New integrations and native platform enhancements build excitement for lending

As the day moved forward into deeper dives of software and development, Vice President of Lender*VP Ashley Melder joined Geoff on stage to discuss exciting work in the area of lending.

Melder first touched base on some recent projects affecting variable rate loans and participation lending before moving on to some new integrations to the CU*BASE platform including OpenLending for insurance and Auto Financial Group (AFG) for balloon lending.

The two also shared some recent success stories from the CUSO’s 1-Click Loan Offers, a system function that allows credit unions to deliver qualified loan opportunities to members online, who in turn can accept and complete the loan application process all the way to funding in an expedited manner. Recent and upcoming enhancements will allow credit unions to add a processing fee, allow checking-secured offers, and unfunded loan offers. To further fill out the toolset, Melder announced that coming next would be 1-Click offers based on CLR Path score, CU*Answers’ free decision advisor that scores members based on their reputation with the credit union.

Online and mobile projects will revamp how members use the mobile app

Segueing into developments in CU*Answers online and mobile projects, Melder yielded the stage to VPs Kristian Daniel and Ken Vaughn who were happy to discuss the new online loan application which will roll out in three phases. Phase I is a user interface refresh of the existing loan app, available today; Phase II adds storefront web modules that credit unions can start building today; and lastly, Phase III will add loan app web modules. To manage these changes, the duo introduce Loan Manager for CU Publisher, a content management putting the power of online and mobile lending customization in the hands of the credit union!

In addition to the spotlight on the new online loan app, new releases to other popular products will improve user and credit union experience across the board. The new Membership Opening 3.0 adds state ID proofing to decrease fraud; and Mobile App 6.2 adds e-statement enrollment and RDC auto-enrollment.

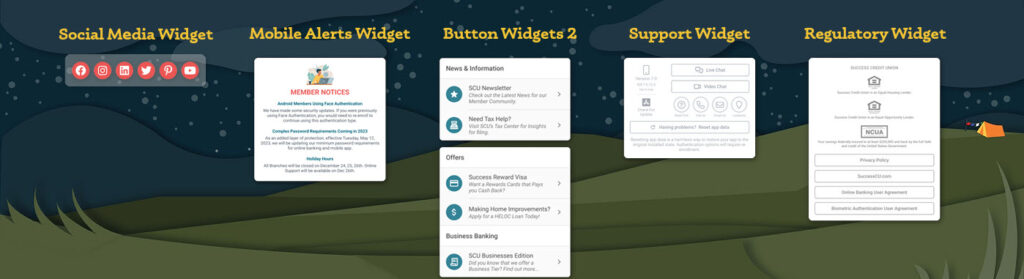

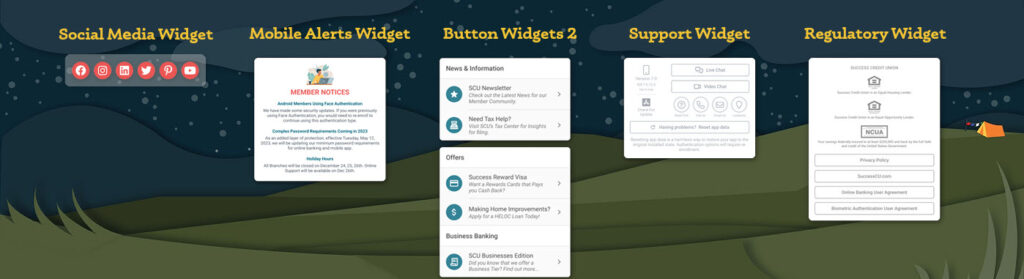

Looking out a little further, Mobile App 7 will further improve member experience by adding home tab widgets, implementing card center enhancements, and improving security with two-factor authentication and biometric updates for mobile access.

Melder came back up on stage for one more exciting announcement: Online Banking “Localization.” Or in other words, online banking in Spanish! Speaking to the attendees in Spanish, Melder said, “Localización significa que ahora puedes ofrecer a los miembros la opción de visualizar banca en línea y móvil en otro idioma.” The new functionality also supports French, Italian, and German.

