As we wade further into Financial Literacy Month, I want us to shift direction for a moment and look away from the “what” and “why” of the month to the “when” and “where.” In many articles over the years, we have covered the importance of financial education and what areas credit unions should focus on—where their members and community are struggling and how they can meet those needs through financial literacy and financial wellness support.

But often, we treat the where and when of the equation as a foregone conclusion. Where: On the website or in the branch. When: Whenever the member finds the section on the website or makes an appointment at a branch. If the credit union is feeling particularly savvy, it might post a graphic or two to social media sites like X (formerly Twitter) or Instagram and call it a day.

While this strategy is nearly effortless and gets the credit union a checkmark for participation in Financial Literacy Month, it fails to achieve what credit unions must strive for: to meet members where they are. So, where are the members? Well, along with the other 1.5 billion monthly users, most of your younger members are on TikTok. Oh, you meant where they are going for financial advice and education? I repeat, TikTok.

TikTok leads in the financial literacy space

Younger generations are hungry and desperate for financial education, but often struggle to obtain it or find the right resources to do so. Schools don’t always teach it. In fact, only a quarter of high schoolers are guaranteed a financial education class before they graduate. Meanwhile, their parents may not educate them on the topic either (or worse yet, pass down poor money habits), and financial institutions can make it cumbersome to access their financial literacy advice, which can often be buried within blogs in the far corners of their website.

This means that for many, financial education is downright inaccessible. Therefore, it’s no wonder there has been a shift toward using incredibly accessible avenues like social media to get financial information, and research shows the majority of younger generations are doing just that. According to a study by PYMNTS, 79% of Millennials and Gen Z turn to social media, namely TikTok (and sometimes YouTube), as their primary source for financial literacy.

In the last few years alone, there has been a massive rise in financial literacy content on the platform, leading to the creation of FinTok—the personal financial education and wellness corner of the app, which, looking back all the way to 2021, saw over 4.4 billion views. However, not only are an overwhelming number of people going to TikTok for financial literacy and watching these videos, but 50% say the content helped their finances, reports Credello.

What it gets right

But how has social media, namely TikTok, become such a haven for financial wellness seekers and influencers? How has it achieved such popularity in such a minuscule amount of time? Because these FinLit creators have mastered two things: making the barrier to engage with their content as low as possible while making the satisfaction from doing so as high as possible.

The reality is, most FinTok users probably didn’t start out looking for financial literary content on TikTok—or maybe they did; I’m sure there are some. However, most Americans spend over two and a half hours a day scrolling, an amount that totals over 300 feet of media.

As users they get sucked into the endless scroll, the algorithm feeds them any content it thinks might even be tangentially interesting to them. At some point, most users will come across financial literacy content, even unintentionally. Without even lifting a finger, users are being fed personal finance content and advice, all while scrolling through their daily dose of entertainment (but we will touch on the algorithm more later).

Furthermore, unlike many traditional forms of financial education, videos on FinTok are created by users who have struggled with finances themselves and can pass down real, actionable advice. It hits at the core of where people are struggling and what critical information they need. The content also leans into the social media aspect as well, creating TikTok challenges such as No Spend November, essentially gamifying financial wellness.

Additionally, much like other areas of the social media app, such as CleanTok (videos of people cleaning), the financial wellness corner of TikTok creates a feeling of satisfaction and improvement for the user in a very brief period of time. Whether it is by watching others achieve financial wellness—there are a number of accounts that show how they are tackling their debt and tracking the payoff through a series of reels—or by learning for themselves, users have found that engaging with this content makes them feel successful and empowered.

The algorithm

With the creation of targeted content and complex algorithms that determine exactly how long and how often users engage with certain content, anyone using social media to browse through categories like #FinLit or follows #FinFluencers, or even just watches a financial wellness video every now and again, is bound to get increasing amounts of this type of content on their feed. That means that after a time, without even having to search it out, they will be shown financial literacy content automatically.

While this can be a great way to increase the visibility of financial literacy content and reach a wider audience, there is a downside to the algorithm’s process as well. Even if the user intentionally seeks out reliable financial accounts to start with, over time, the algorithm will simply throw anything even slightly related to finance by anyone talking about anything slightly related onto their feed.

