The opportunity is sitting right there in those numbers. Early consideration and planning—if not outright adoption—of a crypto strategy is the way to drive innovation.

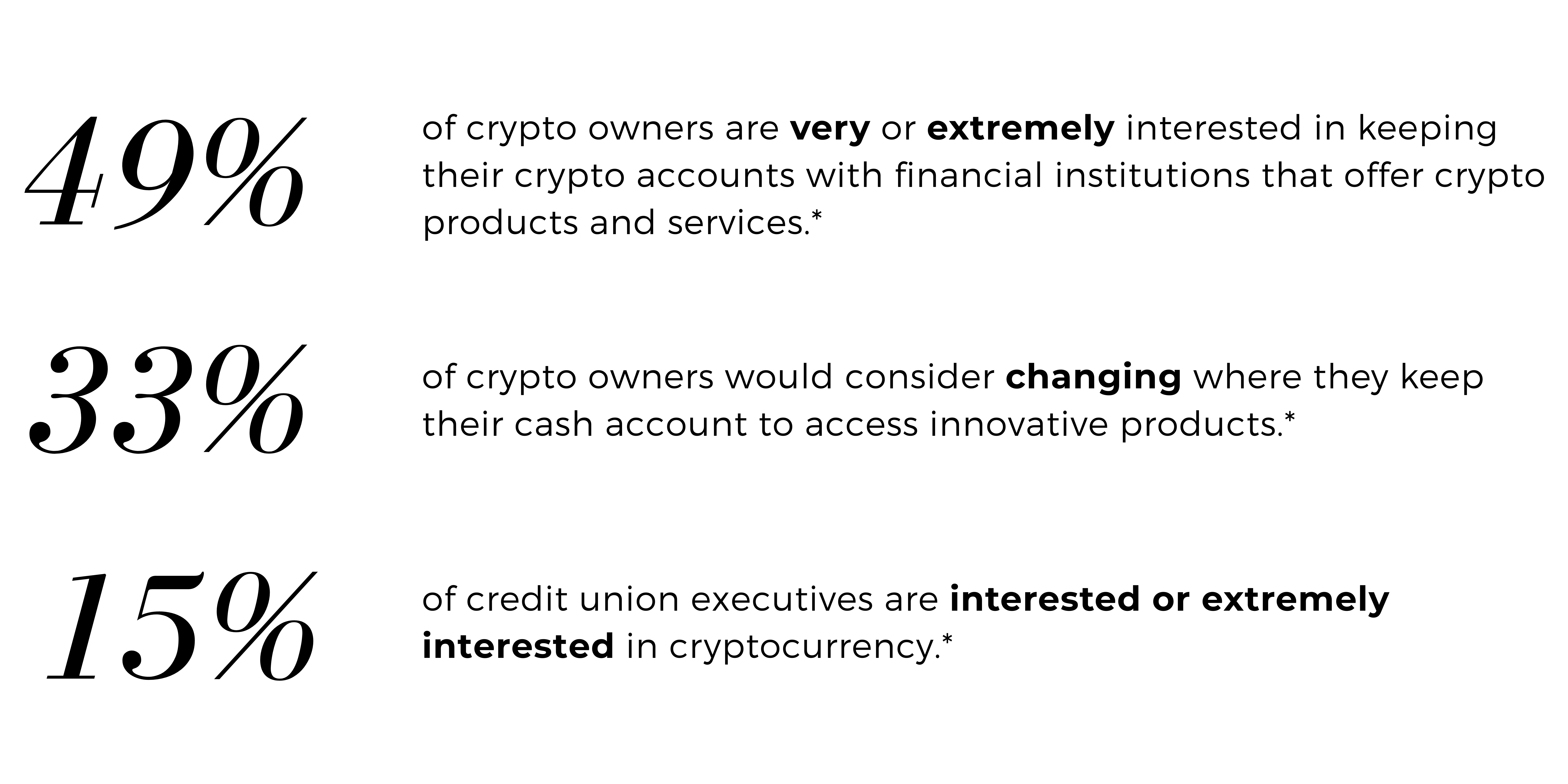

Even in the “crypto-winter” and a post-FTX-crash world, digital assets continue to grow in popularity and potential as more investors look towards them as financial instruments. 49% of cryptocurrency owners are interested in keeping their accounts with financial institutions that offer cryptocurrency services. While the market has matured quite a bit since the early days, crypto services with credit unions are still in the early stages.