After a short break, EVP of Software Development Brian Maurer and EVP of Client Experience Dawn Moore joined Johnson on stage to discuss some major projects in the pipeline. First, multi-factor authentication (MFA) and all its associated projects.

To address the ever-growing concern for cybersecurity and fraud prevention, CU*Answers has been hard at work on a handful of MFA projects. Available today, credit unions can enable MFA for personal information updates in online banking, thus preventing fraudsters who gain access to online banking from changing a member’s email, address, or other personal information without confirming the change with a secondary authentication method. Coming later this year, credit unions will also be able to enact MFA for P2P enrollments and transactions, with MFA for logins coming down the line.

From an internal standpoint, teams are also working on multi-factor authentication for CU*BASE using an integration with MemberPass, which would require the user to secondarily authenticate using a mobile device.

The new face of CU*BASE and new payment options

Moving on to the biggest project announcement of the day, Maurer and Moore were eager to introduce CBX, the new name and face of CU*BASE. The core processing platform will sunset the existing LegaSuite platform for a new web-based design, which will provide new opportunities not currently possible with the current design.

The two shared their excitement for the future ability to combine data from multiple screens into one; improvements to workflow and usability; and setting the foundation for API development and 3rd party direct integrations. To make this all possible, the CUSO will be doing dual development of CU*BASE GOLD and CBX for at least two releases after CBX rolls out, which is currently aimed for Fall 2024.

As the morning continued, Maurer and Moore moved on to provide updates on new payment options, including RTP©, FedNow℠, and Zelle. Other integrations in the works include Plaid for online banking, CryptoFI for crypto capabilities, Prizeout for loadable gift cards, Ascensus for IRA processing, and a slew of web chat and call center integrations.

Wrapping up the day

As the day continued, more CU*Answers leaders joined Johnson on stage to discuss developments in the areas of analytics, EFT, network technologies, and imaging. Among those highlights was the introduction of CU*Forms, which on top of letting credit unions create their own forms, will also make programming more efficient, integration with CBX, require less software, and eventually eliminate print sessions.

With the day’s festivities beginning to wind down, Johnson took center stage again to award two leaders within the CU*Answers family. First was Jennifer Watson, CEO of Limestone FCU in Manistique, Michigan, who was awarded the 2023 “Spirit of CU*Answers” Collaborator Award for her work in fostering a growing and thriving community of Upper Peninsula credit unions on the CU*BASE platform. Said Geoff of Jennifer: “Cheers to Jen Watson for all that she’s done. She’s been a great partner who joined not that long ago.”

Following an update on the state of the cuasterisk.com network of CUSOs, which today supports 366 credit unions in 42 states on CU*BASE, Johnson gave out the second award to Jon Hernandez, CEO of three Los Angeles-area credit unions: CalCom FCU, Nikkei Credit Union, and Mattel FCU. In a recorded message accepting the “Spirit of CU*Answers” Ambassador Award, Hernandez said, “I believe that CU*Answers will continue to attract and create new ways for credit unions to collaborate and work together. I’m excited to learn more about the new and innovative initiatives by this group and we’re glad to finally be part of the CU*Answers family. Thank you and I look forward to meeting you all.”

Long-time CU*Answers employees Jim and Laura Welch-Vilker came on stage to be honored as they transition into retirement. With 56 combined years of experience at the CUSO, the two thanked CU*Answers, the Board, and the entire community for the time spent together. “If we were to say thanks, we’d start from the top down. The Board of Directors, thank you for a career. Thank you for governing a co-op in the spirit that matched our passion.”

As Geoff closed the festivities he thanked the community for its spirit of collaboration, “This firm is amazing. Each and every one of you is amazing. I wish you to celebrate with me all the beautiful things and all the cool opportunities that come our way every single day. And on the hardest days, reach out to your peers and your partners and ask for help. That’s what we’re here for.”