This means unvetted content and creators will eventually make their way to the user as well. Ultimately, this can result in an array of financial advice—potentially ranging from true to false or even falling into scam territory—leaving the user responsible for deciding what’s true and what’s not. For people just dipping their toes into financial wellness, this is less than ideal.

It’s also important to note that wellness in all forms has become trendy as well. It’s why areas like skincare, healthy eating, cleaning, mental wellness, and now, financial wellness, have all become so prominent in the last few years. And much like the rest of these categories, being trendy officially means an influx of creators and content dedicated to the topic, meaning users are able to be influenced by content creators and brands, many of whom are looking to sell products. The information users get from these accounts, then, can often be manipulative or misrepresented in order to steer the viewer toward the product.

Cultivate a trustworthy brand via TikTok

This is why it is critical for credit unions to be engaging in these spaces, to serve as a trustworthy source of financial literacy that can cut through the noise for users and provide sound financial advice. Not only does this benefit users, but credit unions using these apps properly have now created a great way to reach younger generations—a group they often struggle connecting with.

By using social media, credit unions don’t have to hope that Gen Z is going to find their website or stop into a branch (a risky bet to begin with), but trust that if they are putting helpful and educational content into these apps, the social media algorithm will make sure it reaches its target audience—people who are interested in financial literacy. It also gives users an outlet to connect with the credit union and ask questions directly. What topics do they need clarification on? How can they build better credit? The chance to interact with potential members on this level should not be passed up.

And while posting videos to TikTok can feel like a daunting undertaking, or perhaps even a tad silly and unprofessional, that doesn’t change that this is where your members are, this is where your audience is, and this is how they are getting their financial advice. Millions of people are engaging with this content daily, making TikTok the largest free marketing and educational opportunity in your arsenal.

