This article first appeared on ChipFilson.com.

The credit union system faces a major challenge to its values and identity in the capitalist-inspired takeovers via merger of financially strong, long-serving credit unions.

The process has been distorted by leaders with member-owners having no meaningful role at any step. The so-called member vote is a charade. But regulators are scared, intimidated, or just simply impotent to stop the self-dealing, self-enrichment, and sometimes, outright corrupt practices. They hold a fig leaf, “Well, the members voted for it,” to hide their private, unexamined approvals of the official disclosures required in the Member Notice.

What is to be done? There is one very simple step in the process that would both address the lack of transparency and the absence of any real member-owner say.

The broken merger process

When the updated voluntary merger rule was passed in 2017, disclosures of special payments were supposed to fix the outright self-dealing by senior managers used to induce combinations of strong charters. But the process was fundamentally flawed. When implementing the rule, the NCUA placed itself in the sole role of protecting the members’ “best interests.” It gives final approval to the required disclosure in the members’ official meeting Notice. This is before members have any input, let alone facts about the reasons and plans for the transaction.

Today, two healthy credit union CEOs announced their intent to combine for a brighter future, but then the process goes backstage. Occasionally, there is a general update or two several months in, saying the credit unions are working on it. The “it” in reality is getting regulatory sign-off on what to tell the members when calling for their vote to approve.

The NCUA is acting as an in loco parentis position about what members should know to approve their charter transfer. The minimal marketing information in the official Member Notice will be the first and only time members learn any official details. But the CEOs now have the okay to proceed with the vote, knowing this content is all they have to provide, as the regulators have already signed off on the transaction.

These Notice disclosures are proforma generalizations, a listing of locations, and with merger reasons sometimes copied from a previous application. There is no meaningful financial or business content that a concerned owner might need to have for an informed decision.

If members are upset when the required self-dealing information is presented, they are effectively powerless to do anything about it. They are just individuals fighting an entrenched leadership with all the resources, needing only a margin of one vote, and the deed is done. 99% of mergers that go to a vote are approved.

These are not votes about a choice. Rather, they are presented as a mere administrative act to ratify decisions already made and approved by those in authority. Decisions made without any owner input or options in the matter.

There is no secret about the lack of any member role or benefit in the majority of these privately negotiated deals. The credit union merger arena has become a Roman amphitheater where lions and beasts prey on unarmed Christians. But there is one simple event, that if added to the merger steps, could change the entire process, restore opportunity for member participation, and make the member voting process more informed and democratic.

Resolving the merger madness with public hearings

The solution: require that within 10 days of mailing the Member Notice, the credit union must hold a public hearing open to all members in person and online. The CEO and board initiating the merger could present their plan, and attendees could ask questions. Members, the press, community organizations, sponsors, and other interested parties would have the right to participate.

The hearing would be led by a hearing officer appointed by the regulator who would moderate the agenda and make a record of the meeting, to be available for all. This public step would be required for all credit unions that have at least 7% net worth.

Whose idea is this? It’s NCUA’s. On July 3rd, the agency posted a notice of a public hearing for an FOM request. The notice outlines very elaborate procedures, registrations, deadlines, etc. However, a merger hearing need not be this bureaucratic. Credit unions are used to holding member meetings as a standard bylaw annual requirement. The only difference is that this event would have a neutral moderator and be open to all members and the public.

Public meetings with those in positions of leadership are part of America’s democratic tradition.

NCUA’s pioneering example

NCUA initiated the practice of open meetings, not just in DC, but across the country.

On May 20, 1982, the NCUA board met in Boston’s Faneuil Hall, marking the first NCUA meeting held outside DC. This was part of Chairman Callahan’s grassroots effort to bring the agency closer to the credit unions and members it supervises.

Left to right at board table: Chip Filson, Director Office of Programs, Rosemary Hardiman, Board Secretary, Chairman Callahan, Vice Chair P.A. Mack, and John Otsby, General Counsel

These on-the-road meetings continued throughout Callahan’s tenure. The second meeting was in July 1982 in conjunction with NAFCU’s Annual Members Meeting in Chicago. It was also the week after the largest bank failure, Penn Square, to that point in FDIC history.

The NCUA staff not only participated in this monthly board meeting but also held an open press conference following to answer questions on credit unions’ exposure to uninsured CDs placed with the bank.

I can still remember the first press question: Does the Penn Square failure mean NCUA will propose a rule to limit credit union investments to the $100,000 insured limit? It was directed at the deregulation policy of the NCUA. The answer was no. But we also outlined the help that would be provided by the CLF and NCUSIF 208 assistance if necessary.

These public board meetings were held in each of the six regions on a rotating basis. They often coincided with League Annual Meetings or other national industry conferences. Regional senior staff were part of the presentations. The local press was notified. Sometimes, a new charter would be presented by NCUA in person to the organizers.

The effort was to promote the democratic, member-owned system in all of its multiple capacities. It introduced the NCUA and the credit union option to the public press in cities across America. For many members, it was their only chance to meet and chat with NCUA senior staff in an open dialogue.

Credit unions: made in America

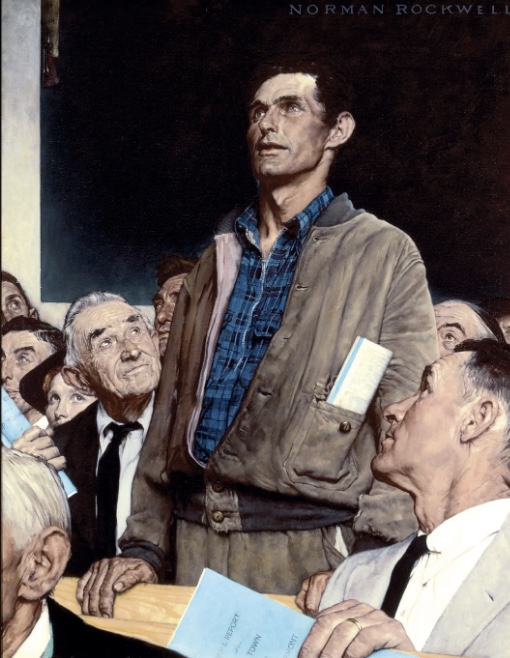

Public meetings are part of America’s democratic character and practice. Norman Rockwell captured this town hall spirit in his Freedom of Speech, a part of the Four Freedoms WWII poster.

Public hearings enable public accountability. The “member special meeting” that wraps up the merger process on the last day of voting is anything but a public event. The votes are mostly by mail ballot sent along with the initial Meeting Notice—urging a Yes vote. There is no way for people to learn or hear the details that would make the process meaningful with different points of view.

Public hearings are the easiest, most immediate, and democratic way for members-owners to have a say about whether their charter and relationships should be sold to a third party. The hearings require no NCUA board approval. Members should have the chance to play a real role in mergers and not merely be passive ratifiers of decisions by those in authority.

Whether a credit union believes that mergers are inevitable or harmful to the future because of the shenanigans now occurring, everyone should be in favor of giving the owners a real voice in this live or die decision. Let the Regions get on with it.