There is a continuing need for small credit unions, especially those that are Low-Income Designated (LID), Minority Depository Institutions (MDIs), Community Development Credit Unions (CDCUs), and Community Development Financial Institutions (CDFIs). These very important credit unions do outstanding work, and many serve unserved and underserved individuals and communities.

Sadly, over time, many of these institutions have either ceased operations or merged into larger credit unions. Compounding this, there has been a limited number of new credit unions started to continue the outstanding work these credit unions did while in operation.

In many cases, as these credit unions ceased operation or merged, members and communities were left without financial institutions that fully understood their financial needs and were willing and able to meet those needs. Thus, these members and communities were forced to seek out alternative financial service providers that offered loans and services at significantly higher costs, to the detriment of these members and communities.

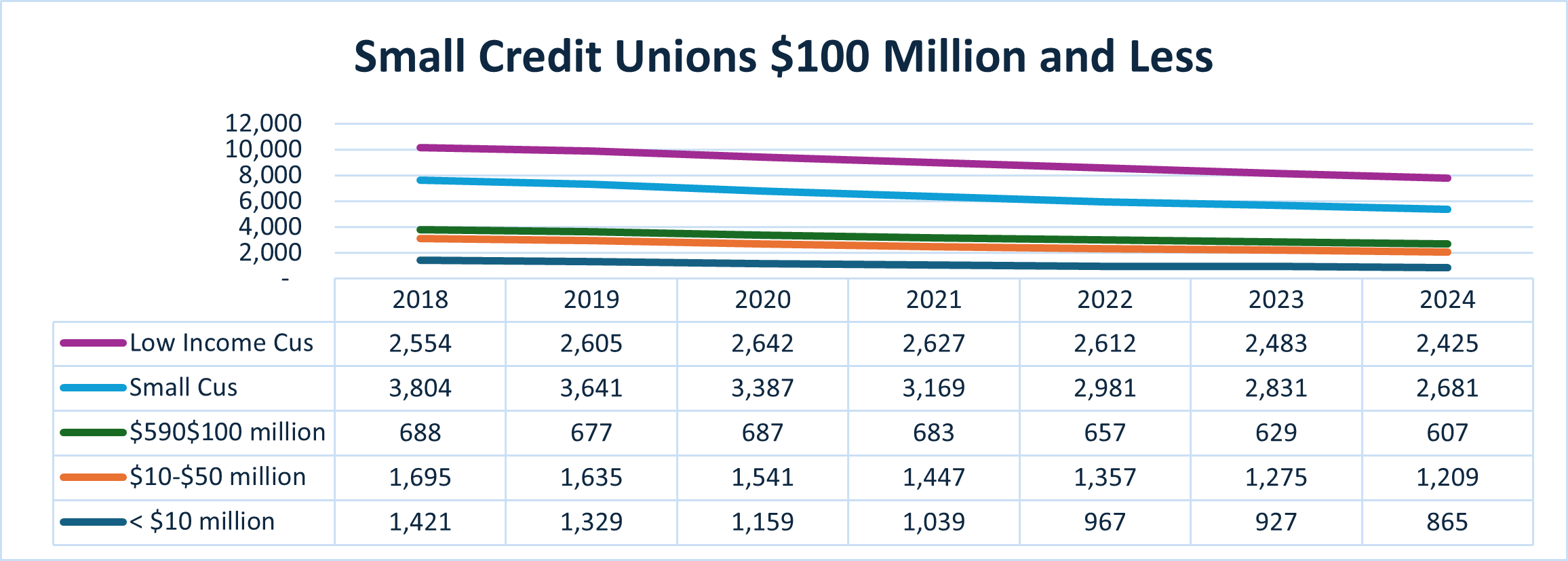

Reduction in small credit unions

Despite their great work, the number of small credit unions has steadily declined over recent years.

