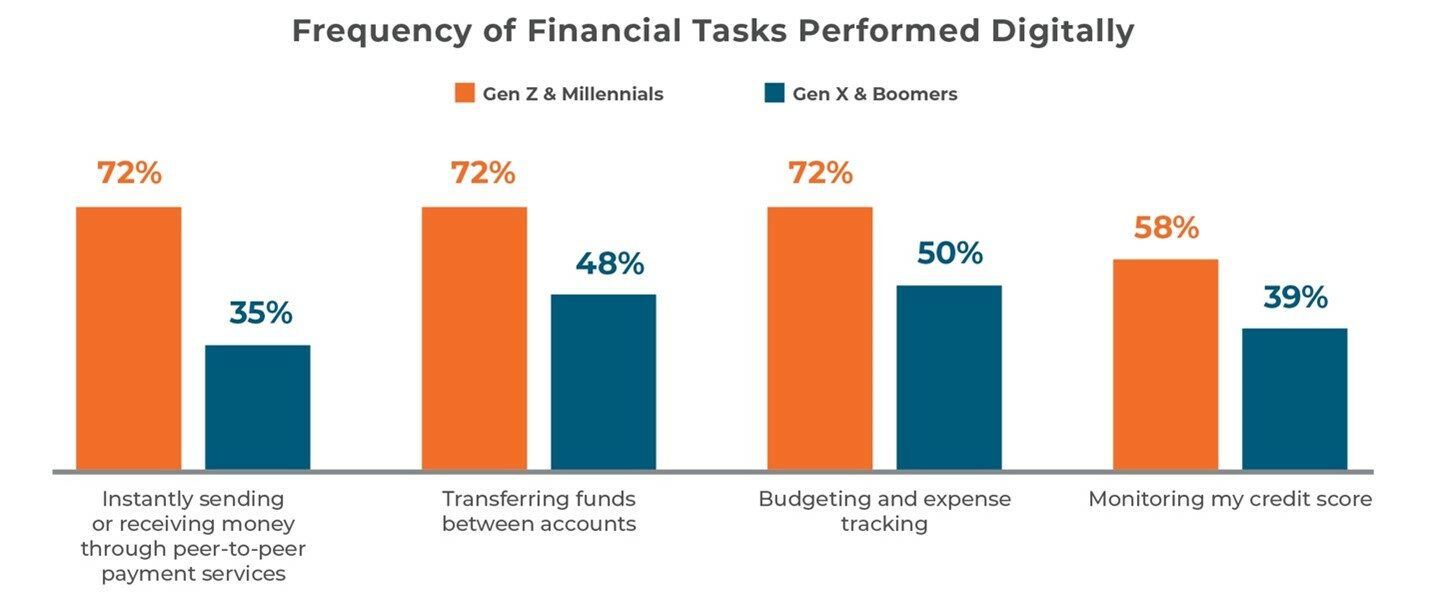

- Digital Task Frequency: Younger vs Older Consumers

To win these consumers, your credit union should ensure you capture Gen Z and millennials where they are—online—with a digital account opening solution that enables consumers to open new accounts in minutes.

Once accounts are established, you must deliver the in-demand capabilities younger members expect. Among the most important are the following features, which younger consumers use more frequently than their older counterparts:

- Payment services like Zelle®

- Transferring funds between accounts

- Budgeting and expense tracking

- Credit score monitoring

- Bill payment

- Mobile check deposit

Younger generations also want to be able to conduct banking activities through nontraditional channels. For example, 25% of Gen Z and 22% of millennials want their digital banking solutions to be compatible with digital wallets. Additionally, 13% of Gen Z and 7% of millennials look for compatibility with wearable devices, including smartwatches.

Although these percentages seem small, it’s this type of nontraditional, innovative feature—one that consumers may not even know they want—that can set you apart as a progressive financial institution.

The importance of a personalized experience

Digital natives such as Gen Z and millennials have come to expect the same highly personalized digital banking experience they have when using sites like Amazon and Facebook.

With today’s innovative data intelligence solutions, even the smallest credit unions can deliver tailored experiences for members through online and mobile channels. These tools can help you analyze how and where your members spend their money, how they interact with your digital banking solution, and how they prefer to pay. That analysis can help you know your members even better and deliver in-channel guidance, personalized messages, or campaigns to enhance the experience and improve their financial well-being.

Data and marketing tools can also consolidate financial data from various sources, delivering valuable insights about your member base in interactive charts and graphs. With this information, you can create highly targeted campaigns, offering members the right solutions at the right time to build greater engagement and loyalty.

As artificial intelligence (AI)-powered solutions evolve, they are likely to help your financial institution deliver an even more personalized digital banking experience. Moreso than Gen X and boomer populations, Gen Z and millennials are open to—and expect—AI to support their banking activities. Potential applications include:

- AI-powered financial education tools offering personalized lessons and quizzes

- AI-driven budgeting, saving, and spending recommendations

- Automated fund allocation to savings based on spending patterns

- Subscription-based financial wellness services

- AI-staffed customer support

Americans are most likely to envision using AI-powered financial assistants within the next five years. And more than a quarter of Gen Z and millennials can imagine using these assistants within one year, according to The Harris Poll.

Credit unions must evolve to survive and thrive

As Gen Z and millennials continue to demand digital transformation in banking, your credit union must evolve to attract and retain these consumers. By delivering a modern, fully featured, highly personalized digital experience, you can help your credit union thrive in a highly competitive environment.