A credit score is a numerical three-digit value that summarizes a person’s credit risk, based on a snapshot of their credit report data at a point in time. It evaluates the past and is commonly used as a factor to help lenders determine how likely a member or potential member is to repay the loan for which they are applying.

A credit score has an influence on not only the loan decision but more granular factors such as the loan term and the interest rate charged by the credit union. The higher the score, the lower the assumed risk.

Does a member have just one credit score?

Members don’t have just one credit score. All three main credit reporting agencies (CRAs)—Equifax, Experian, and TransUnion—create their own credit reports from their respective repositories with marketplace reported data. These scores can vary to a wide degree based on two main factors:

- What a CRA knows about a person (in file data)

- Which scoring model is being used (FICO or VantageScore version)

The data that credit unions and other institutions report to CRAs, such as loan repayment history or delinquency, are used in the scoring algorithms. Since it is not mandatory to report data to all CRAs, there can be times when one CRA has derogatory data on a member that another does not. This can cause scoring differences between CRAs.

In addition, scores are calculated using different scoring models. There are dozens of specialty credit scoring models out there, each of which may calculate a member’s score a little differently. Credit scoring models like VantageScore and FICO use these different calculations to come up with a score that typically ranges from 300-850. The credit bureaus can also calculate scores based on their own proprietary models.

Different credit score methods

The FICO© Score and how it’s calculated

The most commonly used credit score brand in our network is FICO. Developed by the Fair Isaac Corporation, this score is widely used among lenders and credit card issuers across the U.S., with billions of scores purchased by lenders each year. Base scores range from 300-850. Among the many versions offered are industry-specific and specialty FICO models.

For example, what is commonly called an auto-enhanced model is a tool often used for vehicle lending and gives additional weight to member’s past performance with an automobile loan repayment.

FICO© Scores are based solely on information in consumer credit reports maintained at the CRAs. The scores are accompanied by reason codes that indicate factors influencing the score.

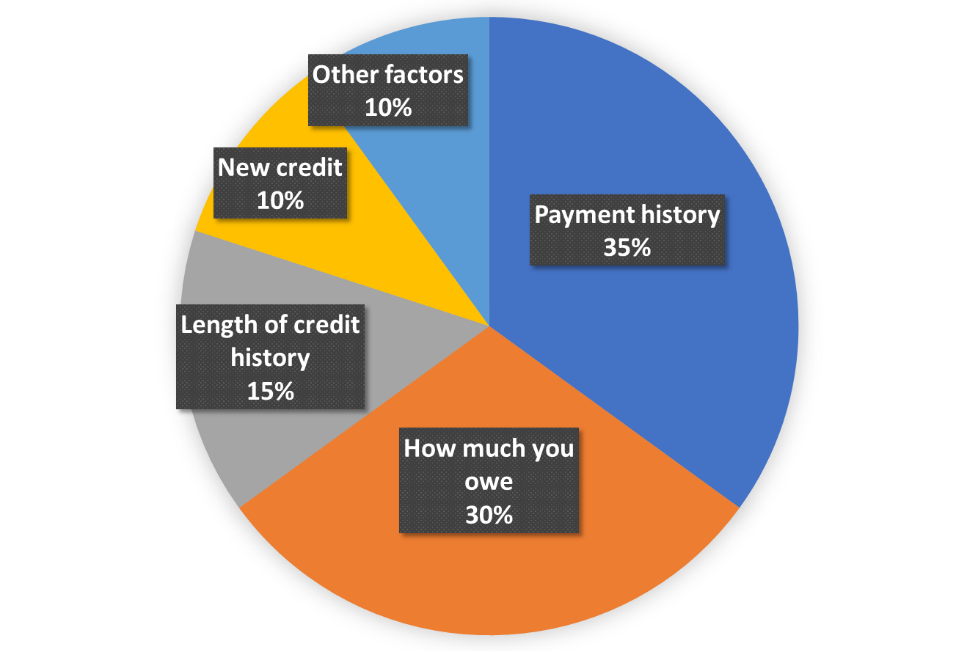

Scores are generally made up of a mix of a person’s payment history, how much they owe, available credit, the length of overall credit history, and other factors.

The chart below shows an approximation of how each factor influences a person’s overall FICO© Score.

