This detailed analysis of Credit Union 1 (Illinois) presents a pattern of declining financial performance covered up by multiple merger acquisitions, one-time sale events, and rented capital. The future fortunes of eleven local sound credit unions have been destroyed in just two years. I believe this kind of predatory activity, left unexamined by all those in positions of responsibility, will lead to a reassessment of the advantages of the credit union charter by external legislators.

The article’s length is to present as much of the facts from these events so readers can make their own assessments. The situation summarized is I believe an example of internal industry reckless actions which present a false perception of success. The question for readers is: Does something need to change?

A case study of Credit Union 1

When there are no guardrails for a financial institution, anything goes. It is the law of the jungle; or what some describe as free market capitalism.

The dictionary definition of rogue is “an elephant or other large wild animal driven away or living apart from the herd and having savage or destructive tendencies.” Another reference is to unprincipled behavior by a person or persons.

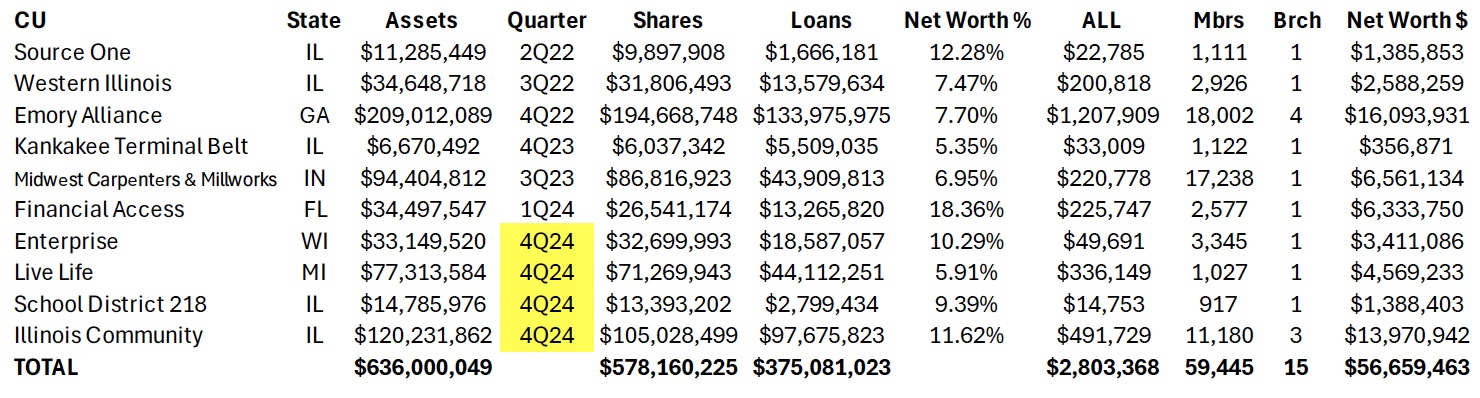

The word “rogue” came to mind as I reviewed the activities and results of Credit Union 1 in Lombard, Illinois, since its conversion from ASI share insurance to NCUSIF in February 2022. A summary of the credit union’s merger tempo since this insurer changeover is shown in the following table for the ten already completed or scheduled to be by the 4th quarter of 2024.

In its October 2024 Member Notice, Synergy listed 23 Credit Union 1 branch operations in six states including the head office in Lombard, Illinois. The two furthest branches are in Bradenton, FL (1,230 miles) and Henderson, NV (1,750 miles apart).

Other new or ongoing initiatives along with this accelerating merger expansion activity include:

- The credit union’s continuing and new sponsorship and marketing promotions with four outside organizations:

- Official Banking Partner of Notre Dame Athletics

- Naming rights to the UIC Pavilion, Chicago, for 15 years and $750,000 in scholarships for a total of $10 million

- Credit Union 1Amphitheater, Tinley Park naming rights

- The Western Conference tie-in: On October 3, 2024, the Big West Athletic Conference announced Credit Union 1 had become its official financial and literacy partner and the entitlement partner for the Mountain West Basketball Championships and all Olympic Sports Championships.

- On June 3, 2022, Credit Union 1 announced an agreement to purchase the $311 million NorthSide Community Bank, located an hour north of Lombard in Gurnee, IL. Both boards approved the transaction subject to regulatory and bank shareholder approval. The deal was not completed. There was no public explanation.

- In May 2023 Credit Union 1 announced it would serve New York cannabis entrepreneurs who plan to open marijuana businesses as part of the state’s CUARD coalition. The same CUTimes article reports, “Credit Union 1 has been selected to participate in the Illinois Department of Commerce’s Cannabis Social Equity Loan Program and is also the preferred banking partner of the Chamber of Cannabis in Las Vegas..”

- In April 2022 DEI and Credit Union 1 announced plans to build three new branches in Chicago, Springfield, and Southbend, IN.

The merger frenzy

Even with these multiple marketing and business initiatives, the core of Credit Union 1’s growth efforts is mergers. The operational intensity of acquiring and converting 11 credit unions (six outside Illinois) and all associated member and vendor relationships in just over two years would be a major operational challenge for any organization.

The immediate question is: how will the members of the merged credit unions benefit?

In the Member Notices posted on NCUA’s website for these combinations, the wording used under “Reasons for Merger, Net Worth, and Share Adjustment, or distribution” are identical. Members’ collective reserves are never distributed to owners even when the merged ratio is higher than Credit Union 1’s.

