Seems like a simple enough question, but in my interactions with credit unions, it has become clear that many struggle with understanding how many members they have. Maybe it’s because the credit union’s management team inherited a strategy that was passed on to them from a prior regime. It may also be the credit union has a board of directors that is focused on analyzing members in a very specific way. Regardless of how credit unions have arrived at their reporting style, there is no shortage of ways to calculate the number. The key is understanding what question you’re trying to answer.

Traditional Method

In a classic sense, many credit unions would consider the grand-total of all memberships as the number of members that a credit union has. Think 5300 Call Report number. Credit unions should keep a watchful eye on this number as it is often what is used by third-party vendors to calculate cost. While a greater number of memberships may seem impressive on a report, keeping the bloat around could prove costly.

Individual Method

The individual method is used when credit unions look to review how many SSNs/TINs exist within their databases. This is an important concept for credit unions to review because it very well may be possible that a credit union has 10,000 memberships that belong to 8,000 SSNs/TINs. This strategy is often overlooked by marketers because they may think that there may be more opportunity than what truly exists in the data. Credit unions in general can curb some of this behavior by analyzing how many individual SSNs/TINs they have compared to the total number of members.

The ratio of SSNs/TINs to memberships is one that I would be tracking closely to ensure the following:

- That the total number of members at my credit union is not exaggerated and therefore my bill with third-party vendors is not larger than it needs to be; and,

- My credit union employees are being as efficient as possible when working with new, existing, and potential members. This means that we are communicating with members to let them know that additional memberships are not needed in certain situations (e.g. a member who wants to save money for their children’s college fund does not need a separate membership; they can simply open an additional savings product on their already existing membership).

Natural Born Person Method

With this method, credit unions are looking specifically at members who are individual members. This means that the credit union is excluding memberships that are not listed in the database as individuals (businesses, trusts, representative payees, LLCs, sole proprietorship, etc.). This methodology takes data governance to ensure that the appropriate membership types (businesses et al) are available for use during the membership onboarding experience, and that staff members are routinely educated on when to use the appropriate membership types. If this method is of interest, it is not only important to coach credit union employees on what options to use and when, but it is also important to audit the membership to ensure that established procedures are being followed.

Household Method

You are probably thinking, “with all these membership counting methods, what about all the methods for calculating households!” We’ll keep it simple: A household is a financial decision-making unit. This financial decision-making unit is most commonly comprised of all members living at the same address. It is assumed that all individuals who live at the same address are more than likely part of the same family and represent a group that typically decides on strategies together.

For example, if two individuals are married and they reside at the same address, it is unlikely if one individual has a mortgage that the other individual would be interested in one too. The married couple would be considered one household.

Like other methods for counting the number of members at a credit union, this takes discipline. Sometimes, even more discipline than other strategies. That is because when a credit union employee onboards a new member, they must ask the member if there are any other family members they have that are also members of the credit union. And when a member changes their address, the credit union employee must follow-up with performing household maintenance (if applicable and based upon credit union policies).

Just like the natural born persons method, this method takes work to ensure credit union employees are using the appropriate data markers (and asking the right questions…) for this method to be effective.

Exclusion Method

The exclusion methodology is one that takes into consideration any number of exclusions that a credit union may wish to use. To calculate the number of members within this method one must start with the grand total of members and then remove members that meet the exclusion criteria. Some of the most popular exclusion criteria are as follows:

- Members with a written off/charged off loan account

- These members have caused a loss to the credit union and have therefore lost their privileges that they are entitled to as a credit union member.

- Members with a balance less than or equal to the par value requirement

- These members have not invested the par value requirement and are therefore not a member.

- Members who are dormant or currently in the process of escheatment

- These members have not remained active within their membership, so they are therefore no longer considered a member.

- Members with a written off/charged off savings/checking account

- These members have caused a loss to the credit union and have therefore lost their privileges that they are entitled to as a credit union member.

- Members with a negative share/checking balance

- These members may not be exhibiting the normal tendencies of a traditional member, so they are therefore excluded.

- Members with a delinquent loan balance (XX days or greater…)

- These members may not be exhibiting the normal tendencies of a traditional member, so they are therefore excluded.

- Members with an incorrect residential address or incorrect email address

- The member has not updated their information with the credit union, so they are therefore excluded.

- Members under the age of 18

- Members that have yet to attain an age of 18 are not able to support the credit union/cooperative because they have yet to reach in age where they can participate with all services offered.

With all the unique options for excluding members from the overall membership count, it is easy to see that a lot of time can be spent on determining why members should be excluded rather than focusing on the servicing of the member.

Credit Union Examples Using Membership Counting Methods

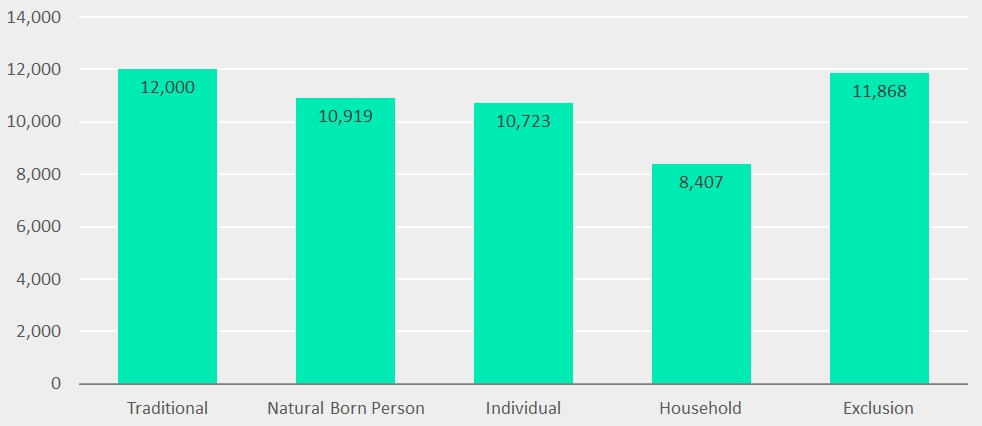

In order to help demonstrate how the membership count at a credit union may fluctuate, here is a representation of the overall membership count at a sample credit union.

In the chart above, you may find it surprising that the exclusion method does not eliminate more members, but this is because a limited set of exclusion criteria was chosen. Ultimately, the number of exclusions used with this methodology will determine the outcome of how many members will be represented. And the exclusion method is not necessarily mutually exclusive with the other methods. You may choose to apply the same exclusions (e.g. written off loan and wrong address) to the other methods as well.

It is no surprise that the household method yields the lowest number of members. Common sense tells us that there are members who have referred their own family members to the credit union, so naturally the household method will yield fewer members than the other methods.

Conclusion

It is possible that depending on the type of marketing or member outreach that credit unions are performing that the methodology for identifying members may be different. For example, a credit union may be interested in using the Exclusion method when identifying members who are eligible to vote based upon the bylaws related to member in good standing rules. But this same credit union may be interested in the household method when sending a newsletter to members. Therefore, it is important that credit unions understand and commit to a membership counting method for each operation they perform.

Each of the membership counting methodologies requires data discipline and consistent staff coaching. End-users must be encouraged to ask the right questions, input data correctly, and we must audit the data effectively. A credit union may wish to track all of the membership counting methods periodically to ensure that staff is collecting and reporting the correct information.