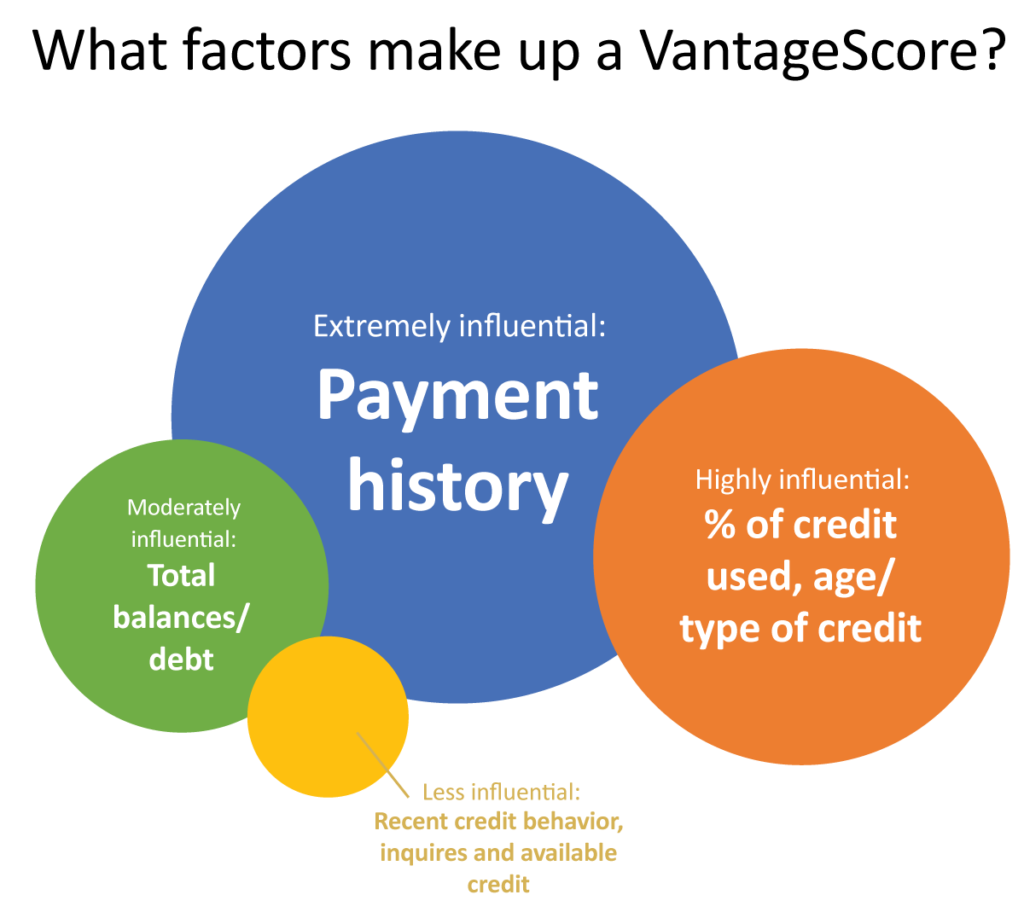

Not a fan of FICO? Try VantageScore

The biggest trend that I have witnessed in the last 12 months is a spike in interest in other brands of credit scores, with VantageScore being at the top of that list (based on changes in my network of credit unions). The VantageScore model was introduced in 2006 and developed by the three nationally recognized CRAs: Equifax, Experian, and TransUnion. Utilizing decades of collective analytical experience, the teams developed new analytical techniques.

The main goals of the model are to not only be more predictive, but more consistent across all three CRAs. Although created in partnership, VantageScore is now independently managed with all intellectual property owned by VantageScore.

VantageScore is fairly similar to other credit score systems. Time, thought, and decades of expertise has gone into the model creation, and VantageScore was built in consideration of ECOA, FCRA, and the Federal Reserve/OCC Guidance on Model Governance. VantageScore is also widely recognized by regulators such as NCUA, CFPB, and others. The credit score delivered is a three-digit number in the same familiar range of 300-850, no different from other systems.

However, VantageScore differs in that it uses an identical algorithm at all credit bureaus. In other words, the same member would have the same score from one bureau to the next. This is under the assumption that the same data is present at each bureau.

What makes VantageScore special?

Because VantageScore allows a shorter credit history than previous models and a longer period of recognition for reported accounts, the ability to issue credit scores now exists for millions of consumers who wouldn’t qualify based on FICO models. VantageScore 3.0, which is the latest version, gives scores to approximately 30-35 million previously unscored consumers. These individuals are labeled “credit invisibles” and their numbers are shrinking because of VantageScore recognition. According to sources at TransUnion, “Borrowers that are new to credit or haven’t been using it recently could benefit from VantageScore, as it might be able to prove trustworthiness before FICO has enough data to issue a rating.”

Score consistency

There are four reasons why a scoring model will generate different scores from one credit bureau to the next:

| Reason | Who & Why | Remedy | ||

| 1. Credit information is not reported to all credit bureaus | Many regional and community lenders do not report to all bureaus | None | ||

| 2. Credit information is reported to credit bureaus at different times | Most lenders report to different bureaus at different times during calendar month | None | ||

| 3. Variances in how credit bureaus define and store information | Bureau data management strategies evolve based on their unique business model | Data definitions must be aligned and standardized (characteristic leveling) | Remedy is unique to VantageScore | |

| 4. Scoring models developed on different information and therefore have different algorithms | Developers must use the bureau-specific data to maximize performance for that bureau | With leveled characteristics, the identical algorithm can be installed at each bureau |

Source: VantageScore Solutions, LLC.

Use the system that works best for your members

While each scoring system is reliable, they all have different priorities and different considerations. Carefully weigh the benefits and drawbacks of each system when checking for members’ credit scores, and determine what will work best for them—and for you.