Credit unions seek ways to empower their members, to help them achieve financial wellness, and, of course, lean on their credit union when they reach a fork in the road or need advice.

What most credit unions get wrong in driving member action, however, are timing and deep personalization.

That stumble becomes a full‑on face‑plant with Millennials, Gen Z, and the emerging Gen Alpha. These digital‑first cohorts can spot a sales pitch a mile away. What they want is tailored, just‑in‑time guidance that respects their unique circumstances—say, paying down $20K in student loans and funding a destination‑wedding trip—rather than blanket advice about “saving for retirement.”

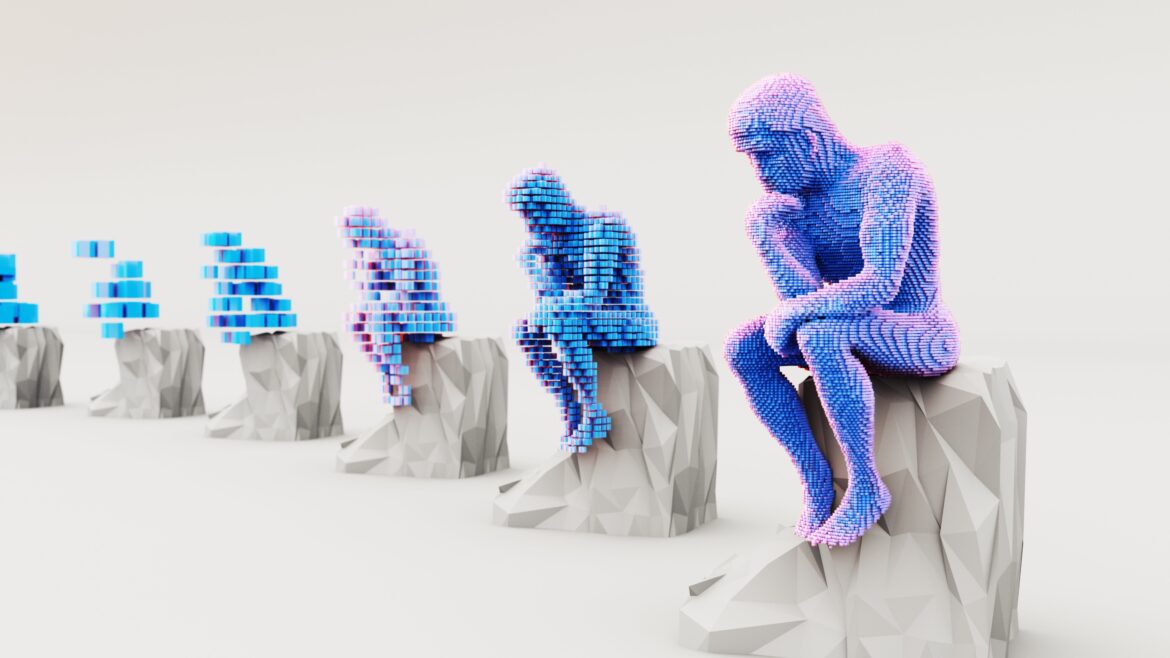

Delivering that level of precision to tens or hundreds of thousands of members sounds impossible—until you combine behavioral‑science principles with real‑time generative AI.

The engagement gap in financial services

Sure, members want to improve their finances, but don’t always follow through.

While 73 percent of millennials report saving money, only about 39 percent consistently stick to their budget. Meanwhile, 67 percent of Gen Z feel behind on their savings goals, and 41 percent of Gen Alpha, who already save toward long-term goals like college or a car, need help building financial skills independently from parental guidance.

So, where do credit unions go wrong in helping steer the next generation to financial wellness? Traditional financial education, which seems to be a great place to start, is often too broad and impersonal. Especially with these digitally focused generations, personalization is absolutely imperative. A young 20-something doesn’t want generic tips on saving for retirement; they want guidance on how to save while paying off $20K in student loan debt and affording their sister’s upcoming destination wedding.

The result? Good intentions evaporate before they become habits.