That decline is in no small part due to the fact that it has become increasingly challenging to operate many small credit unions. Overall, there have been continuing increases in regulatory requirements, technology, rising labor and overhead costs, and on an increasing basis, difficulty in attracting and retaining qualified individuals to successfully, compliantly, and profitably operate small credit unions.

Because of these and other valid reasons, many small credit unions have merged and will continue to merge into larger credit unions, on a voluntary or involuntary basis, as circumstances may warrant.

Common reasons for current mergers

Perhaps the most common reasons small credit unions merge are to “expand products and services” and “expand branch locations.” Additionally, small credit unions are merging due to an inability to replace leadership, technology limitations, aging membership and/or declining membership, regulatory burdens, difficulty attracting/retaining sufficient staff, limited loan demand, and reduced potential members.

It is believed that we need to expand our efforts to ensure that there are qualified CEOs in the wings ready to succeed outgoing CEOs when they retire, leave the credit union, etc. As former NCUA board member Todd Harper stated back in 2022, when the NCUA first proposed its succession planning rule, “If we want to ensure small credit unions can thrive in the marketplace and in their communities, then we need to address the lack of succession planning within the industry.”

Actions taken to address this

The good news is that there are many working on the issue of the declining number of small credit unions. The NCUA is striving to make it easier to charter new credit unions and make it easier to expand fields of membership. Additionally, they have a successful minority depository institution (MDI) preservation program and a small credit union program. There are many Credit Union Service Organizations (CUSOs) that offer back-office support. For example, the outsourcing of data-processing, accounting, compliance functions, and human resource/benefits administration.

There are consultants who work with small credit unions regarding strategic planning and performance improvement. Additionally, there are also consultants who offer comprehensive, hands-on support to help small credit unions successfully start and complete big projects by providing project leadership, research, and reporting assistance, allowing credit unions to focus on serving their members. Further, there are consultants who assist credit unions with their relationship with NCUA, exam findings, and provide many other helpful services to credit unions. America’s Credit Unions and many credit union leagues offer mentor programs and have special programs that focus on the needs of small credit unions.

Regarding CEO succession, one solution is to engage individuals from “Emerging Leaders” and “Young Professionals” programs that are developing throughout our nation. From these programs, then create a nationwide database of eligible candidates and match credit unions in need of successor CEOs with qualified applicants.

Additional solutions could include ensuring that there is an approved succession plan at each small credit union and ensuring that current CEOs remain engaged in their credit union until they are succeeded. Furthermore, the industry could create a nationwide database of eligible individuals to serve as interim CEOs, CFOs, COOs, etc., that could be utilized until a permanent replacement can be secured. There are other unique programs operating, such as a “Shared-CEO” program, whereby one highly experienced CEO oversees several credit unions on a shared basis that is working very well, and also “Fractional” Chief Financial Officer, Chief Marketing Officer, and Compliance Officer programs.

The sixth cooperative principle

Perhaps a better solution would be to follow the 6th Cooperative Principle “Cooperation Among Cooperatives” and create a collaborative effort amongst key stakeholders to solve this multi-layered problem of losing small credit unions! To begin, industry stakeholders would come together, share best practices, and work collaboratively to develop a “comprehensive plan and approach” to solve this problem. Perhaps a “new operating model” should be developed whereby the above-identified issues causing small credit unions to merge could be adequately addressed and mitigated.

Don’t let the small credit unions go extinct

So why do this? Well, the answer is simple. To ensure that these very special credit unions not only survive, but also thrive for decades to come, serving the needs of persons of modest means, and to continue the great work they do in serving unserved and underserved individuals and communities.

Dee Wilson#1

I believe so deeply in the value of small credit unions. Over the course of my career I have been involved in many mergers and I’m always sad when I see a credit union getting merged. One recurring theme I often see is credit quality and loan pricing issues and I often wonder why small credit unions are not leveraging fractional chief lending officers. Probably because people like me are too scared to step out on their own and do the damn thing!