“You will know us by our stores.”

That was the message to credit unions shared by CU*Answers CEO Randy Karnes at the 2016 Leadership Conference, when he introduced the Internet Retailer Support Center Store. The goal: create a community that believes it can afford to implement new online store strategies and sell as well as serve members online, like never before.

“It’s not about selling more,” says Karnes. “It’s about adjusting to the way the modern member does business. Meeting them where they are instead of forcing them to come to us. We’re just moving it all to a single digital storefront making it easier for credit unions to find what they want, and faster to move from want to action.”

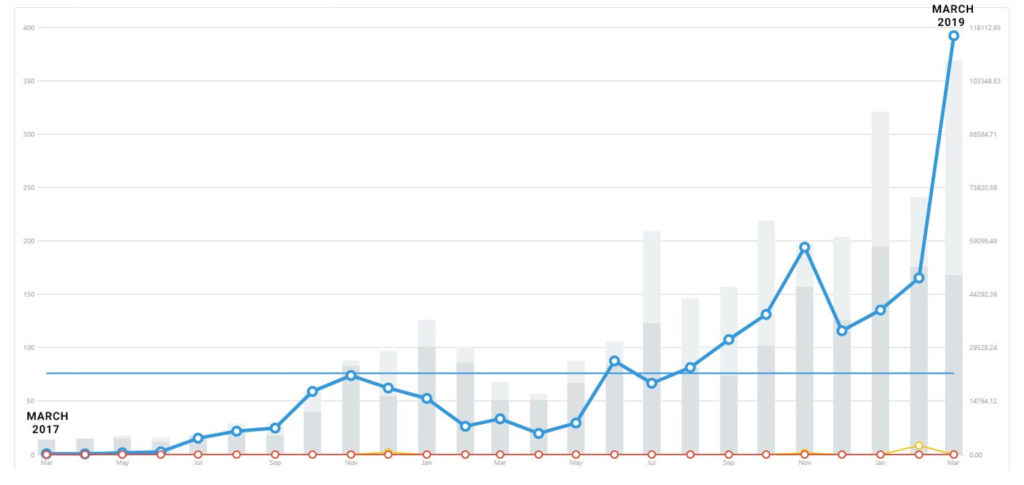

To sell the strategy as a way for credit unions to do business moving forward, the CUSO had to first prove that it could work. Looking back, two years since the initial launch of the Online Store, it’s clear it does.

The online store launches

CU*Answers launched the Online Store in March 2017. Before then, credit unions needed to find and contact the appropriate CU*Answers team to get more information on or start utilizing a service, then go back and forth with emails and forms to fill and scan, lengthening the process to get the client from point A to B. With the launch of the Store, clients could sign up for a product or service with a few clicks of a button, giving the relevant teams the upfront information they needed to get moving.

The Store kicked off with 126 CU*Answers Management Services products across 7 “shelves”. Although adoption was slow it first, as more products were added and the Store was promoted among the network, the sales started to build up.

The team celebrates two years since opening

Fast forward to March 2019. The Online Store now has over 830 active products and services across 130 shelves and is continuing to grow each day.

“Together we have fulfilled over 2,000 orders and recently surpassed the half million mark in gross sales,” says David Damstra, Vice President of Marketing Services & Creative Director. “This is thanks to [the staff] and [their] participation in Store Days, and validating the content in our Store.”

That half million is only tangible sales, excluding any products that require quotes from the individual departments. “We’re extremely proud of the growth we’ve seen these past two years,” adds Keegan Krajniak, lead developer of the Store. “Seeing the numbers continue to climb tells us that our credit unions are buying into this method of working with the CUSO, no pun intended.”

What comes next for the store?

According to Krajniak, simply adding more products isn’t enough for the team. “We have been actively meeting with each team involved in the Store to improve the existing products and find ways to further streamline the ordering process, simplifying the kickoff for the credit unions and ourselves alike.”

Damstra and Krajniak also plan on breaking away from the standard tiled shelves, and pushing for customized templates structured specifically for each team giving them the ability to advertise the most beneficial services and events they know clients will appreciate. After that, it’s getting credit unions to implement the strategy for their sites.

“Together, we hope to provide our clients with the best online retailing presence we can offer and can’t wait to see what the future holds for the CU*Answers Online Store,” concludes Krajniak. Neither can we.