We had three ponies, played Cowboys & Indians all summer long with our homemade bows and arrows from the stand of poplar trees. Every morning, my older sister would milk the cows by hand, my mom would pasteurize and bottle the milk, and my dad would deliver into town. We raised fruits and vegetables which we sold on the roadside in all growing seasons, we bred and raised our own pigs, and several times a year we would send a hog to be butchered for meat. We kept the meat supply in a frozen locker in town. The rabbits we raised were for eating, rolled in flour, and pan fried just like chicken.

My dad wanted to be a farmer and buy more land, but America was literally feeding the world in the 1950s. Five acres provided a rich experience, as long as we understood the best way to use our limited resources.

Community supported agriculture

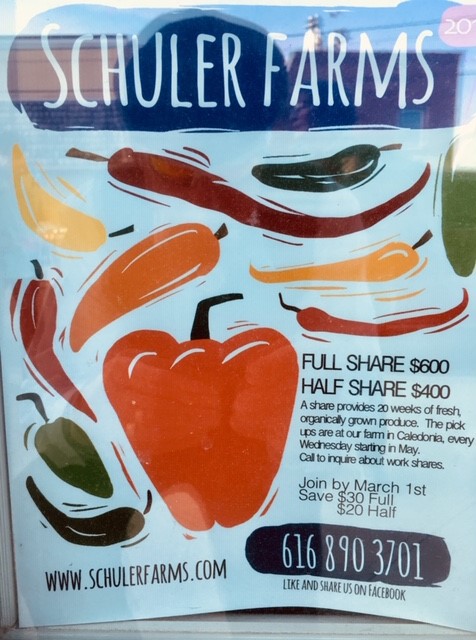

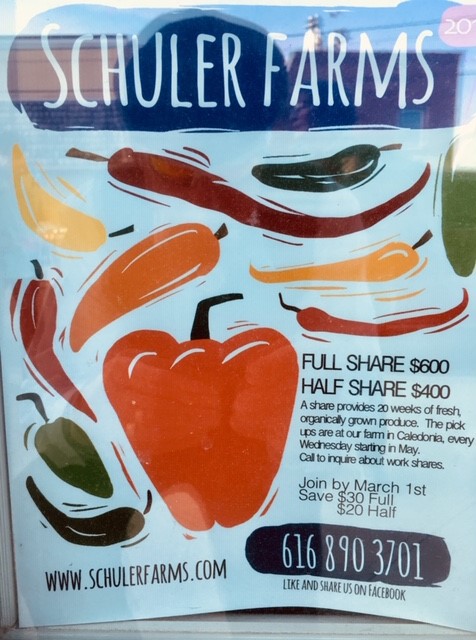

Last summer I visited Caledonia, Michigan (pop 1,600) for dinner. As we walked down the two-block main street, I saw a Schuler Farms poster in a store window selling “shares.” The business offer was full shares for $600 or half shares for $400. This Community Supported Agriculture (CSA) farm model is described as a “micro farm with vision and planning.” I went to the website for more information.

A CSA honors a commitment between the farmer and the share holders. The members pay the grower in advance for a weekly share of the harvest. The shareholder receives a crate of fresh, local, naturally grown produce from a source they know and love.

The 2019 Membership Agreement reads in part:

In the community supported farm structure, every member of the relationship benefits: the share-holders, the farmers, the farms (the earth), and the greater community.

Each member will receive a weekly share of organically grown gourmet produce, that varies throughout the growing season. The product is expected to be available by mid-May and end in October. We farm with all natural organic methods . . . Our vegetable selections are for the most part based on taste and experience with various varieties, as well as trying new varieties all the time. . . .

Our plan is to start small and develop a core group of members that buy into our philosophy and quality. We are looking for families who have a high vegetable intake, culinary skills, and the time to prepare the food and eat within the season.

This locally focused farm model has become more relevant as a broader change is occurring for direct distribution of farmer’s crops. Since 1994, the number of farmers markets has grown from 1,755 to over 8,700 today. Communities large and small are supporting the need for fresh and local produce.

My current hometown Bethesda, MD has a cooperative Farm Women’s Market where Jean Paul sells plantings and vegetables from his 43 acre farm three days a week.

I believe this growing model of local farming has direct meaning for credit unions. The diversity of credit union size is a source of system strength. Some small credit unions today will be the seed for larger ones in the future. But not all firms or farms can be large scale-whatever size that might mean. Credit unions of any size work well when they focus on the needs of their member shareholders. When that connection gets lost, then scale cannot replace relevance and relationship.