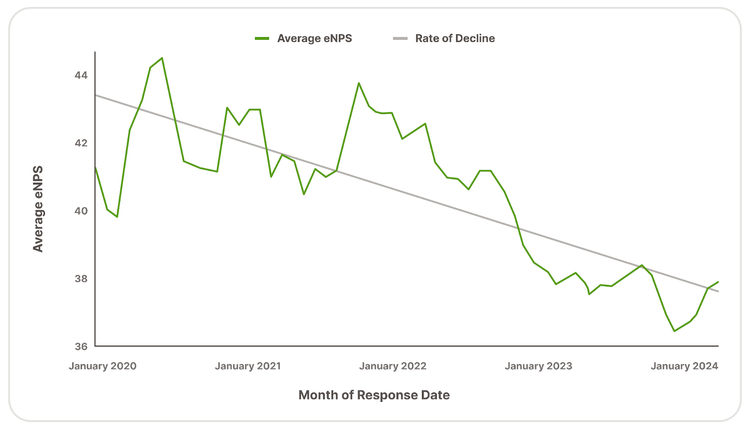

As credit union leaders, you know the heartbeat of your institution is its people. However, since 2020, employee happiness has steadily declined, reaching a four-year low by mid-2024, according to survey data from over 57,000 employees across eight industries.

This data, drawn from BambooHR’s employee Net Promoter Scores (eNPS) and the Employee Happiness Index report, highlights a challenging era, now dubbed the “Great Gloom.” This period marks a nationwide surge in disengagement, burnout, and workplace dissatisfaction.

What is the “Great Gloom”?

Employee unhappiness poses a serious threat to organizational morale, service quality, and productivity—cornerstones of credit union success. Now more than ever, credit union leaders must take action to re-engage and foster a culture that inspires.

The “Great Gloom” describes a steady decline in employee well-being and engagement (as shown in the chart below) fueled by increasing workloads, lack of managerial support, and stagnant compensation amid the rising costs of living.

Source: BambooHR “Spotlight on Q3: The Unexpected Rebound in Employee Happiness”

Unlike the “Great Resignation,” where employees voluntarily left their jobs, the Great Gloom is quieter but no less impactful. For credit unions, where collaboration, dedication, and member service are crucial, a disengaged workforce can hinder productivity, innovation, and growth.

Disengaged employees lack focus, work slower, and fail to give their best effort, often because they see little connection between their hard work and rewards, leaving employees unmotivated. Without pride or purpose in their roles, their involvement dwindles, and their job becomes just a paycheck, not a meaningful contribution.

Key drivers of declining morale:

- Economic instability: Concerns over job security and layoffs.

- Financial pressures: Rising inflation outpacing wage growth, leaving employees feeling under-compensated and undervalued.

- Workplace disconnects: Misaligned expectations around hybrid or remote work policies causing frustration.

- Recognition gaps: Employees feel overlooked despite their efforts.

As an industry focused on community and people, addressing these issues isn’t just beneficial, it aligns with your credit union’s core values.

Seven effective strategies to re-engage employees in credit unions

Your employees are as critical to your mission as your members. Investing in their well-being and success ensures your organization thrives. Here’s how:

Celebrating achievements

- Spotlight wins: Publicly recognize successes and top performers in meetings and company announcements to boost morale.

- Personalized acknowledgments: Personalize recognition to make employees feel truly valued—it’s not “one size fits all.”

Foster meaningful communication

- One-on-ones: Make time for meaningful weekly check-ins to address concerns and goals.

- Transparency: Hold monthly all-staff meetings to discuss changes and invite input to foster trust and a sense of involvement.

Offer flexibility

- Flexible scheduling: Provide flexible hours or hybrid options to support work-life balance when practical.

- Workplace Support: Equip employees with the tools and resources they need for success.

Invest in growth & development

- Learning opportunities: Offer training programs to build skills, boost confidence, and empower employees.

- Growth pathways: Create clear pathways for career advancement and role development.

Promote well-being

- Wellness initiatives: Implement programs focused on physical and mental health, such as Employee Assistance Programs, gym reimbursements, and wellness days.

- Work-life balance: Encourage the use of paid time off and set realistic workload expectations to prevent burnout.

Build team unity

- Community projects: Organize community-focused activities, like charity drives to strengthen team bonds.

- Connect mission to purpose: Regularly tie employees’ contributions to the organization’s mission and impact.

Lead with purpose

- Show leadership through action: prioritize employee happiness and embody the credit union’s mission in daily decisions.

Overcoming the Great Gloom

Amid the Great Gloom, credit union leaders have the chance to not only address these challenges but turn them into opportunities for growth. By focusing on employee engagement and cultivating a supportive, mission-driven culture, your organization can navigate this tough period, emerging stronger, more connected, and ready to serve your members with excellence.