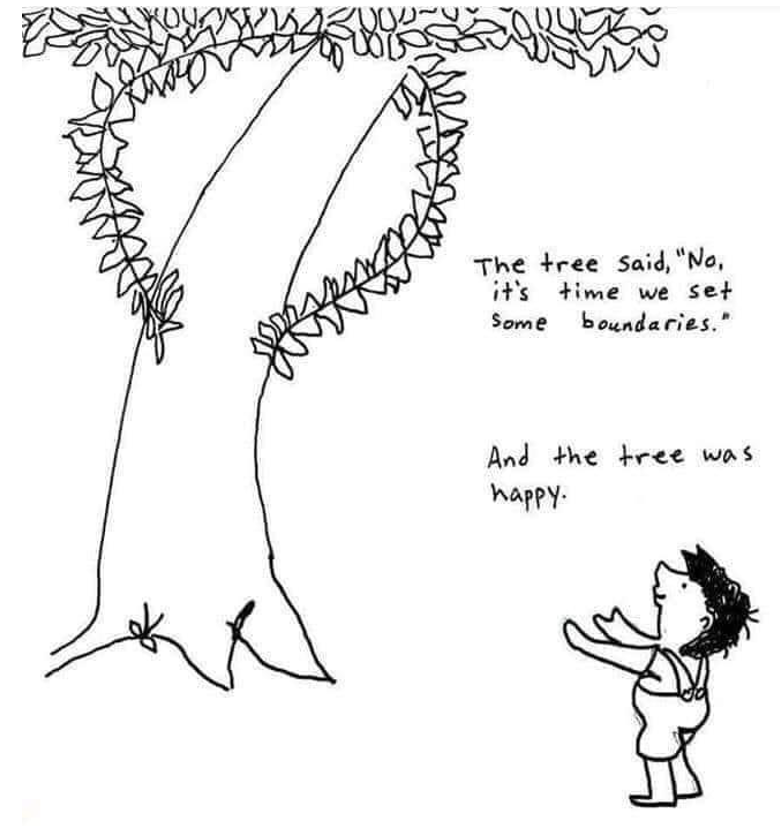

This children’s book is overtly about the relationship between a tree and a young boy.

He first asks to pick the apples from the tree to sell. The tree says okay. He then requests to take branches to build a house. Again the tree agrees. As the boy grows older the tree lets the boy take its trunk to build a boat.

For some, this is a heartwarming tale that explores the selfless nature of unconditional love. It is a relationship of a tree and a boy, a metaphor that teaches valuable lessons about the joy of giving and the importance of gratitude.

For others the morale is more straightforward and simple: it teaches the dangers of being selfish. When life has no boundaries, we just take and take until we end up destroying the source of our well-being.

Current-day readers have generated interpretations far removed from what may have been the author’s initial intention. Some argue the boy’s behavior is narcissistic and the tree an enabler. The power of a good story is to draw forth multiple reader reactions. So at the risk of some reader’s understanding of The Giving Tree, I want to apply its lessons for credit unions.

A metaphor for credit union behaviors

I believe one takeaway is that the current view of some credit leaders is that theirs is an organization with no limits (internal or external), subverts, and could destroy the integrity of the cooperative model.

There is no logic or reason between cross-country mergers or even those many states and miles away eg. Maine and Illinois. The continuing credit union’s home market and legacy have no relation to the newly acquired members or the local community.

These deals corrupt the merger process making the executive sellers rich and the members poorer. The member-owners who are victims in these financial empire-building combinations are asked to give away their accumulated value for nothing.

The justification for buying banks, sometimes completely out of the credit union’s market, is also suspect. These bank owners often reap above-market returns. The credit unions readily pay premiums to bank owners, but acquire members’ accumulated wealth in mergers for free.

Both cases use members’ mutual savings accumulated over decades to enable corporate ambition, not improve member benefit. The intangible value and goodwill that created this commonwealth becomes the means of transforming the coop’s purpose into a market-driven, tax-exempt financial hybrid.

Instead of a more equitable and just financial system, the result is a greater concentration of wealth and power often outside all local connections–the antithesis of the cooperative model’s intent.

There is no virtue in being a tree and allowing someone to take away everything created until there is nothing left. The free market defense of these open-ended expansions destroys the mutuality on which credit unions depend.

The irony of these takeovers is that they eliminate the critical source of credit union’s abundance-the trust and belief by member-owners that coops are different. Boundaries are critical for knowing when to say yes and when to say no. It’s time for credit unions to say enough! Let’s remember who we are and how we earned our standing.

The dish ran away

Silverstein was not the only author offering wisdom in a children’s idiom. If one looks at Mother Goose’s brief verses, they can be applied to many areas of our behavior. Here’s one that may also be relevant to the above concerns.

The Cat and the Fiddle

Hey, diddle, diddle!

The cat and the fiddle,

The cow jumped over the moon;

The little dog laughed

To see such a sport

And the dish ran away with the spoon.

A nonsense poem to teach children rhyme and verse with familiar words? Or, might one ask who is the Cat playing the fiddle? Who is the dish running away with the spoon? Does this seeming blather suggest the pretense that buying and selling cooperatives is somehow benefitting members?