Community banks and credit unions are often seen as two sides of the same coin. While they still have their differences (with community banks being for-profit and credit unions non-profit), they find common ground in their customer service and commitment to the community. Both tend to be smaller and more local than the large commercial banks such as Chase, Capital One, etc.

In this case, it might be easy to picture the two seemingly underdogs as allies against big banks, but the reality is this often means they compete for the same pool of members. After all, they offer similar services and similar rates, and both boast a personal touch. Any consumer looking for a local financial institution will ultimately need to choose between the two.

However, according to the 2023 Community Bank Survey conducted by the Conference of State Bank Supervisors and released earlier this month, most community banks don’t view credit unions as their main competition. The majority found other community banks to be their main competition. In fact, many noted that the credit unions in their area were too big to compete with.

Andrew West, CEO of Eagle Bank in Polson, Montana, argued this exact position, lumping credit unions into the “big bank” category. He noted, “It’s really hard for me to compete with the two biggest banks and the biggest credit union in our state in terms of consumer deposits. And we’re certainly not going to do it on price. If we’re going to do it, it’s going to be on service, because we’re smaller, we’re flexible and we’re nimble, and we have what I believe to be really exceptional customer service.”

Survey responses

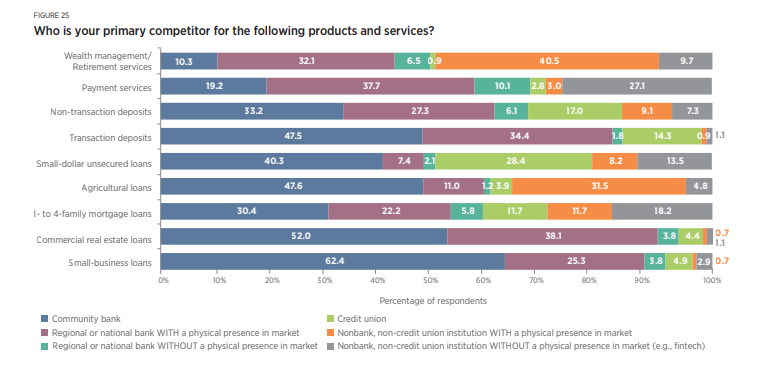

On the topic of competition, the survey lists nine product or service lines and the top competition reported by community banks for each. In seven of the nine categories, (non-transaction deposits, transaction deposits, small-dollar unsecured loans, agricultural loans, 1- to 4-family mortgage loans, commercial real estate loans, and small-business loans) community banks were listed as the number one competitor, with nonbanks taking one category (wealth management and retirement) and regional or national banks taking the final (payment services). Credit unions did not rank in any of the nine, despite being listed in the previous year.

“It is also notable that more community banks viewed other community banks as their primary competitors for small-dollar unsecured loans—a business line that, prior to 2023, was increasingly the domain of credit unions,” the survey notes.

Only 28.4% of respondents listed credit unions as a main competitor for small-dollar unsecured loans, down from 32.4% the previous year. In the category of payment services, only a staggering 2.8% listed credit unions as their competition, ranking lower than regional or national banks, community banks, and nonbanks—all with and without a physical presence in the market. This was also the case for wealth management/retirement services, in which credit unions did not even account for one percent. (See below for full responses).

What does this mean?

Far and above, community banks view other community banks and regional banks as their primary competitor. But what does this mean for credit unions? These responses could suggest any number of things, but it seems highly unlikely that this indicates a loss in market share for credit unions. While community banks may not be as worried about credit unions this year, it could be chalked up to different responders this year than last, less participation from community banks (i.e., fewer responses), or simply the timing of the survey. With only a loss of 4% in its strongest category, it is entirely possible we will see credit unions back on the list next year.

To see the full survey results, click here.