Uncertainty about the direction and timing of economic growth can lead to interest rate volatility. All financial institutions face greater uncertainty as the economy transitions from one stage to the next. Often, uncertainty creates opportunity if we can make sensible decisions. Economic cycles are the primary driver of yield curve changes, and recent activity has delivered many challenges.

We closely monitor economic indicators such as GDP growth, employment, personal spending, and inflation in order to provide sound advice. We also consider the unique needs and risk profile of each client. Read on for a deeper understanding of where we are in the current economic cycle, why considering economic cycles is important, and how we can use this information to make informed decisions.

Importance of economic cycles

Many factors can influence yields and the slope and shape of the yield curve. At a basic level, the economic cycle is perhaps the most important factor which drives yields up or down. That’s because the Federal Reserve and bond investors will react based on economic indicators and their growth or recession expectations.

The economy fluctuates in unexpected ways. Some trends may indicate strength while others indicate weakness. A successful strategy often depends on understanding current economic conditions, changes over time, and the potential impact.

Expansion and recession

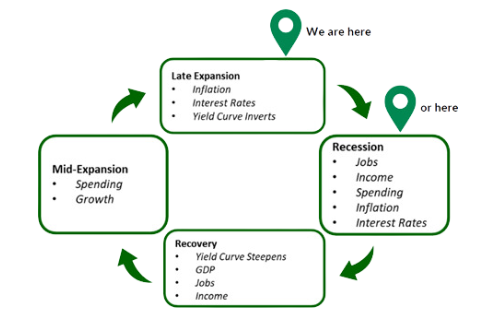

A full sequence of an economic cycle will have four phases. Late expansion or recession phase?

Late expansion or recession phase?

Depending on who you ask, the U.S. economy is currently either in the late expansion phase or recession. In a late expansion, the economic cycle reaches maturity where growth peaks and business activity moderates before sliding into a recession. We pay close attention to several economic indicators such as employment, inflation, GDP growth, and others to help identify where we are in the current business cycle. Some measurements may show changes before others and the trend of economic indicators rarely follows a pattern.

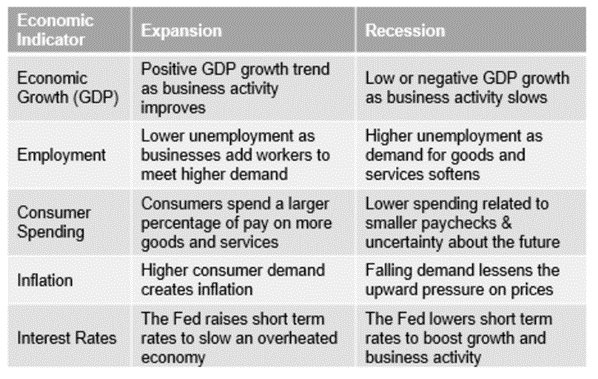

Economic indicators and cycles

Here are just some of the economic indicators that we study to help us make recommendations and guide decisions.

Inverted yield curve recession indicator

We often look at the slope and shape of the yield curve for clues on how the U.S. economy will perform. When short-term rates rise above long-term rates, it’s called an inverted yield curve. It’s not common, so when the yield curve does invert, it gathers a great deal of attention.

An inverted yield curve is associated with the belief that longer-term interest rates will fall, typically due to a recession. In the last 60 years, the yield curve has become fully inverted only 9 times. In every prior instance, the economy has slipped into recession on average 16 months after the yield curve inversion.

Recession indicators and higher short-term rates

Faced with slow growth or weaker economic conditions, the Federal Reserve’s typical response is to reduce short-term rates to stimulate the economy. This is common, related to the normal ebb and flow of economic cycles. However, it is the opposite of what is happening now. Instead of cutting rates to stimulate growth, the Fed is boosting interest rates. Why?

Inflation

The Fed’s typical response to inflation is to boost short-term interest rates. This action is rare and was last used on a large scale when Ronald Reagan was President and Paul Volcker was the Fed Chairman (early 1980s).

Federal Reserve action

When inflation ramps up, the Federal Reserve must first act to control it by increasing interest rates. This action will likely result in weaker economic conditions. Once inflation improves, the Fed will likely cut rates to boost economic activity. When the Fed reverses course, it is called a Pivot Point, which is widely expected in late 2023.

Federal Reserve Inflation Response

- Fight Inflation (higher rates)

2022-2023 - Inflation Improves Economy Slows

Late 2023 - Boost Economy (lower rates)

Late 2023 to Early 2024 (estimated)

Action items to consider

Based on the above, it appears that the U.S. economy is in the late expansion stage. The yield curve is inverted, and the Federal Reserve has been raising rates to control inflation. These simultaneous conditions are uncommon. Understanding the economic cycle can help with budgeting, protecting earnings, and achieving performance goals. Consider the following actions items:

Action item: ALM modeling and testing

- Review ALM model capabilities and the ability to quickly simulate planned activities and unplanned events

- Run more simulations related to growth, run-off and stressed scenarios

- Perform additional liquidity stress tests assuming simultaneous loan growth, increased use of unfunded commitments and deposit run-off

Action item: funding

- Increase deposit rates and review deposit rate tiers

- Raise deposit rates in response to the need for funds, not merely local competition

- Compare cost of borrowing vs local CDs

- Carefully review structured borrowing options. Cheaper doesn’t always mean better

Action item: loans

- Raise loan rates now

- Review and possibly reduce indirect loan dealer reserves, if applicable

- Take advantage of large demand for 2nd Mortgages & HELOCs

- Understand that ‘toy’ loans may be stressed as economic conditions deteriorate

- Consider SBA floating rate loans, which offer limited risk

- Review & update risk-based pricing grid

- Consider slower loan growth, especially if expensive non-core funding is necessary

Action item: investments

- No negative convexity

- No callable bonds

- Limit mortgages

- Carefully review corporate bond credit quality

- Muni bond credits should hold up well due to U.S. Govt assistance

- Invest a little longer at some point in time

Action item: general thoughts

- As the economy weakens, we can expect that delinquency and charge-offs will increase

- Need strong earnings now to prepare for possible future stress

- Higher yields will result in larger margins over time, but at first the rising cost of funds may cause a negative impact

- A higher loan-to-deposit ratio may result in expensive funding; borrowing rates are very high in relation to local core deposits

Be ready to change as needed

Understanding the economic cycle and where we are currently within it is important to planning and managing your credit union’s finances. With knowledge of how the economy at large operates, you will be better positioned to respond to changing economic tides and maximize your yield potential.