This article first appeared on chipfilson.com

Many participants see credit unions as having two operating options: either a federal license or a charter issued by one of the forty-five state authorities. Within this second group is a small subset of approximately 100 cooperatively insured credit unions in ten states that are subject to only to their home state regulations.

Traditionally the choice of charter has been an important check and balance when a regulatory system, local or national, becomes unresponsive. Charter conversions go both ways. In 2023 there were 12 changes with nine state charters moving to FCU’s.

Traditionally state regulators and legislatures have been perceived as more accessible and responsive versus the federal system. Some state FOM practices are less complex and CUSO and other authorities more flexible. For example, the majority of bank acquisitions have been by state-chartered credit unions.

A multifaceted charter choice

But reality is not this simple binary selection. Operating options are more complex than either a state or federal charter.

In a CUSO Magazine article summarizing NCUA’s year-end data, the writer pointed out several of these other operating designations.

From the December 2023 data summary: “NCUA reported that the number of federally insured credit unions (FICU) declined to 4,604—156 fewer than there were as of the fourth quarter of 2022. Many of those may have come from low-income designation credit unions, whose numbers dropped by 129 from 2,612 in 2022 to 2,483 in 2023.

“Meanwhile, the number of “complex” FICUs—those with total assets over $500 million—increased by 5 to 714.”

These sub-classifications matter, as they grant additional authorities or impose different regulatory requirements. Newly chartered credit unions have different reserving timeframes in their initial years. NCUA will periodically update the status of Minority Depository Institutions (MDIs) which it sees as a special class of charters.