At this point, very few credit unions offer any form of crypto-friendly solution. Those providers who engage in innovation, education, and implementation early will no doubt be seen as innovative leaders as adoption grows moving forward.

Gain buy-in from leadership

Creating believers

A challenge at many traditional financial institutions is often that most of the interest is coming from members and customers. This leaves the executive team wondering if those customers are only interested in the technology or crypto itself. Are they exploring it as a new asset? What does the customer want to do with it? What is the goal they are trying to achieve? Many banking executives have yet to realize that many of their existing depository assets are moving towards crypto with or without them.

Often, it may be the marketing or customer experience team bringing the conversation to execs. Rather than a position of “crypto is something on the fringe that might be interesting to look into a bit,” people in these roles see that users are demanding crypto, whether it be from industry trends they are noticing or directly from the customer’s mouth. Thus, the drive toward crypto needs a customer-centric approach.

Next, the institution must consider what next steps they need to take if they want to be able to tackle the needs of their members. How do they envision themselves occupying the space? The goal becomes to answer these questions quickly as the landscape evolves, which is difficult as typically financial institutions have a slower decision-making system. Developing tactics to address this new, fast-moving space within existing development cycles is a big complication that must be faced.

Define offerings and expectations

The first step for many banks and credit unions will be offering a buy/sell/hold function for their users. As discussed, there is much more to explore, but this is a good starting place especially as banks and credit unions look to build additional trust with their users. Consumers need to be able to manage all of their assets in one place, and their banking dashboard is a good place for it.

This step also gives financial institutions better insight into the portfolios and interests of their users when it comes to cryptocurrency. Finally, this first step is also a great part of a strategy to engage with young consumers, as well as to lessen withdrawals to third-party exchanges.

Planning for buy/sell/hold

Just like in traditional finance, there’s a suite of companies in the cryptocurrency space that can serve a purpose as strategists plan out a buy/sell/hold solution at their institution. There are custodians, liquidity providers, and more, alongside a suite of other choices in coins to offer, regulatory concerns, infrastructure, and more.

Addressing concerns

There are some real concerns for a credit union dealing with cryptocurrencies. Some of these—volatility, criminal enterprise, and fiduciary responsibilities—need to be addressed at a very high level.

One of the primary concerns of the C-suite in banks and credit unions is what happens when the market experiences valuation changes. For instance, a bank executive may feel that offering this service and experiencing a downturn could result in displeased customers.

Will the customer that invested in Bitcoin that had its value halved come to them and complain, “I just lost a bunch of money; why did you, my trusted financial institution, give me access to crypto?” Or even worse is the interpretation that an institution is tacitly recommending that members participate in cryptocurrencies. This is part of the education and training of both the staff and consumers.

This is also part of the discussion about regulation. What happens if a regulator comes in and says the bank needs to be responsible for the cryptocurrency losses of its customers? CryptoFi’s team will work alongside the institution long after launch to ensure they are meeting top regulatory standards and to help work through all regulatory concerns the institution may have.

Scope implementation needs

With a sound digital asset strategy, credit unions gain a secure, resilient, and flexible crypto platform foundation they can build on to drive more differentiated digital experiences for members. Adding digital assets as an option for members can open numerous areas of value. Below, we look at some of the most common starting points for credit unions.

Identify the opportunity that digital assets provide and the advantages these integrations and platforms enable, including member retention, behavior insights, and increased revenue.

The components of a digital asset program include technology, liquidity, custody, and legal/regulatory frameworks.