But zero is not what several of the merging CEO’s and senior staff are gaining.

Rewards for the enabling CEOs

In the case of the $34.4 million Enterprise CU in Brookfield, WI, the 24-year tenured CEO, Jeff Bashaw, will receive a minimum ten-year contract with a base salary increase of $38,000 on top of his current compensation. I estimated (absent the required 990 IRS filing) that to be a minimum of $125,000 per year plus a $100,000 bonus upon closing. Total minimum amount is $1,350,000.

The credit union is in sound shape at 10.6% net worth, a profitable, single branch with low delinquency. After turning over his CEO responsibility, Bashaw’s role if any will be a branch manager or other honorary title. This ten-year contract with a pay raise seems merely a lengthy sinecure. The 8 employees and 2,815 members receive nothing—except the retiring CFO who will receive a bonus and severance of $110,000.

A minority depository institution leader?

At the $34 million Financial Access FCU in Bradenton, FL, the situation is more complicated. The credit union prior to merging, reported a 1Q ’24 loss of $517, 310. However, its net worth was still high at 18.4% ($6.4 million) and delinquency of only .39%. Was this a temporary loss or another problem?

In this merger CEO Sherod Halliburton is receiving a total of $3.2 million composed of a bonus of $125,000, an eight-year employment contract at $200,000 per year, and 100% immediate vesting of a $1.5 million split life benefit plan. He no longer has any CEO responsibility as the credit union will become merely a branch operation. The 15 employees and 2,577 members of Financial Access received nothing for their loyalty.

In a CEO Profile published by Inclusiv in February 2022, prior to the merger efforts, Halliburton is lauded for his leadership. The article remarks on “his strong community ties and business acumen and how he decided to “bet on me” when offered the CEO position” eight years earlier. Further, he points out that he is “one of a limited number of African American men running a financial institution and he accepts the great responsibility accompanying that honor.”

The profile lists his efforts “toward racial equity and responsibility.” He states, “We’ve gone from a somewhat negative perception . . . to now being viewed as a vital part of the economic infrastructure.” The credit union received two technical assistance grants to upgrade technology to meet his goal to double membership in three years. He closes with this affirmation: “We’re here to change lives. I want that to be the enduring message even when I’m gone.”

This Bradenton community credit union which he described as “a vital part of the economic infrastructure” no longer exists. Halliburton is now a Market VP for Credit Union 1 for the next eight years.

An October 2024 approved merger

The most recent example of CEOs cashing in is the $116 million Illinois Community Credit Union with over 11% net worth and a delinquency of .5%. In this acquisition, CEO Thor Dolan will receive a minimum in immediate total benefits of $1,904,494.

This total is described in the Member Notice as follows: a retention bonus of $150,000; deferred compensation of $50,000; a salary increase of $33,724 added to his 2023 reported 990 compensation of $245,770 or $279,494 per year (no employment length given}; and immediate 100% vesting of a $1,425,000 split dollar 20-year life insurance benefit plan.

This salary increase is despite the fact he is no longer CEO, either managing branches or a regional rep, both with no CEO operating responsibilities. Every additional year he remains employed will add another $280,000 to the package. There is no indication the 38 employees (except the CEO and CFO) gain any assurances of employment, and the 10,482 members receive nothing.

The fates of the merged employees and members

Each member merger notice posted by NCUA which I reviewed includes two standard assertions:

- The credit union’s branch location(s) will remain open and become a part of Credit Union 1’s nationwide branch locations.

- Employee Representation: Employees of the credit union will be offered employment with Credit Union 1.

However intended, neither of these statements have proved lasting in practice. Comparing the branch listing in the August 2023 Kankakee Valley Notice with the latest listing in Synergy’s October 2024 notice, six of the branches in the earlier notice no longer exist, including three for Emory Credit Union in Georgia and three for Illinois credit unions with single branch operations.

As for employees’ fate, for the twelve months ending June 2024, Credit Union 1 reported a reduction of 67 full-time employees, from 418 to 351.

As a result of Credit Union 1’s merger strategy, there will be eleven fewer local charters that were operating well, a reduction of 70-80 volunteer directors and member committees, and a loss of all local relationships and legacy brands.

All member savings and loans, collective capital, liquidity, and fixed assets are now in the full control of an institution for which the members have no connection or first-hand knowledge. And in some cases thousands of miles distant. Ironically, Credit Union 1 states in all its promotions that anyone can join, so if members really thought this was a better deal, they could join anytime. But that would be a much harder marketing task than just purchasing the business by paying the CEO—and getting the members’ accounts and accumulated reserves for free.

Members also have a totally new financial institution relationship to navigate. The Credit Union 1 material sent to each member post-voting is a 15-page pdf system conversion process and timeline. Member instructions include setting up new payment and loan options, establishing digital accounts, and using online financial tools.

Depending on the version sent, the membership agreement for each merged credit union is a minimum and 20 pages. It contains essential information about fees, rates, funds availability, mandatory arbitration, and multiple other disclosures that few will be able to read through. The members will learn through experience how everything has changed.

An important difference in Illinois state versus federal charters is the use of proxy voting in all member-required elections, including mergers. For Illinois credit unions, proxies are controlled by the board. I did not see this fact disclosed in the FCU mergers, where proxies are not permitted. In essence, FCU members turn their voting governance power over to a new board. These directors can routinely reappoint themselves without any member vote. We’ll talk about this in part two.