Multiple service designations

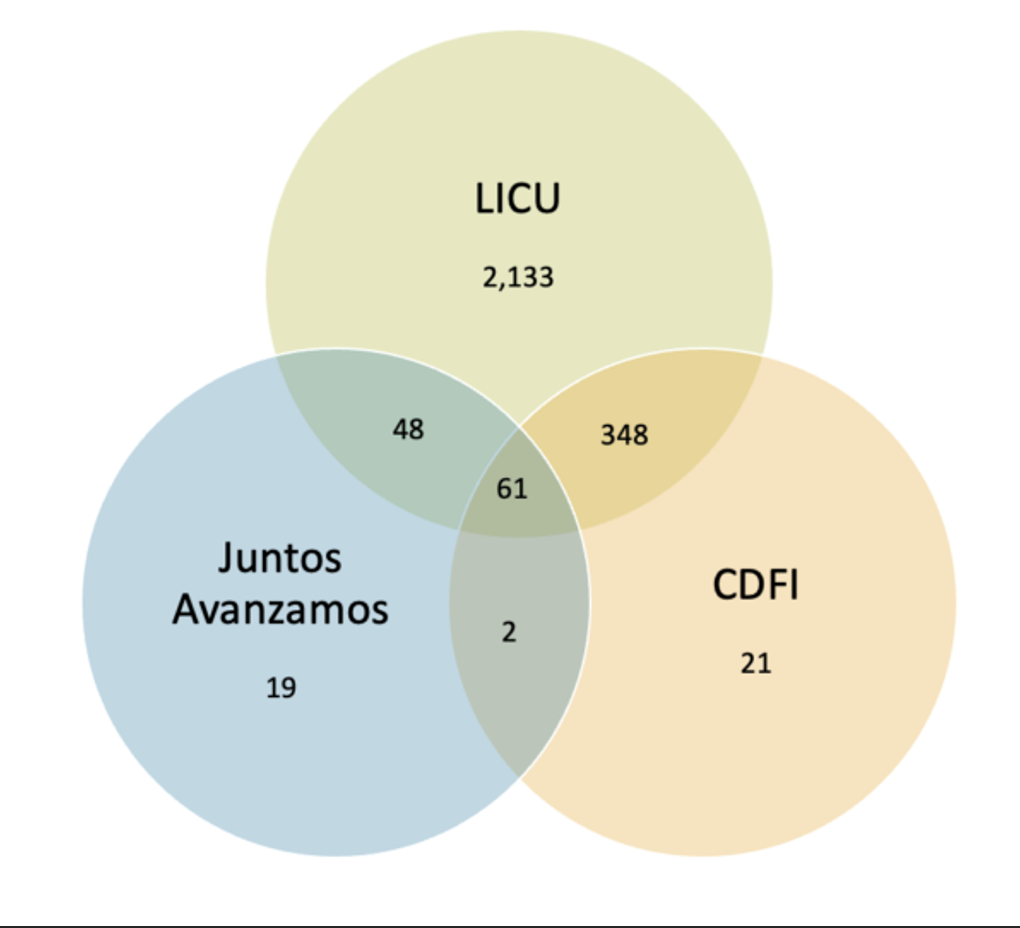

In January 2024 Callahan, using September 2023 data, published a summary of three other “service designations.” In their full analysis they showed how these operating authorities, low-income (LICU), community development (CDFI), and Juntos Avanzamos will sometimes overlap.

CREDIT UNION DESIGNATIONS

FOR U.S. CREDIT UNIONS-DATA AS OF 09.30.23

Source: Callahan & Associates, Peer Suite

The report states 56% of credit unions have at least one designation. The most common is NCUA’s LICU held by 55% of all credit unions. The other two designations require certifications. Hence only 9.1% of credit unions are CDFIs and just 2.7% are part of the Juntos Avanzamos network.

The LICU advantage

The LICU status is by far the most popular and important classification. The status is assigned by NCUA to a credit union in which a majority of its membership qualifies as low-income as defined in Section 701.34 of NCUA Rules and Regulations.

The potential operational advantages include accepting non-member deposits, offering secondary capital accounts, qualifying for exceptions from the member business lending cap, and participating in NCUA’s Community Development Revolving Loan Program.

The Callahan article points out that the 2,590 LICUs range in size “from less than $100,000 (Holy Trinity Baptist FCU, $25,899, Philadelphia, PA) to more than $20 billion (Golden 1 Credit Union, $20.5B, Sacramento, CA). In the $1B-$10B peer group, 60% are designated as a LICU.”

Of the 432 CDFI-certified credit unions that can access grants from the CDFI Fund, 95% are also LICUs.

The pervasiveness of the LICU designation has been a focus for groups who oppose credit unions. One critical study by the Tax Foundation expressed the following opinion of the low-income designation in a January 30, 2024 article, After 90 Years, It’s Time to Wean Credit Unions of Taxpayer Subsidies:

“More than half of all credit unions have been designated “low-income” institutions, a meaningless term. This designation appears to be little more than a signaling device to allow credit unions (and NCUA) to claim they are serving underserved populations without having to provide any documentation to back it up. The Congressional Federal Credit Union, which serves members of Congress and their staff members, has been a low-income credit union since 2022. Members of Congress are “hardly low-income customers.”

Diversity of purpose and operating models

These charter variations create opportunities that a one-size-fits-all regulatory structure may not accommodate. Most credit unions were founded with a unique, and generally limited, field of membership that gave them a unique “persona.” Over time most have moved far beyond this initial market identity.

As the evolution continues, the imperative of a unique identity becomes a challenge. Business models and/or technical innovations are necessary but often not sufficient for competitive differentiation.

While much discussion of innovation focuses on technology or new partnerships, the option to modify a credit union’s organizational definition can be overlooked. Yet these choices may be more strategic in establishing a special market profile. These designations are more than a brand; they are a commitment to a special expertise when serving members.

Other collaborative service networks besides those above have been or are being created. These emerging organizations sponsor specialized products, virtual distribution options, innovative member services, and even specialized support organizations such as Inclusiv (a CDFI) or the Global Alliance for Banking on Values.

The critical factor is choices of organizational design and networks. The ability to draw upon many options, not just a single charter model, can help keep credit unions aligned with their member-owners’ changing circumstances.