“Roadmap” considerations of digital assets, such as crypto native use cases or crypto-as-an-investment.

Scoping of implementation needs to address legacy infrastructure and core financial services applications to take advantage of modern frameworks like cloud-native architectures, or new technologies like microservices, to enable greater flexibility and make it easier to adapt to change.

Data insights bring together disparate sources of data so you can apply advanced analytics to extract more value from your data. Robust dashboards and analytics are built to understand your customer and help you accelerate your insights.

The risk/ROI of a digital asset solution must be weighed and a path chosen, whether API or platform based.

Evaluating and choosing a platform partner is increased by simplifying the management of infrastructure assets and lowering costs by retiring expensive on-premises hardware. With AWS, you gain a single control plane for managing and governing resources on AWS and on-premises, enabling greater visibility and making management straightforward.

Rollout and deliverables are set when defining the digital customer experience for members. Everything should make it easier for them to manage their financial goals within your ecosystem.

Measuring success after your rollout is critical to ensure you’ve built a platform that fully meets your members’ needs.

Preparing for success

Zoom back out to the overall roadmap of rolling out a crypto solution at a credit union. Financial institutions looking to start out on the right track can work to clarify compliance concerns, understand first steps, and more.

When a financial institution says, “Yes, this is a place we want to be. Our customers are asking for it. This is a product that we’re interested in,” the first step should clearly be on the education side. For both credit union executives, the credit union team, and members. Education builds trust.

Developing the product roadmap

How does a credit union decide what the product solution looks like? It’s going to be very different for every institution. Once the decision is made as to what is right for the institution, it becomes all about understanding the different technology partners in the market and choosing the one that fits the institution best.

Credit unions should strive to understand the different players that need to be involved in an overall cryptocurrency program. And it starts with the technology—an elegant technology solution that is natively integrated into existing banking software, both from an end-user standpoint and from a back-office standpoint.

Next is the liquidity aspect. How are these orders for Bitcoin getting filled? Having the right partner embedded to ensure best-in-class exchange rates for the on-ramps and off-ramps into crypto is incredibly important.

An additional consideration on the roadmap is the custodial model. The large majority of credit unions are likely to turn to third-party custodians initially, especially as they learn about consumer trading habits. However, giving the organization the flexibility to bring custody back in-house is vitally important, and the value of holding crypto assets themselves will grow substantially, instead of using a third party. While this definitely is a little ways off still, it is worth considering for the roadmap regardless.

It is vital that stakeholders ensure that from conception through release there is flexibility within the solutions so that the organization is able to adapt to evolving needs.

Post-implementation

Isn’t Bitcoin enough?

Can credit unions get away with just offering Bitcoin to their members? Why are Ethereum or other tokens important?

Bitcoin is great. But objectively, the trading volume of Bitcoin and the overall market cap is not anywhere close to being 100% of the overarching volume. Giving choice and access to customers and members to use other coins (with the caveat of ensuring the risk compliance, and regulatory considerations around them are understood) besides just Bitcoin, and even besides just Bitcoin and Ethereum, is probably a good idea.

Especially as more regulatory clarity is provided on the other coins, there is more demand for them as time goes on. Credit unions will never need to offer as many coins as an online exchange like Coinbase, but having more choices than just Bitcoin will be important.

The future is here now

The traditional banking industry has stood still and watched cryptocurrency remove hundreds of millions of dollars from depository assets. Adding new services and providing consumers access to cryptocurrency helps banks and credit unions become more relevant. The future customers of brick-and-mortar institutions want a digital experience and access to innovative products.

Creating a roadmap now and engaging the right partners will ensure future consumers don’t flee to online exchanges and other neobanks. To remain relevant—and profitable—credit unions must diversify the product set they offer and find ways to provide services in a manner that is more relevant to their future customers.

*source Pymnts.com. (2023, April). Credit Union Innovation Report: Crypto, Digital Currency and Member Loyalty.