Basic mechanics of behavioral science

Understanding how a person ticks—their financial goals, motivations, fears, and habits—forms the foundation of meaningful engagement. A credit union that nails personalization and authentic member engagement must master the art of understanding and connecting with each member on a deeply personal level.

Soft nudges

Finances are already a sticky subject for many people. Especially for folks who may have fallen behind in their budget or savings, guidance that’s misconstrued as forceful or overbearing can have the opposite effect. Cueing members with gentle prompts that drive meaningful change—at the right moment—can help create behavioral change.

Habit formation

The key to behavior change? Building daily bite-sized momentum. They say it takes 21 days to form a habit, right? Take budgeting, for example. Setting a budget and putting it on a shelf doesn’t build a healthy budget habit. However, getting into the routine of inputting your expenses against your projections helps you stay engaged.

Provide members with clear, actionable steps to stay engaged with their financial goals—whether that’s building saving habits or sticking to a budget. And, knowing when to step in with relevant products and services to steer them back onto the right path.

Hyper personalization

Broad tips and vanilla messaging do not drive action or change. However, clear and tailored guidance that speaks to a member’s personal budget, financial habits, fears, and goals is more likely to drive action. For example, “Save more for retirement” is a well-meaning message, but “You’re $50 away from your monthly savings goal to retire at 60 years old” provides clarity and motivation rooted in the member’s data.

Leveraging behavioral science to drive personalization, whether through soft nudges or habit formation, is the blueprint. But scaling these tactics manually is unrealistic. That’s where artificial intelligence comes into play.

Supercharge behavioral change with artificial intelligence

AI’s strength lies in pattern-spotting and prediction across vast datasets. Combine that with behavioral science, and credit unions can deliver customized, contextual guidance to every member without burning out staff.

Leveraging artificial intelligence in conjunction with behavioral science can provide personalized guidance at scale and drive member action. Becoming an integral part of your members’ financial wellness hinges on how and when you show up. Both are directly tied to how well you understand their needs and personalize your approach.

Smart segmentation

Leverage personal data—like financial goals, tendencies, or fears—and cluster members into behavioral groups for more relevant outreach, cross-sell, and retention strategies. Instead of grouping members by age or ZIP code, machine-learning models cluster them by behaviors and needs, such as new parents balancing daycare costs, recent graduates tackling debt, and retirees managing RMDs. With that insight, you can target messaging, product offers, and educational nudges with surgical precision.

Predictive analysis

Part of custom guidance is anticipating what your members need next. Instead of blanket-spamming all members “Tips to save more money,” leverage AI to identify which members are nearing a life milestone and would benefit from specific guidance, products, or services.

For example, identify which members are expecting a child and share tips to save for a new baby, or how to open a 529 college savings plan, or why now is the time to get cracking on their estate planning. What once required a one-on-one conversation can now occur automatically with the help of fintech and behavioral data.

24/7 access to conversational support

If you’ve used ChatGPT or other generative AI chat systems, you probably didn’t get a jargon-laden response, even to highly technical prompts. Instead, you probably got a response in plain English, citing relevant sources, possibly at 2 AM. Members have similar expectations: they want expert-backed, jargon-free support tailored to their personal financial journey—anytime, anywhere.

If there’s one thing the next generation loves, it’s intuitive digital experiences. By combining detailed segmentation, predictive analytics, and 24/7 access to jargon-free guidance, credit unions can leverage AI and behavioral science to create seamless digital journeys that drive member action.

Combine behavioral nudges, habit scaffolding, and AI-powered insights, and you create a digital ecosystem that feels almost telepathic, knowing what members need and delivering it in the moment.

Your credit union’s next move

AI and behavioral science are no longer “nice-to-have”—they’re your formula for driving real, measurable member action. You have the opportunity to leverage a scalable, digital-first solution that still feels deeply personal, while informing, inspiring, and activating members.

AI‑backed behavioral science lets credit unions do what they’ve always promised: empower every member to achieve financial wellness. Now, you can do it at scale and with pinpoint precision.

The technology is here, the behavioral playbook is proven, and the next generation is waiting. It’s time to bridge the gap between intention and action—one personalized nudge at a time.