When you hear the phrase, “Remember the ’80s!” what comes to mind? Bright colored clothes, leg warmers, and power suits with shoulder pads? Or is it permed and teased hair, stiff with hairspray? Maybe, it’s the music you remember the most? Maybe you remember singing along to some classics like “Every Breath You Take,” by The Police, “Jessie’s Girl,” by Rick Springfield, or “Sweet Child of Mine,” by Guns and Roses. As for me, I always flash back to my favorite Bon Jovi song at the time, “Livin’ on a Prayer.”

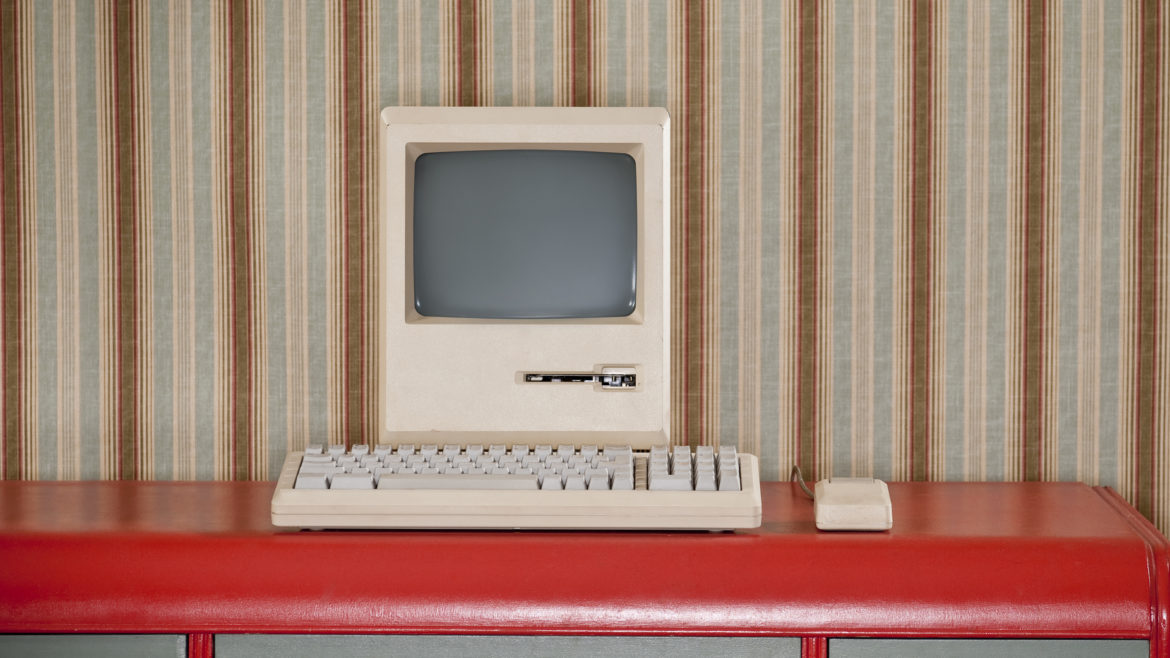

While those songs always take me back to the good ol’ days, when I think of the ’80s, I also fondly remember starting my career in credit unions. Things were so different back then. It’s hard to believe we managed before all this technology. Don’t remember? Let’s take a quick jaunt back to credit unions of the ’80s.

Looking back

As a young woman working my first “real” job as a teller, I remember paydays being extremely busy. Since debit cards and direct deposit weren’t prevalent yet, members had to come into the credit union to get their money. Members of our credit union formed lines that snaked around the lobby, down the back stairway, and out the back door to the parking lot, just waiting to cash their paycheck from one of the local businesses. Despite the excessive lines, most members were patient and calm as they waited to make their car payment, deposit to their Christmas Club, or share draft accounts. The patience and easy-going nature of most members was just the way it was. Waiting like this today would be unfathomable for most people!

A cool new machine called a facsimile (fax) machine brought much excitement to our office! We were in awe that we could transfer data from one location to another so easily and timely. In addition, we started a new process with the Federal Reserve Bank called the Automated Clearing House (ACH). Each day, we would receive a fax with deposits and withdrawals for our members and we would post them manually to their accounts. And boy, do I remember how many members wanted nothing to do with ACH. Members wanted their paycheck in hand to cash it; they said they’d never use that new-fangled service called Direct Deposit, they didn’t trust it!

A much more difficult process

And then there were share account passbooks… These were records of savings that we updated each time a member made a deposit or withdrawal. Unfortunately for me, the booklet seemed to jam every time I had to print them. There wasn’t any mobile or online banking yet, so members had to keep track of their account balance in their passbook or keep track of their quarterly paper statement. Also, check registers were a necessity to keep track of your share draft/checking account.

Hand-written forms and paperwork were common, but we started to use typewriters more often for loan and certificate forms. The loan process was quite a bit different back then. Usually, the member had to come to the office and meet with the loan officer and then the request had to go through several chains of authority to be reviewed within a few days. Finally, the loan officer would call the member with either a yes or no answer. It wasn’t a quick process and there was lots of paper involved.

After working at the teller line, I would do end-of-day processing on our main frame computer, which had a separate, air-conditioned room. It was pertinent, for disaster recovery proposes, to ensure the large backup reel tapes would be taken off the premises for safety and security, so it was common practice to take them home each night. Think what the auditors would say about this practice today!

Technology may change, but our principles don’t

As technology advanced, credit unions embraced it and evolved to provide financial services to people worldwide. Despite the rapidly changing times, the spirit of credit unions has remained much the same, always focusing on people helping people! And today, even though credit unions have all the same services as other financials, I believe that spirit is alive and thriving!

I hope this trip down memory lane brings fond memories to some of you. To those of you that don’t understand what the heck I’m talking about, just know, credit unions have been evolving and growing for decades and will continue to evolve and grow for generations to come. Thank you for being part of a rewarding industry built on the concept of people helping people!

Steve Winninger#1

I owned that very Mac in your photo. I also saw the first fax machine and said it was cool, but I didn’t think we’d ever use it.