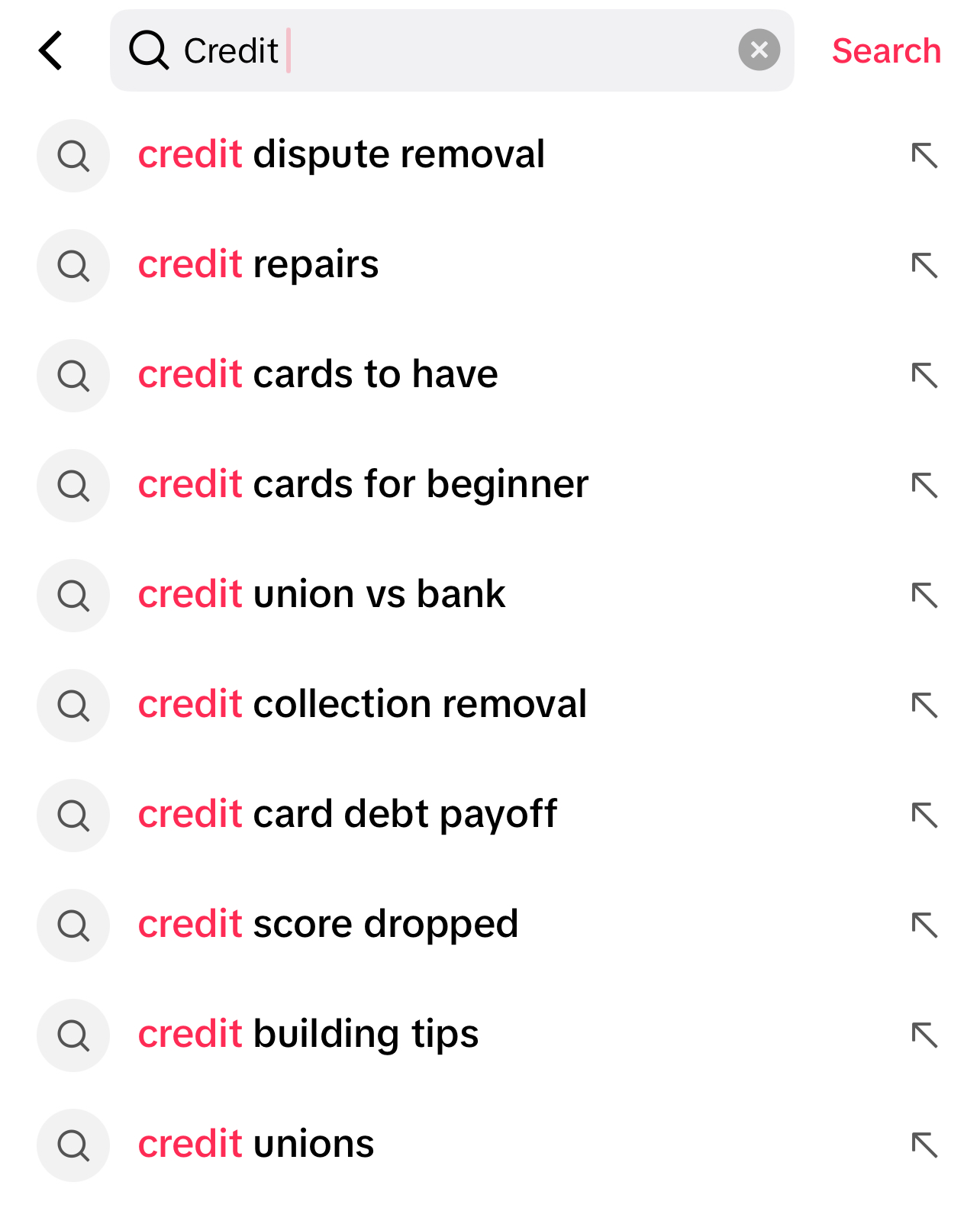

Users want to know about you and your credit union as well! The image on the right shows the top related searches on TikTok relating to credit. Notice that credit unions and the difference between a credit union and a bank are both on the list. Users are actively seeking to learn more about credit unions! Don’t you want them to hear about the credit union difference from you? Or do you trust influencers and big-name banks to do the job?

Furthermore, once users associate your credit union with a brand they can trust and one that is supporting their financial goals (remember, interacting with this content creates feelings of improvement and satisfaction), you will have developed a reputation as a financial institution that prioritizes financial wellness and can do so in a way that works best for the member. Eventually, when they seek out a new loan or get the urge to switch financial institutions, credit unions will be top of the list!

Getting into this space, if your credit union is not already, should be near the top of the list for 2025, for both the betterment of the credit union and the people you serve. Good marketing and good service mean going to the member in a way that works for them, not waiting for them to come to you.

Where to begin

Credit where credit is due, there are a number of credit unions already on the app, and a few of them have even leaned into using the platform as a space to share financial advice and encourage members to reach their financial goals. At the same time, they are also using it as a means to direct users to their website and financial literacy tools that might already exist there. Credit unions taking their first steps into this method of content creation can and should use these as a guide for getting started.

But if leaning into funny trends is a bit too much to tackle right now, not to worry! Users don’t need your content to have trending audio or feature a TikTok dance for attention (though you might get bonus points if you do). What they want are clear, actionable pieces of education. One very simple video series, made by user Thurman Brooks, treats the app as an “Intro to Financial Literacy 101” class, where he shares basic financial literacy lessons. The first video in the series now has over 1.1 million views, tens of thousands of comments, and his account has gained nearly half a million followers.

It’s okay to start small and share simple informational videos. This could be a thirty-second tidbit on the difference between APR and APY, what qualifies as a good or bad interest rate for various types of loans, how to start tackling debt, or even how to interpret credit scores. As you get more comfortable with the platform, you can consider adding more flair or participating in trends to increase your visibility, but users have shown time and time again that they prefer substance over style in their financial content.

Step into the arena

People are ready and eager to learn about finance and are sincere in their desire to build better financial habits and a better financial future for themselves. TikTok, while perhaps an unconventional source for such information, is successful in providing users with the help they need in easy-to-digest and accessible ways.

With TikTok’s future in the US uncertain, the time for credit unions to get onto the app and establish themselves is now. If TikTok is banned in the US, it will leave a massive void in the financial literacy space—one that credit unions can and should move to fill. Cultivate a following on the app today as well as on alternatives such as Instagram (not through posts, but reels), Threads, or Bluesky. Then, no matter the future of TikTok, credit unions will be primed and ready to continue providing educational content.

While credit unions might prefer members come dancing through their doors, ready to learn about their products and how they can help them achieve their goals, it’s clear that younger generations lean toward short-form video content as a learning tool. Therefore, it’s on the credit union to change its methods to meet the needs of these members, not the other way around.

What’s the saying? If you can’t beat them, join them.